You may have thought about excellent arbitrage opportunities. However, this might not be as easy as it looks initially. Let’s dive into more details to see how to make money with crypto arbitrage.

Suppose you have been in this crypto world for a while. In that case, you may have noticed the price differences between various cryptocurrency markets and exchanges. Bitcoin trades at different prices on separate markets, even the most liquid digital asset.

Now, you must wonder whether these differences bring about great arbitrage opportunities. However, it might not be the case.

Crypto Arbitrage

Arbitrage is the sale and purchase of an asset to earn a profit from an imbalance in the price. It is a trade that helps you gain profits by exploiting the price differences of similar financial instruments on various markets or in different methods.

Crypto arbitrage is just like sports or fiat arbitrage in many ways. The main concept here is simple:

You try to get benefits from price differences for the same asset on various markets or exchanges. In other words, you buy at low prices and sell at higher rates which results in profit

Ways to do Crypto Arbitrage

- Regular arbitrage

- Triangular arbitrage

- Automated arbitrage

Reasons for the Crypto Arbitrage to be Lucrative

- Quick profits

- A wide range of opportunities

- Crypto markets are still volatile, and young

- Competition is less as compared to other traditional markets

- Crypto price differences tend to range from 3-5% and sometimes reach up to 30-50%

So, there is no doubt that crypto arbitrage can be highly lucrative, but only if you do your research, calculations, and estimations.

How to calculate the profit and costs of crypto arbitrage?

- Fees of maker and taker at the purchase exchange

- Transaction commissions (withdrawal commissions)

- Deposit fees at the selling exchange

- Fees of maker and taker at the sale exchange

- Cashing out or final withdrawal fees

Market volatility

Some coin fluctuations are variable, and their prices may change faster than expected.

Taxes and regulations in your jurisdiction

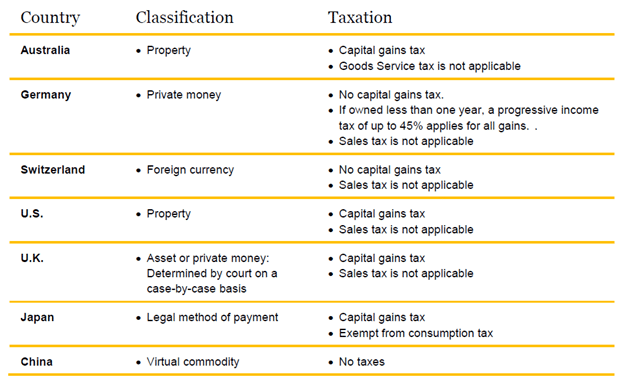

You must have to pay your crypto trade taxes. However, the rules may differ in different domains; for this, you may want to estimate the amount of taxes you must pay per trade when calculating arbitrage costs and potential profits.

Relatable: HOW TAX-LOSS HARVESTING CAN BE USED TO REDUCE LOSSES

Cryptocurrency laws by country:

How to select exchanges for Crypto arbitrage?

Once you take advantage of crypto arbitrage, you need to research and evaluate that. Then, register on the most advantageous crypto exchanges. Some exchanges, like Bitfinex, need you to verify your account and a minimum deposit of $10,000 to trade.

The most important variables when selecting an exchange for crypto arbitrage are:

- Fees during the process

Higher or lower trading, deposit or withdrawal fees can make or break the deals. Go for low-fee exchanges whenever possible.

- Geography

Some exchanges are restricted and limited in your area, so you must be aware before going for trade.

- Reputation

Reviews of people about certain exchanges are necessary to consider before depositing your funds. There are many frauds and unregulated platforms, so it’s better to stay safe and do your research before proceeding.

- Transaction times

Some blockchains carry out exchanges quickly, while others take hours or more time for transactions.

- Withdrawal times

Some exchanges make manual fund withdrawals that occur once daily, so you must be aware of and understand the rules before proceeding.

- Account verification

Some exchanges don’t allow you to withdraw funds or fully use the markets without verification, which may take several days or weeks.

- Market liquidity

Not all exchanges have enough liquidity, particularly if you want to buy or sell large quantities of digital assets.

- Wallet maintenance

Most of the arbitrage opportunities happen due to wallet maintenance in certain exchanges; therefore, be aware of if you can withdraw or deposit the crypto assets of your choice.

Relatble: HOW TO EARN PASSIVE INCOME WITH CRYPTOCURRENCY EXCHANGES

Step-by-step crypto arbitrage process

1. Discover opportunities

There are many tools that aid you find many crypto arbitrage opportunities. For example,

Other than this, you can take advantage of many arbitrage automation programs.

2. Decide whether the opportunity is worth considering

This is the critical and most crucial step as it helps you consider if the opportunity is worth considering or not. For the best decision, you need to look into:

- Estimate fees

- Research the risks

- Weigh how much of your profit will go to taxes

The best strategy is to open, verify and deposit funds into your accounts on various exchanges before you spot an arbitrage opportunity. It would help you save a great deal of time when executing trades. Besides, at times you might want to avoid BTC transfers between the exchanges since the network is known for being slow and expensive, but it is an issue only when it becomes congested.

Arbitrage Automation Programs

Best automated programs include EU-regulated ArbiSmart, which offers investors various plans starting from 500 euros. Different programs include:

- Arbitao

- Gekko

- Haasonline Software

- Gimmer

Wrapping up

Crypto arbitrage is a strategy to take the benefit of an asset trading at variable prices at different exchanges. To put it simply, if we buy a crypto asset for a lower price on one exchange and then sell it at a higher price on another exchange, then we have used the crypto arbitrage method.

Crypto arbitrage may give you great benefits, but the risk is higher. Therefore, you need proper research before proceeding.

Hopefully, this guide has taught you what crypto arbitrage is and how to implement it. Note that it is quite risky, and you should never risk money you can’t afford. You can invest your extra savings after doing extensive research when you would be able to bear the responsibility of your decision.

Discussion about this post