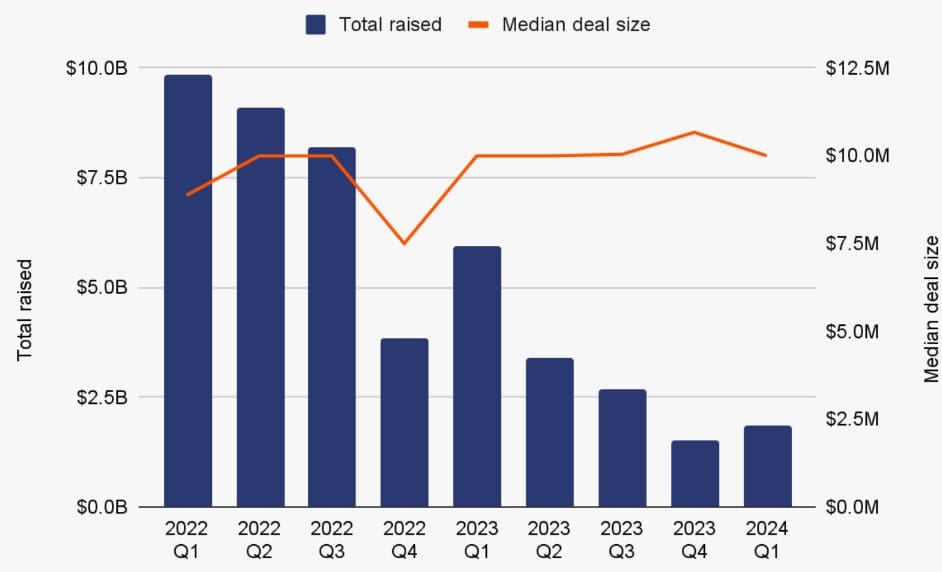

Venture capital investment in the cryptocurrency sector has shown promising signs of resurgence in the first quarter of 2024, hinting at a potential turnaround from the prolonged crypto winter that gripped the market since 2022.

Notable VC Deals in the Crypto Sphere

Despite a general decline in VC activity throughout 2023, the cryptocurrency space experienced several substantial deals exceeding $100 million, including both early-stage and late-stage investments spanning from Q3 2023 into Q1 2024.

According to Chainalysis, standout deals included substantial investments in projects like the blockchain interoperability platform Wormhole and the Decentralized Physical Infrastructure Network (DePIN), known as Together.ai. These ventures secured investments totalling $225 million each, underlining investor confidence in innovative blockchain solutions.

Key Players and Major Investments

Among the noteworthy VC deals, prominent projects such as Swan Bitcoin, Blockchain.com, Totter, and EigenLayer have attracted substantial funding. Swan Bitcoin, a platform focusing on crypto asset management and taxes, secured a significant $165 million investment in late 2023. Similarly, Blockchain.com, a leading cryptocurrency exchange service, received a substantial funding injection of $110 million in November 2023.

Additionally, Totter, an open-source cloud storage platform, and EigenLayer, an Ethereum protocol, entered the limelight by raising $101 million and $100 million, respectively, in major VC deals during the period under review.

Market Context and Impact

The surge in crypto VC deals coincides with a remarkable uptrend in the broader cryptocurrency market during early 2024. Notably, Bitcoin soared to new all-time highs, reaching $73,600 in mid-March. This bullish momentum was largely attributed to the launch of spot Bitcoin exchange-traded funds (ETFs) in the United States in January 2024.

Insights for Investors and Observers

Resurgence in VC Confidence: The increase in VC funding signals renewed confidence and interest from investors in the long-term potential of cryptocurrency projects, despite the market’s previous challenges.

Diverse Investment Landscape: The diversity of projects receiving significant investments underscores the broad spectrum of opportunities within the crypto space, ranging from blockchain interoperability to asset management platforms.

These insights shed light on the evolving dynamics of the crypto investment landscape and offer valuable perspectives for both investors and industry observers navigating the rapidly changing crypto market.

Discussion about this post