The market for cryptocurrencies has grown rapidly in recent years and now has a market valuation of more than $1 trillion.

Discovering the best low-cap crypto gems and investing in them before they bloom has become a successful business strategy for many investors. Day trading can result in substantial gains, but it also entails risk.

For investors, low-cap assets bring considerable opportunities. They frequently begin discounted, but as the underlying projects gain more traction, their prices increase.

The majority of the main cryptocurrencies have turned sideways as the crypto market appears to be taking a break from the intense buying seen in January 2023. Although this consolidation may restore the bullish trend and provide sidelined traders with entry points.

We’ll quickly review some of the top low-cap cryptocurrencies in this article that could deliver good returns in 2023.

Top 3 Low-Cap Crypto Investments For 2023

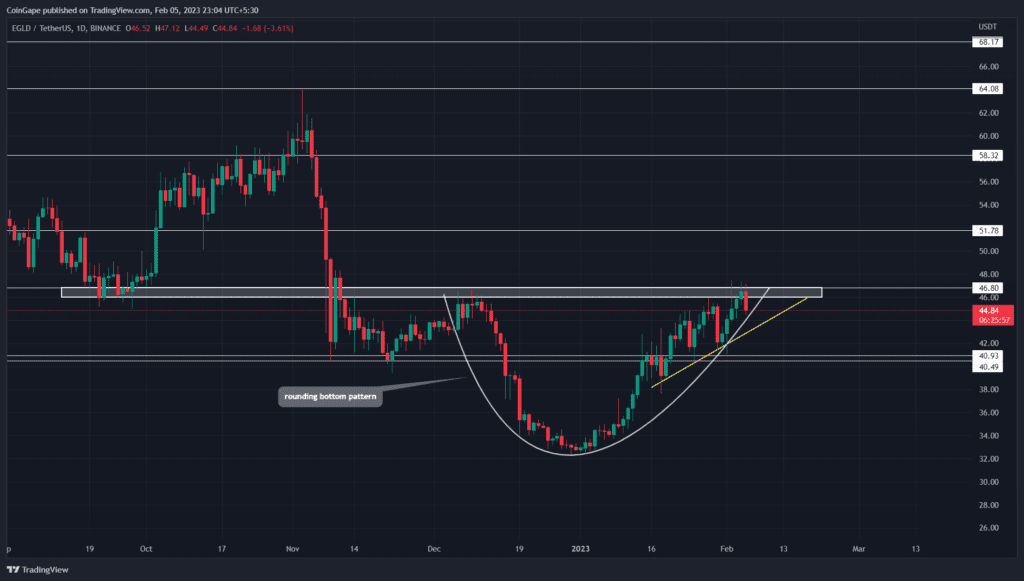

MultiversX(EGLD)

The price of MultiversX(EGLD) coins has recovered in a U shape, indicating the emergence of a rounding bottom pattern. The coin price has increased 43.5% since January 1 throughout this rebound and has already reached the neckline resistance of $46.7 to $46.

A positive breakout from the $46.8 resistance level will strengthen the bullish trend and drive the EGLD prices 36.5% higher to reach the $61.5 target.

The coin price, however, shows a struggle to break beyond this barrier because of the continuous market uncertainty. The MultiversX coin is currently trading at $45.12 as of the time of publication, and if the overhead selling pressure continues, the prices may consolidate for a few trading days before the uptrend resumes.

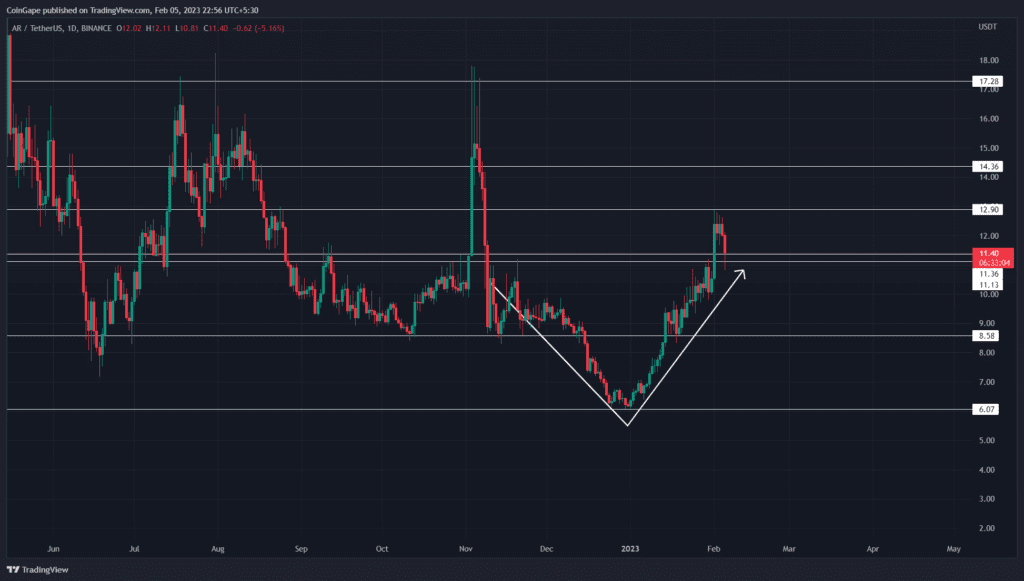

Arweave(AR)

The price movement of the Arweave(AR) coin over the past three months exhibits a V-shaped recovery. The creation of this structure suggests that buyers are being aggressive and confident in the market.

The AR price has so lately provided a huge breakout from the monthly resistance of $11.3-$11.1 amid the recovery. Buyers should have further support following this breakout, which should help the bullish trend continue.

Currently trading at $11.45, cryptocurrency is back testing the $11.3 support after today’s 4.5% loss. Additionally, the lower price rejection associated with the daily candle shows that the price is able to sustain itself above the new resistance level of $11.3.

The prices should so hit the following targets of $12.9, $14.36, or $17.3 with continued buying.

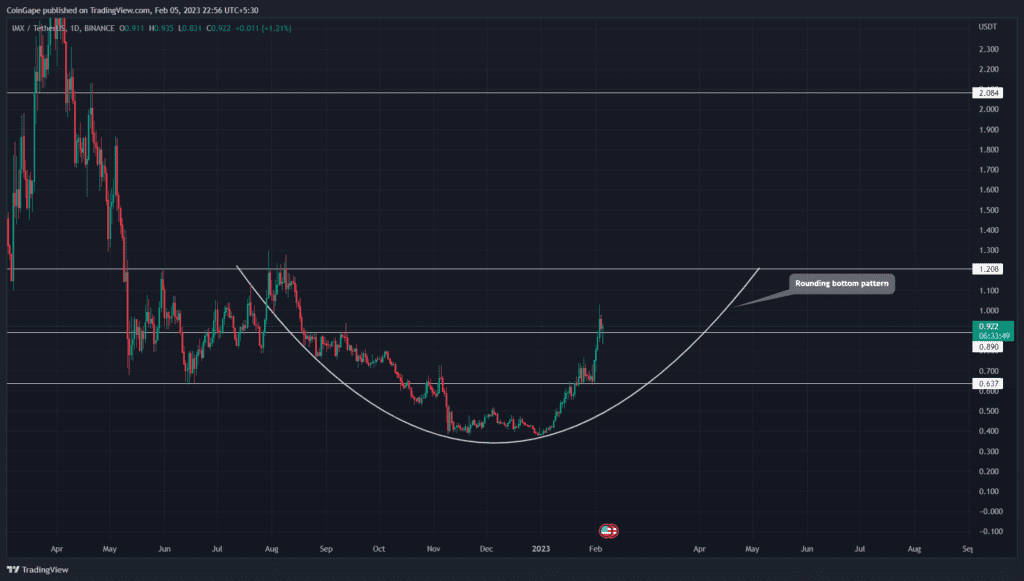

ImmutableX(IMX)

Similar to the EGLD analysis discussed above, the ImmutableX (IMX) coin exhibits the creation of a rounded bottom pattern with a neckline resistance of $1.2. The coin price did, however, give a strong breakout from the $0.89 barrier on February 3.

This breakthrough ought to restore the bullish momentum and encourage purchasers to carry on with the rounding bottom pattern recovery. The price of the coin is at $0.93 and indicates a retest of the breached resistance.

Today’s candle’s long-wick rejection suggests that buyers are defending recently gained support and are aiming for a prolonged bullish rally. The post-retest surge should attempt to break through the neckline barrier of $1.2 if the buying pressure continues.

In any case, under ideal bullish circumstances, the ImmutableX coin’s market value may double and reach $2.

Conclusion

The best low-cap crypto gems offer an exciting opportunity for investors to profit from the cryptocurrency market. Although some assets may not be as well-known as some of their large-cap competitors, they have a lot of growth prospects. If they take off, investors who invested in them early enough will receive the highest returns.

Also Read:

Top 5 Leading Music NFTs To Watch In 2023

Discussion about this post