FTX, the cryptocurrency exchange embroiled in a significant collapse in 2022, has unveiled a new proposal aiming to compensate victims of its downfall. The latest plan promises substantial repayments, but opinions vary on its adequacy and fairness.

Proposal Details: Compensation and Eligibility Criteria

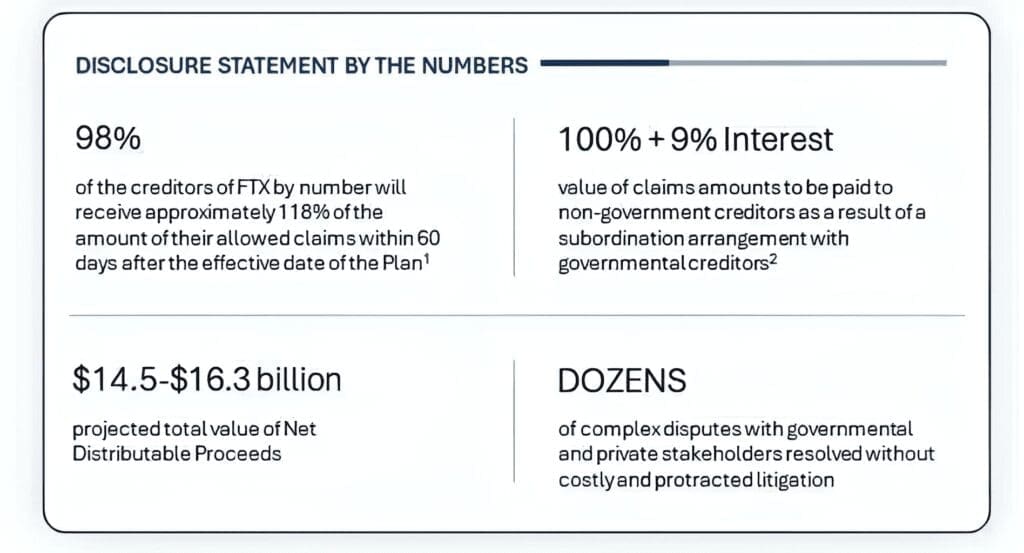

In its recent statement, FTX outlined a plan to provide “billions in compensation for the time value of their investments” to creditors impacted by its collapse. However, only creditors with claims below $50,000 will be eligible for a 118% recovery, encompassing approximately 98% of FTX’s creditors.

Despite the promise of significant compensation, the proposal has drawn criticism for reimbursing creditors based on asset values at the time of the exchange’s bankruptcy, rather than current market prices.

Evaluation of FTX’s Plan: Adequacy and Reception

While FTX CEO John J. Ray III expressed satisfaction with the proposed plan, stating it ensures the return of 100% of bankruptcy claim amounts plus interest, some industry observers remain skeptical. The estimated total distribution to creditors ranges between $14.5 and $16.3 billion, with repayments slated to occur within 60 days post-approval.

Critics argue that the plan falls short in fully compensating victims, particularly as the cryptocurrency market has experienced significant growth since FTX’s collapse. Mike Belshe, CEO of BitGo, voiced concerns over the disparity between the proposed reimbursements and current market values, highlighting lingering dissatisfaction within the affected community.

Also Read: FTX Bankruptcy: Promising 100% Money Back to Customers in Remarkable Turnaround

FTX’s Recovery Efforts and Future Prospects

In the aftermath of its collapse, FTX has pursued various strategies to recover from the financial debacle. Notably, the exchange orchestrated an $884 million share sale in Anthropic, an artificial intelligence firm, as part of its restructuring endeavours.

Despite these efforts, FTX clarified earlier this year that its restructuring plans would not include a revival of the cryptocurrency exchange itself. This decision marks a significant departure from its prior status as one of the largest platforms by trading volume.

As stakeholders await further developments in FTX’s compensation proposal and restructuring initiatives, the fallout from the 2022 collapse continues to reverberate within the cryptocurrency community.

Discussion about this post