The Arbitrum Decentralized Autonomous Organization (DAO), recently launched and funded by the airdropped token ARB, saw extremely volatile trading on Thursday.

On Thursday, after airdropping slightly over 1 billion of its ARB token to network users, Arbitrum, a well-known layer-2 scaling solution on the Ethereum blockchain that enables quick and inexpensive transactions, officially changed its legal status to a DAO.

The ARB/USD coin rose as high as $9 before falling as low as $1.10 in less than an hour, according to TradingView, which cited Kraken data.

On ByBit, prices reportedly surged as high as $14 per token.

According to CoinGecko, ARB/USD was most recently trading sideways at roughly $1.35 per token, giving it a market cap of about $1.7 billion and placing it as the 40th largest cryptocurrency by market capitalization.

With a maximum supply of 10 billion ARB tokens, Arbitrum would place ninth in terms of completely diluted market capitalization with a fully diluted market capitalization at current prices of $13.5 billion.

What Caused ARB to Dump?

Arbitrum’s completely diluted market capitalization would have been massive, between $90 and $140 billion at earlier peak levels in the $9 to $14 per token range, or between 15 and 24% of Bitcoin’s value.

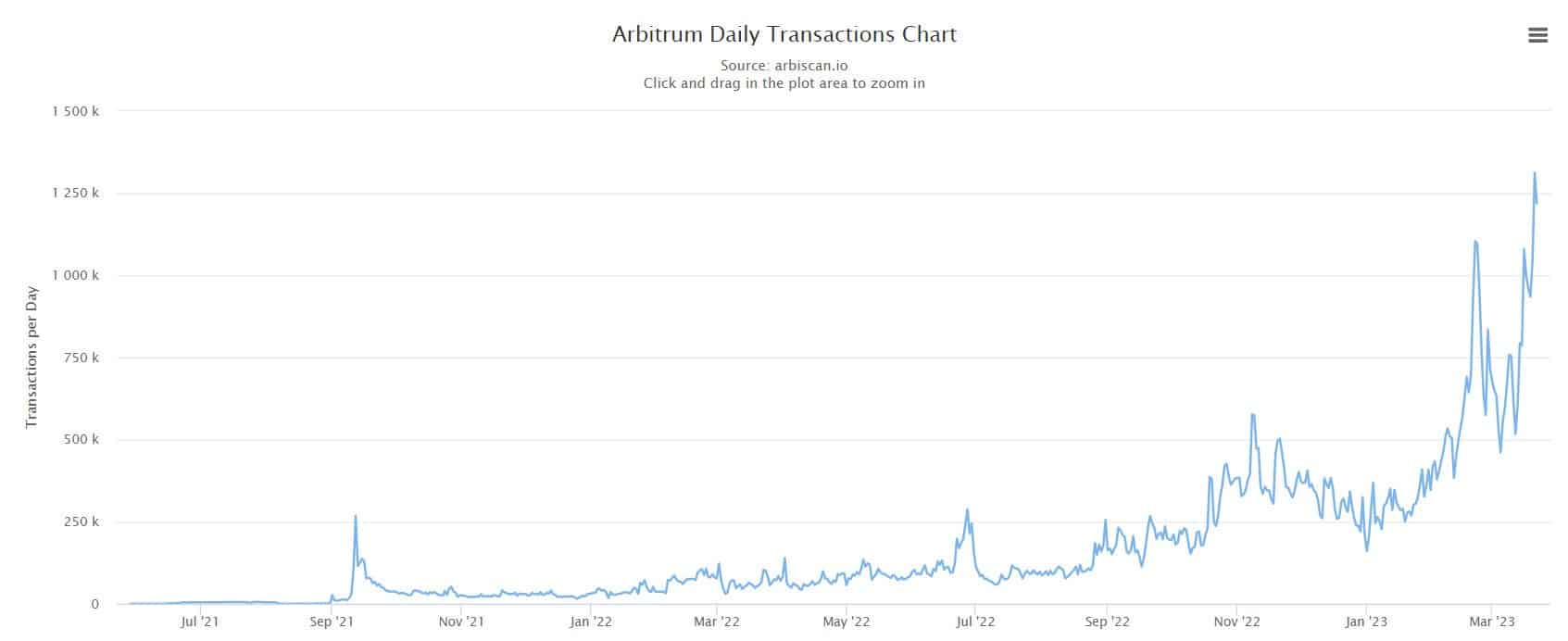

Certainly, Arbitrum is an impressive, rapidly expanding protocol, with daily transactions hitting a new peak this week of almost 1.2 million.

Yet at this moment, it’s probably a stretch to say that Bitcoin is worth 15–24% of it.

In that regard, it probably shouldn’t be shocking that ARB tokens were eventually dumped onto the market as airdrop participants seek to benefit. Also, after the airdrop went live, a large number of users tried to visit the sites, which caused both Arbitrum’s website and blockchain scanner to crash.

Some airdrop participants may have been scared into selling their tokens as a result of this.

Price Prediction: What Comes Next for ARB?

It is challenging to predict the future price of ARB through technical analysis because there is a lack of price information and history.

To predict where ARB will go next, it is probably wiser to keep an eye on movements in the Arbitrum network and ecosystem as well as in the broader cryptocurrency market.

Massive airdrops, like the one just completed by Arbitrum, frequently increase the adoption of a protocol by creating a lot of buzz in the cryptocurrency community.

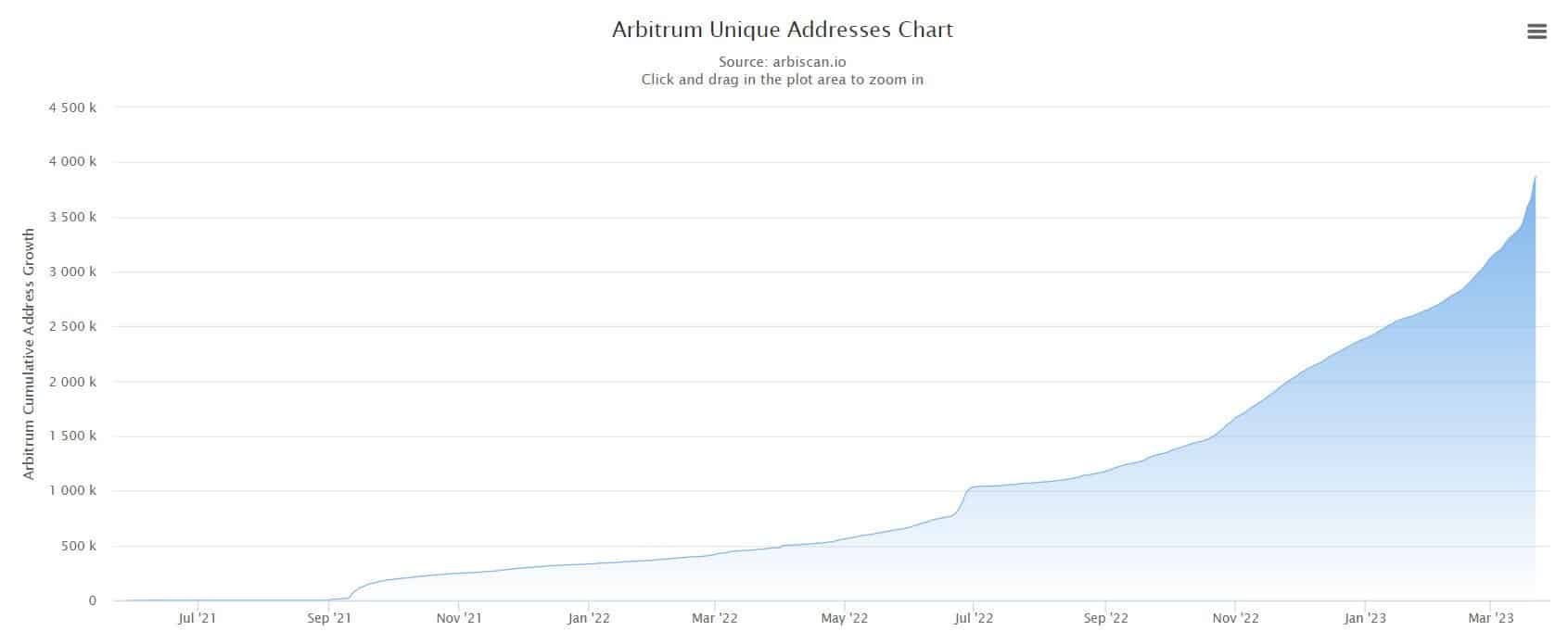

As previously mentioned, the number of unique addresses and daily transactions on the Arbitrum network have both increased.

As more and more significant exchanges list the ARB token, boosting the enthusiasm around the protocol, these positive trends are probably going to continue in the coming weeks. A key indicator for investors is whether the total value locked (TVL) of cryptocurrencies under smart contracts on the Arbitrum blockchain is still increasing.

According to DeFi Llama, it surpassed $3.5 billion on Thursday, setting a new record high.

Investors are continuing to increase their investments in DeFi protocols running on the Arbitrum blockchain. That might encourage a rise in ARB, though it’s hard to predict how high as the market is still in a price-discovery phase.

Can ARB Reach $10 Once More?

If good adoption trends in its network and the overall crypto market continue, ARB can most definitely reach $10 once more.

The bulls in the ARB should be ready to wait their turn.

ARB is a $100 billion (completely diluted market cap) coin once more that may require Bitcoin to reach a market value of $1 trillion or more, as ARB being worth over 10% of Bitcoin is still a bit of a pipe dream at this moment.

But if the US banking situation becomes worse, US economic growth gets worse, and the Fed starts a rate-cutting cycle in the second part of this year, Bitcoin might surpass $1 trillion once more this year.

So, the future appears promising for ARB.

Discussion about this post