What is CeDeFi?

CeDeFi combines CeFi and DeFi, using the best features and attributes of the two financial systems. Before now, these two financial systems existed separately; centralized finance (CeFi), a traditional finance system that uses banks, and decentralized finance (DeFi), which is based on smart contracts and cryptocurrencies.

But a new system has been introduced, which is a combination of the two systems. CeDeFi gives the same features as DeFi while still being centralized. It gives people access to DeFi products such as liquidity aggregators, yield farming tools, decentralized exchanges (DEXs), and lending protocols while still giving them the advantages of CeFi systems.

But unlike DeFi, which is available for use by anyone and is permissionless, CeDeFi leans towards centralization. There are single or small groups of entities that govern this system, making it look more like CeFi.

Generally, the CeDeFi ecosystem aims to improve the traditional crypto model to allow for faster transactions, a larger transaction volume, improved security, and lower fees than the traditional systems.

Do Any CeDeFi Protocols Exist?

There are very popular examples of the CeDeFi protocols like the MakerDAO, Compound, and Synthetix, all of which offer DeFi-like capabilities. Midas Investments, which is a crypto-investment platform, is another example.

MakerDAO, Compound, and Synthetix are built on the Ethereum blockchain. Midas Investments updated its platform in August 2022 to include CeDeFi strategies. This new approach mirrors DeFi by creating smart contracts to handle asset management under various lending protocols. These include soft leverage, lending, and borrowing, allowing an influx of capital into the DeFi space.

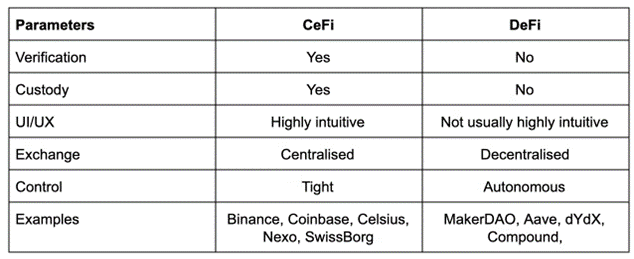

What is CeFi?

CeFi is a structured financial institution allowing consumers to borrow cryptocurrencies via a controlled exchange. It is similar to the conventional banking industry in that consumers can use their cryptocurrencies as collateral when borrowing money. They could also earn interest on their cryptocurrencies when they lend them.

The CeFi platform is the custodian of your digital assets, and you give up control of them when the CeFi platform “safeguards’ ‘ it to make money. As a result, if the platform is hacked, your assets could be endangered.

CeFi platforms are more used and have a larger market share than DeFi. Some of the popular CeFi platforms include Coinbase, Binance, and Diem. However, DeFi became more popular because of CeFi’s expensive transaction fees due to the involvement of third parties, lack of transparency, and total control over your assets.

What is DeFi?

DeFi refers to a wide range of financial products and services established on blockchain technologies in the public blockchain space. DeFi does not function like the traditional centralized system that uses banks and credit cards but is accessible through decentralized applications (DApps) that operate on a peer-to-peer basis.

In CeFi, a centralized exchange takes care of all the crypto trading, so the users don’t have access to private keys. But the DeFi users have complete control of their funds because no centralized authority handles it.

Both DeFi and CeFi have their advantages and disadvantages. For example, DeFi is permissionless and does not require a KYC process, unlike CeFi. Also, CeFi makes it relatively easy to convert fiat to crypto, but this is not the case with DeFi.

Who Introduced CeDeFi to the Crypto Market?

Binance plays a big role in the introduction of CeDeFi as it was Binance’s CEO, Changpeng Zhao, that coined the term “CeDeFi ” in September 2020, during the official launch of Binance Smart Chain.

Ethereum’s popularity is greatly tied to smart contract functionality. Binance realized this and created another blockchain network to compete with Ethereum and its DeFi ecosystem.

It led to the rebranding of Binance’s already existing blockchain network to BNB Smart Chain, a fork of Ethereum having optimizations for low fees and high transaction output.

BNB Chain has grown exponentially since September 2020 because of its ability to fund projects quickly, which led to the rise of CeDeFi.

Apart from Binance, investors can also establish hedged yield streams via digital tactics using Midas’s hybrid CeDeFi investing platform for dependable passive income.

Also, Midas has a large network of backend procedures to hedge and protect the front-end investment opportunities offered to individuals.

Advantages of CeDeFi

CeDeFi runs on a decentralized banking system, allowing users to trade CeDeFi crypto assets without a centralized exchange. Users do not need an intermediary and can transact with one another directly.

A major advantage of CeDeFi is lower fees. Since fewer mediators are involved, CeDeFi transactions cost lower than those on comparable platforms.

Another advantage is improved security. It is now more difficult for hackers to break into the CeDeFi network because of the decentralized structure of the network.

Also, CeDeFi is more accessible than its counterparts because anyone with an Ethereum wallet can use CeDeFi protocols. It reduces entry barriers for inexperienced users and allows them to explore more about DeFi by verifying trade options vetted by various criteria like KYC, fees, etc.

Financial transactions run through CeDeFi are handled faster than traditional financial systems. It is because there is no need for a third party, which often takes some time.

CeDeFi technologies are much more flexible than traditional financial systems and give room for modifications according to each user’s needs. For example, the automated yield portfolio (YAP) strategy by Midas diversified portfolio risk by opening investors to various assets without the stress of buying separate crypto assets.

Most importantly, YAPs go through monthly rebalancing at no extra cost to investors to maximize profits. Midas secures the profits made from better-performing assets and reinvests in underperforming assets. This rebalancing helps Midas take advantage of the market fluctuations to provide a steady portfolio in the long run.

Furthermore, the projects and tokens are evaluated and audited thoroughly by CeDeFi exchanges, making transactions as safe as possible.CeDeFi gives more privacy than traditional financial systems because of its decentralized network.

Disadvantages of CeDeFi

The major downside of CeDeFi is the high earning curve that comes with its protocols because of their complexity.

Also, CeDeFi relies a lot on Ethereum because most of its protocols are still built on the Ethereum blockchain. It poses a severe risk because if Ethereum fails, CeDeFi will likely fail. However, this risk is mitigated because other blockchains have begun to adopt the CeDeFi protocols.

Another major advantage of CeDeFi is that it is still new and so unproven. Although the sector has seen much growth in the past year, it is still too early to conclude its outcome. As a result of this, CeDeFi protocols are highly volatile and so may not be ready for mass adoption.

Finally, CeDeFi has faced its share of scams due to a lack of regulations. So, it is very important to be vigilant and use only reputable CeDeFi protocols.

Discussion about this post