Bitcoin miners continuously upgrade their mining equipment to stay competitive in the cutthroat market by taking advantage of the declining GPU prices.

The hash rate of Bitcoin increased by 10.8% for the whole month of October as it continuously set new records. Even though the hash rate is rising, the security of the Bitcoin network is improving thanks to a variety of other variables.

Reduced Mining Rig Costs

Hash rate is a unit of measurement for the amount of computing power required by Bitcoin miners to produce a block. More efficient mining rigs are necessary for higher hash rates, which may allow miners to mine a block and earn mining rewards.

As the world’s markets recovered from chip shortages in 2022, the price of graphics processing units (GPUs), a critical component of mining rigs, dropped. Miners were first able to reduce their operating costs due to lower GPU pricing because of the prolonged bear market.

Additionally, mining rig suppliers like Bitmain decreased the price of Antminers in an attempt to restore profitability to the industry. The return on investment, however, can take between 11 and 15 months for retail miners and large-scale miners.

By taking advantage of the falling prices for mining rigs, crypto miners are continuing to upgrade their machinery in order to maintain their competitiveness in the fierce competition.

Additionally, significant cryptocurrency firms like Grayscale have disclosed plans to invest in Bitcoin mining equipment.

Rising Numbers of Bitcoin Jurisdictions

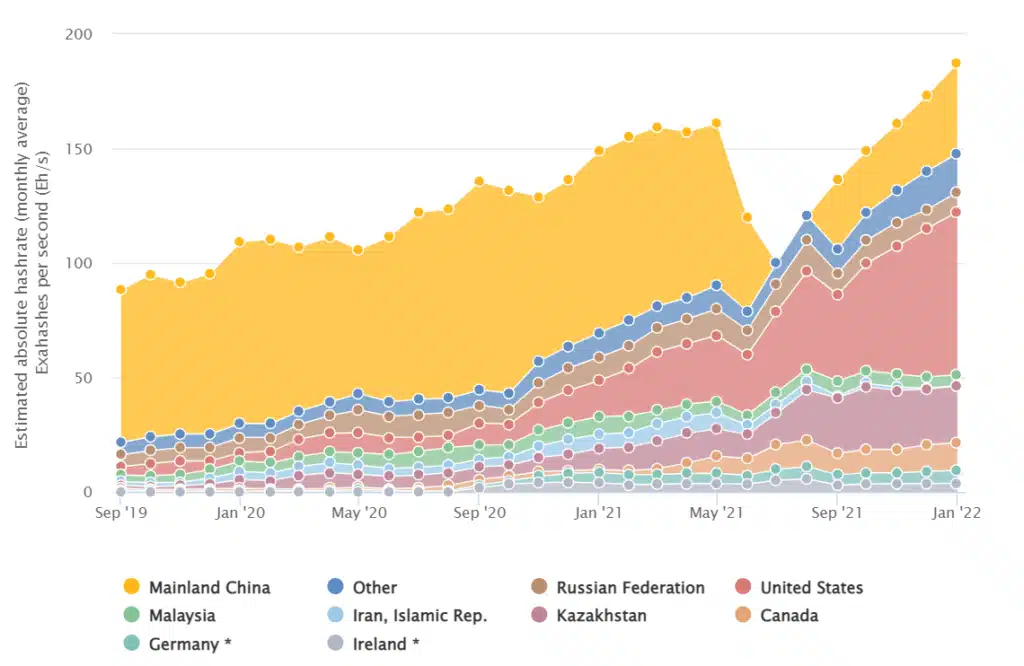

Since China opted to outright ban cryptocurrency trading and mining, other nations have made the decision to assist the stuck Chinese miners by offering a safe haven within their own countries.

When it was time to relocate their mining operations, Bitcoin miners first considered countries like Kazakhstan, Canada, and Germany, among others. As a result, Bitcoin mining was much less dependent on China and more decentralised.

However, according to data from Cambridge Centre for Alternative Finance, China resumed its mining operations just three months after the ban was put in place, which helped to increase Bitcoin’s hash rate.

Now at present, the United States is the jurisdiction that contributes the most to the hash rate of Bitcoin, with Georgia leading the way at 30.8%, followed by Texas (11.2%), Kentucky (10.9%), and New York (9.8%).

The Merge: Ethereum’s Switch to Proof-of-Stake

Following the Merge update, Ethereum recently switched from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus method. Ethereum no longer permits the use of GPUs for mining activities as a result.

Naturally, the immediate change in the mining process prompted Ethereum miners to sell out or switch their equipment to Bitcoin mining.

The rising hash rate can be concerning despite the enhanced network security because mining revenue in terms of U.S. dollars is still struggling to recover due to the current bear market.

Also Read:

After the Ethereum Merge, What Will Happen To Bitcoin And The Crypto Market?

Discussion about this post