Even though the cryptocurrency market is brimming with cryptocurrencies of all shapes and sizes with varying levels of investment potential, there are still some assets that investors may wish to avoid, at least for the time being.

In this context, it may be wise to refrain from investing in the following five crypto assets during the week of June 19. These indicators include price history, ratings such as the Weiss Crypto Ratings (WCR), TokenInsight, Wikirating’s Crypto Rating Index (CRI), and recent developments (or lack thereof) of crypto assets.

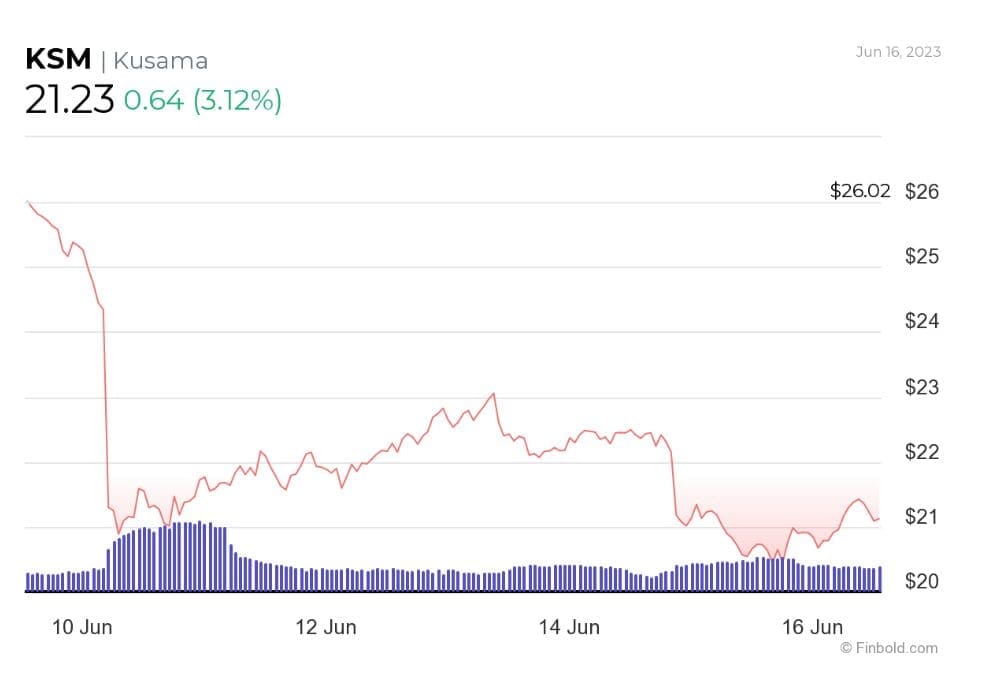

Kusama (KSM)

The Kusama (KSM) token, the pre-production blockchain version of the Polkadot (DOT) platform, is constantly showed up on “to avoid” lists and continues to receive poor ratings, such as an “E” or “very weak” grade from WCR and a “CC” grade from CRI, which indicates a “crypto asset that is currently highly vulnerable” to failure.

According to the most current data retrieved on June 16, Kusama was trading for $21.23, up 3.12% on the day, but exhibiting falls on both weekly and monthly charts of 17.89% and 16.89%, respectively.

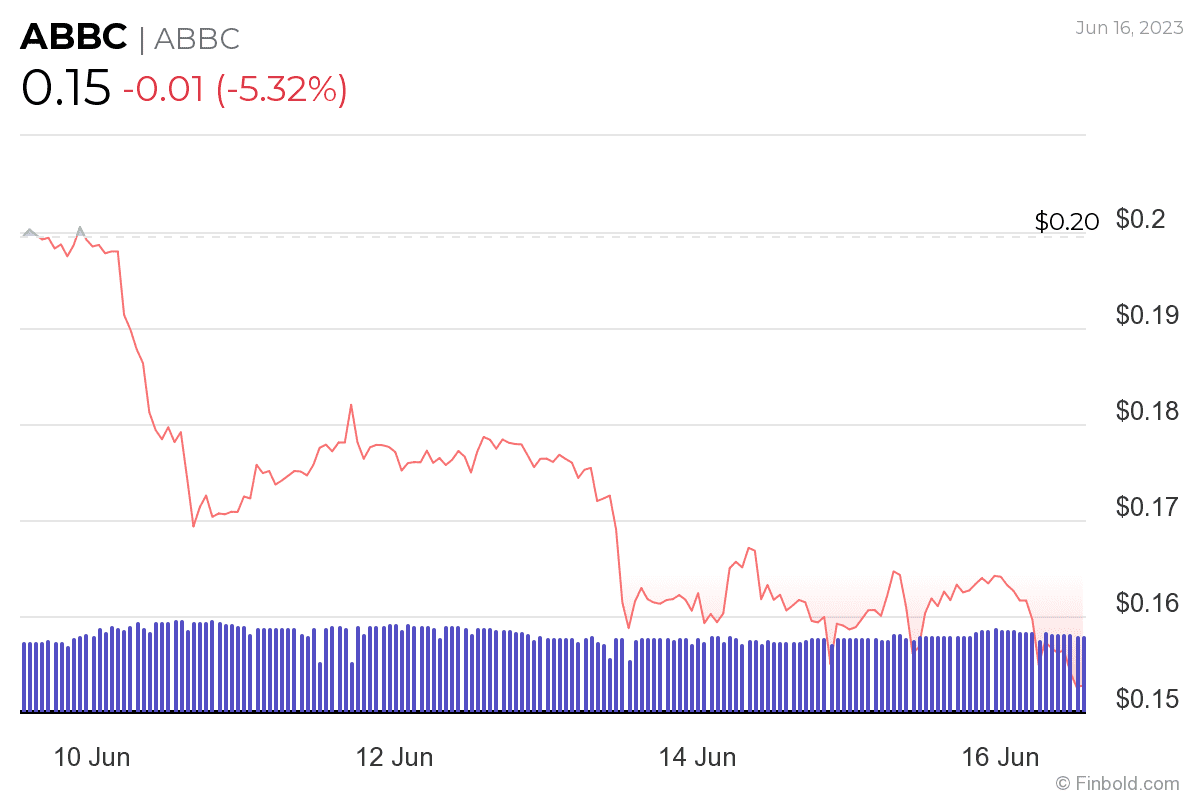

ABBC (ABBC)

With a WCR score of “E+” and a “B” according to CRI and TokenInsight, positioning slightly better than Kusama, ABBC still carries a low desirability rating compared to the majority of assets. This means that even though it “currently can meet its commitments,” it is “more vulnerable” in the near term than other lower-rated crypto assets.

According to the most recent data, the price of ABBC was $0.15 at the time of publication, a decrease of 5.32% over the past 24 hours and a loss of 22.56% despite an increase of 58.29% on its monthly chart.

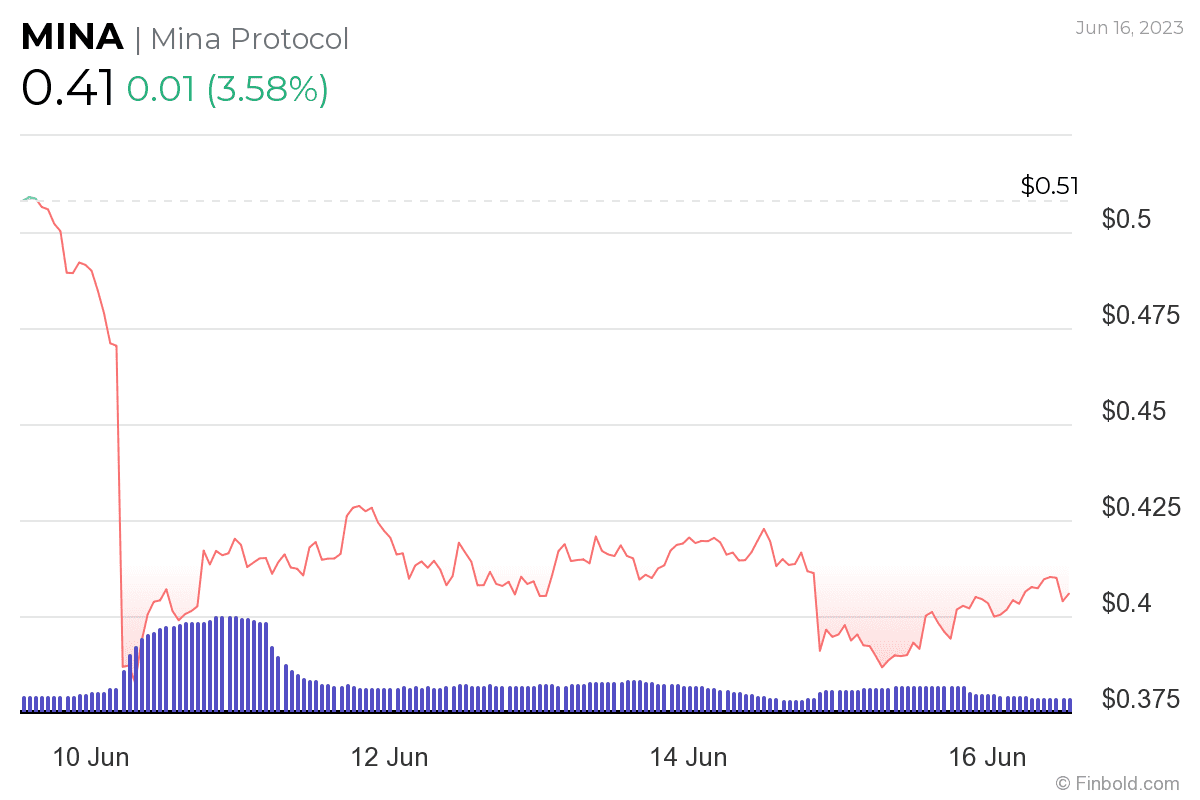

Mina Protocol (MINA)

Mina Protocol (MINA), another asset with an “E+” grade from WCR, also has a low CRI score of “CCC,” indicating that it is “currently vulnerable and is dependent upon favourable business, financial, or economic conditions to remain valuable.”

According to data collected on June 16, Mina Protocol is presently trading for $0.41, showing an increase of 3.58% on the day but a decline of 19.52% over the previous week and 28.20% over the previous 30 days.

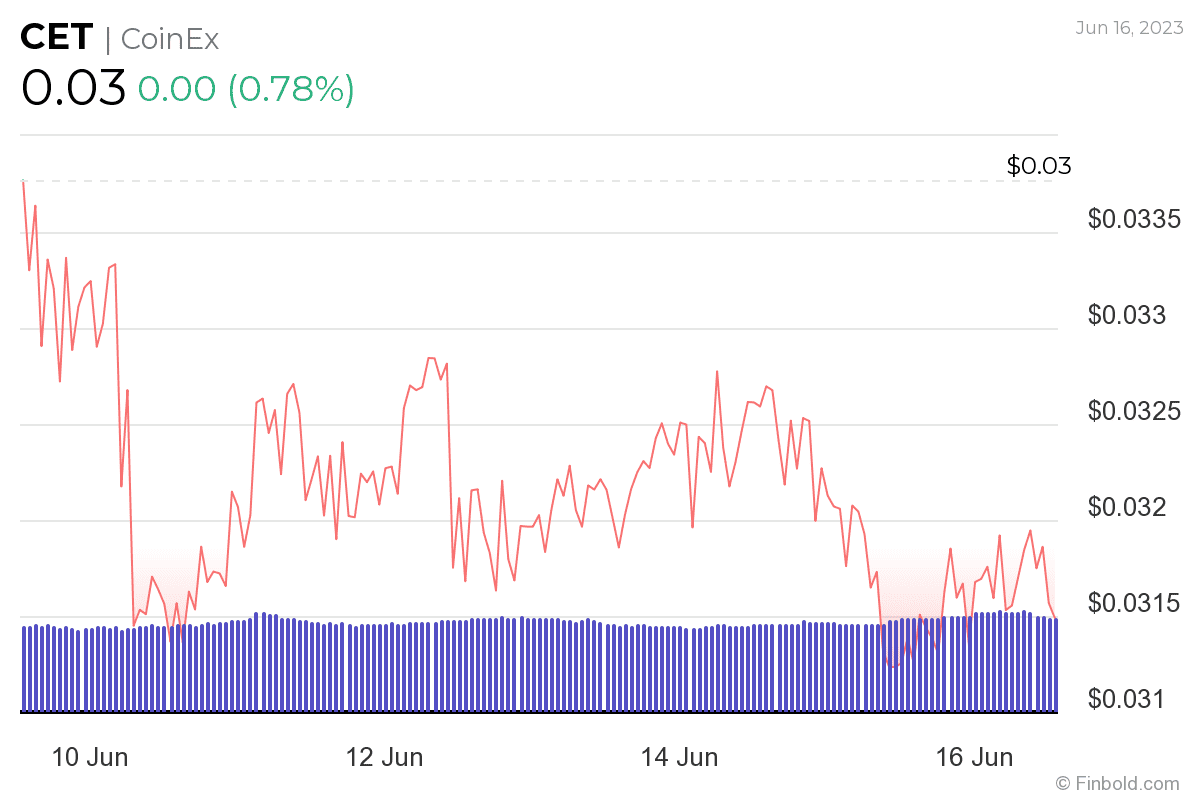

CoinEx (CET)

Following the withdrawal of cryptocurrency exchange CoinEx (CET) from the US market in February 2023 as a result of a lawsuit brought by the New York Attorney General over an alleged securities fraud, its token has also had some difficult times and currently has a score of ‘D-‘ or ‘weak’ from WCR as well as a ‘B’ from CRI.

According to the most recent figures collected by Finbold, the price of CoinEx is currently $0.03, reflecting gains of 0.78% over the previous 24 hours but losses of 5.87% over the previous week and 9.91% over the previous month.

Also Read: CoinEx Exchange Banned In New York, $1.7M Crypto Assets Seized

Filecoin (FIL)

The cryptocurrency of the decentralized storage and payment system network, Filecoin (FIL), depreciated and received a WCR rating of “D-” as well as a “B” from CRI due to Grayscale withdrawing their application to list it as a Trust Investment product during the US regulatory threat.

According to information collected by Finbold, the price of Filecoin is currently $3.61, showing an increase of 2.16% for the day as well as losses of 11.68% over the previous week and 18.61% over the previous month.

Conclusion

All things considered, crypto ratings are a reliable indicator of a digital asset’s capability to survive in the current turbulent crypto ecosystem. However, history has proven that this can change quickly, therefore it is still crucial to carry out one’s research before purchasing or dismissing a cryptocurrency as an investment.

Disclaimer: This website’s content should not be interpreted as investment advice. It is risky to invest. Putting your money into the market exposes it to the possibility of loss.

Discussion about this post