Ethereum tokens have been a key driving force behind the adoption and growth of crypto because of their versatility.

Ethereum is one of the most popular digital currencies available today. Its secured, open-source blockchain technology provides users with a secure platform for trading and investing. On top of that, Ethereum also offers a variety of tokens which are used for different purposes.

Ethereum (ERC-20) tokens, which have a market worth of $211.04 billion and 25.79% of the cryptocurrency market, have been a key driver of the adoption and expansion of the crypto industry.

ERC-20 tokens quickly acquired acceptance because of their adaptable and reliable mechanism, as well as the active Ethereum community. For those who are unaware, ERC-20 allows for the utilization of tokens all across the Ethereum ecosystem, including in DeFi projects, dApps, etc.

Let’s take a closer look at a few of the best Ethereum tokens that could rise in the upcoming bull run.

Best Ethereum Tokens to Invest in January 2023

BNB

The Binance Coin (BNB) is the native currency of the Binance blockchain. It was created to fuel the Binance Ecosystem and is used to pay for fees related to trading on the Binance Exchange. The BNB coin can also be used to purchase goods and services and is accepted by a growing number of merchants.

The BNB coin was originally issued as an ERC-20 token on the Ethereum blockchain. In mid-2017, Binance completed a successful ICO that raised $15 million. The funds were used to launch the Binance cryptocurrency exchange. Shortly after the ICO, the BNB token was migrated to the Binance Chain blockchain.

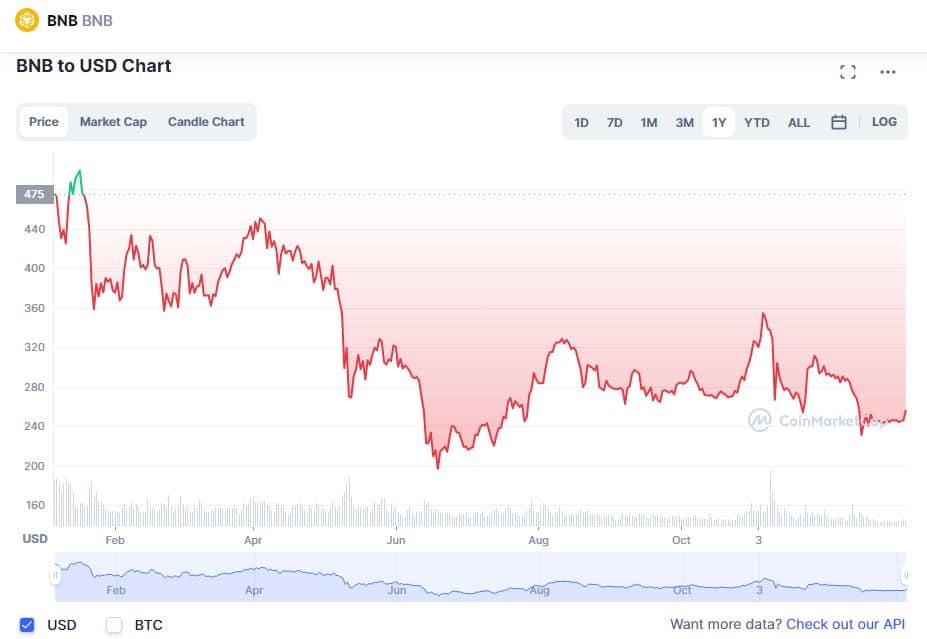

It has a $41 billion market cap and is presently trading at $266.45. BNB has been experiencing a decline for some time. In the past 30 days, 60 days, and 90 days, its price has decreased by 11.01%, 27.54%, and 10.00%, respectively. BNB is down $434.42 from its all-time high of $690.93.

BNB may provide an excellent ROI during the upcoming bull run because both the cryptocurrency market and BNB are currently in a downturn. As per Coincodex, the BNB price might be between $ 477.95 and $ 1,435.26 by 2025.

Polygon (MATIC)

Polygon is a decentralized platform that provides a seamless experience for interacting with Ethereum and other assets. The native MATIC token is used to pay transaction fees on the network. Polygon’s goal is to enable users to interact with the Ethereum blockchain in a more user-friendly way.

On the Polygon network, MATIC is needed to control, secure, and pay network transaction fees. MATIC, which has a market worth of $6.9 billion, has also been on the decline for a while. Its price is currently $0.8004 and over the past 30 days, 60 days, and 90 days, it has decreased by 11.82%, 31.13%, and 5.48%, respectively.

MATIC is now 73% below its all-time high of $2.92. (as recorded on December 27, 2021). The technical analysis of Coincodex indicates that investor sentiment toward MATIC is gloomy.

MATIC can reach new highs in the next bull market because it is currently in a dip despite providing the same value proposition as it did in the bull market of 2021. According to Coincodex prediction, MATIC’s price would be between $ 1.496618 and $ 4.49 by 2025 and may hit $ 22.12 by 2027.

UniSwap (UNI)

UNISWAP is a decentralized crypto exchange built on the Ethereum blockchain. It allows for the swapping of ERC20 tokens without the need for a centralized exchange. UNISWAP uses an automated market maker (AMM) system to provide liquidity and facilitate trades.

UNISWAP was launched in November 2018 and has become one of the most popular decentralized exchanges in the space.

The price of UNI has dropped by 70.99% in the last year despite being amongst the top ecosystems in the crypto industry and being free of any massive issues. From its ATH of $44.97 on May 3, 2021, it has fallen by 87.87%. The price of UNI is present at $5.45.

In the past 30 days, 60 days, and 90 days, UNI prices have fallen by 10.53%, 28.19%, and 21.66%, respectively. MATIC could be seen as an undervalued asset at the moment.

The technical analysis of Coincodex indicates that investor sentiment toward MATIC is unfavourable. By 2025, they predict that the UNI will cost between $14.92 and $44.80, with a potential increase to $99,38 by 2026.

Discussion about this post