The Ethereum network experienced the biggest transaction rise in 2023 and since June thanks to the most recent whale transfers.

Ethereum (ETH), the second-largest cryptocurrency, could fall due to major online transfers. On-chain data shows 300,000 ETH worth approximately $500 million transferred from two wallets to Coinbase.

The two in question are cold wallets and are owned by Coinbase. After transferring the cash from these cold wallets to Coinbase’s hot wallet, each transaction transferred 4282 ETH to numerous addresses.

Santiment stated: “Among the largest of 2023, this is the highest onchain transaction spike since June 13. The reasons for these moves are unknown, and may not necessarily impact price”.

As of press time, ETH is down 1.19% to $1,619 with a market worth of $194 billion. Ethereum’s technical chart remains weak.

Also Read: Ethereum Co-Founder, Vitalik Buterin Transfers 1M$ Worth Of ETH To Coinbase

Ethereum (ETH) Price Analysis

Ethereum’s price fell below the 100-day and 200-day moving averages, lingering around $1.8K, after a big loss from the vital $1.8K resistance level. It rebounded after finding support at $1.6K.

This support zone is crucial because it matches the 61.6% Fibonacci retracement level, which matches the powerful upward rise towards $2.1K in early March. If the price falls below $1.6K, a negative slump is more likely.

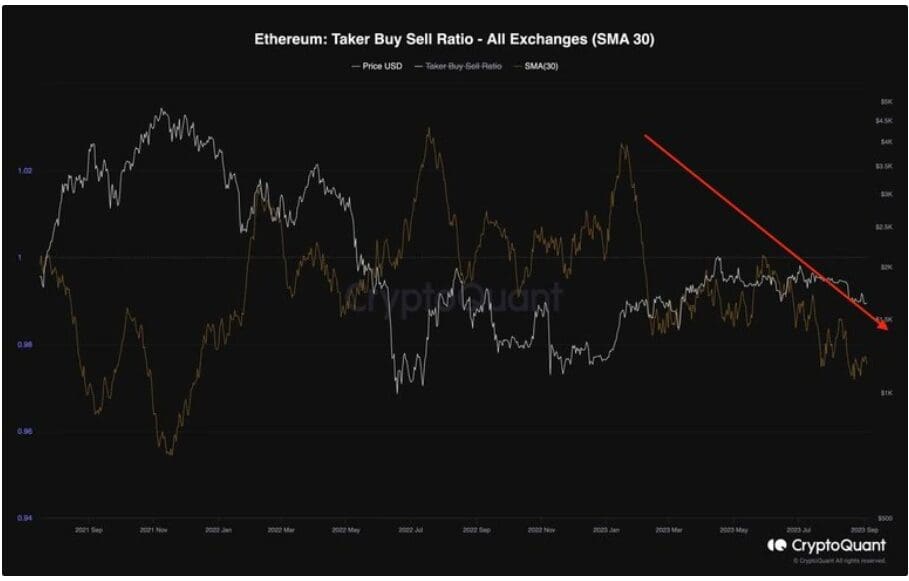

Blockchain data also shows considerable unfavourable sentiment for Ethereum. The 30-day moving average on the chart illustrates that Ethereum’s buy-sell ratio has been falling for months.

Bullish sentiment is indicated by this score over 1. The bearish mood is indicated by the measure falling below 1. Any decline below $1,6000 could lead to a deeper downturn. Market analysts also expect Ethereum to reach $1,000.

The approval of the Ethereum Futures ETF, which appears imminent, would be the next constructive event. The US SEC may approve it soon.

Discussion about this post