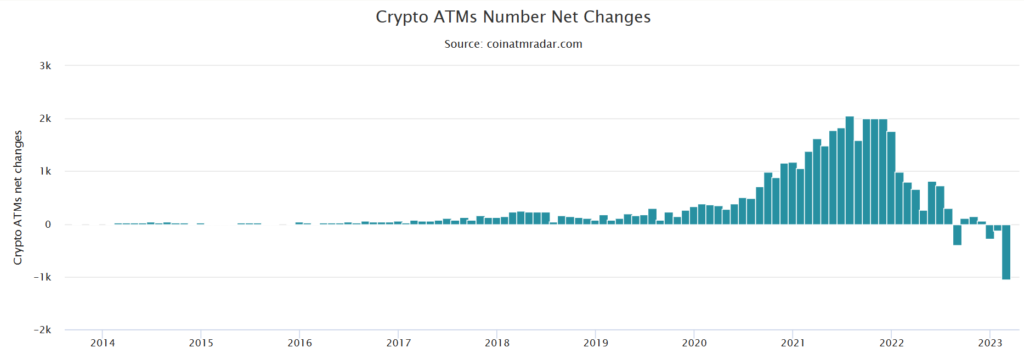

Each month from December 2020 to January 2022, more than 1,000 crypto and Bitcoin ATMs were set up.

One of the essential infrastructure pillars for the widespread use of cryptocurrencies, crypto ATMs, has experienced a sharp decline this year. The number of cryptocurrency ATMs installed globally fell by 412 machines in the first two months of 2023.

Since 2014, the overall number of cryptocurrency ATMs has risen substantially, serving millions of people worldwide for quick conversions from crypto to fiat. From December 2020 to January 2022, more than 1,000 cryptocurrency and Bitcoin ATMs were installed per month. Yet, its expansion was immediately impacted by the bear market.

The number of total cryptocurrency ATMs fell by a net amount in September 2022 for the first time ever. By recording a fall in total crypto ATM installations for two consecutive months in 2023, however, a new low was reached.

The global crypto ATM network lost 289 machines in January 2023, and another 123 machines in February. Service providers have been experimenting with less expensive alternatives for operations, although the ongoing decline was initially solely linked to geopolitical tensions, revenue losses, and a prolonged bear market.

Bitcoin Depot, a distributor of cryptocurrency ATMs, recently converted its 7,000 physical machines to BitAccess software. The action assisted in lowering the $3 million yearly operational expenditures associated with software license payments.

Unsure about how to use the Bitcoin ATMs in your neighbourhood? For more information about Bitcoin ATMs, see Cryptomufasa’s beginner’s guide.

In contrast, payment powerhouse Mastercard collaborated with Binance to introduce a card for cryptocurrency payments in Latin America.

Olá, Brasil! 🇧🇷#Binance Card has just launched in Brazil – another step towards crypto adoption 🤝 pic.twitter.com/UJRmpMhpbQ

— Binance (@binance) January 30, 2023

General Manager of Binance Brazil, Guilherme Nazar, stated the following :

Payments are one of the earliest and most straightforward uses for cryptocurrencies, but adoption still has a long way to go. Also, during launch, the card provided 0% fees on some ATM withdrawals and up to 8% cash back in cryptocurrency on qualified transactions.

Read More:

Crypto ATM Installations: Australia Ranked 3rd After USA and Canada

Discussion about this post