Investors can earn a significant amount of money through their index funds and ETFs through passive income. What does passive income involve? Passive income entails little personal effort while investing in an asset.

Investing In Passive Income Assets

Many investors are aware of the passive income that can be generated from exchange-traded funds (ETFs) and index funds. Index funds refer to mutual funds that are managed on a passive basis. They strive to align with the performance of a particular market index.

The ETFs are found on stock exchange platforms and they do resemble the index funds. These two aspects can help you diversify your portfolio which leads to a reduction in volatility and financial risks. They are also worth investing in due to their low expense ratios making them economical for the investor.

What is an expense ratio? It refers to a ratio that evaluates the amount of assets that are used in settling costs associated with marketing, management and operations. A lower expense ratio therefore means that more of the fund’s assets are used for investment rather in stead of paying expenses.

Just like stocks, you can earn dividends and capital gains building your income as you go along.

Index Funds and ETFs In The Crypto Space

The index funds in the cryptocurrency exchange market copy the performance of a particular cryptocurrency index or market segment. Investors trade ETFs, on the exchanges and therefore follow up on the performance of a cryptocurrency index and market segment. You can therefore trade shares throughout the day.

Comparison Between Crypto Index Funds And Crypto ETFs

The assets provide investors with the chance to diversify their portfolios. Investors can also come across the opportunity to get a broader perspective of the cryptocurrency market.

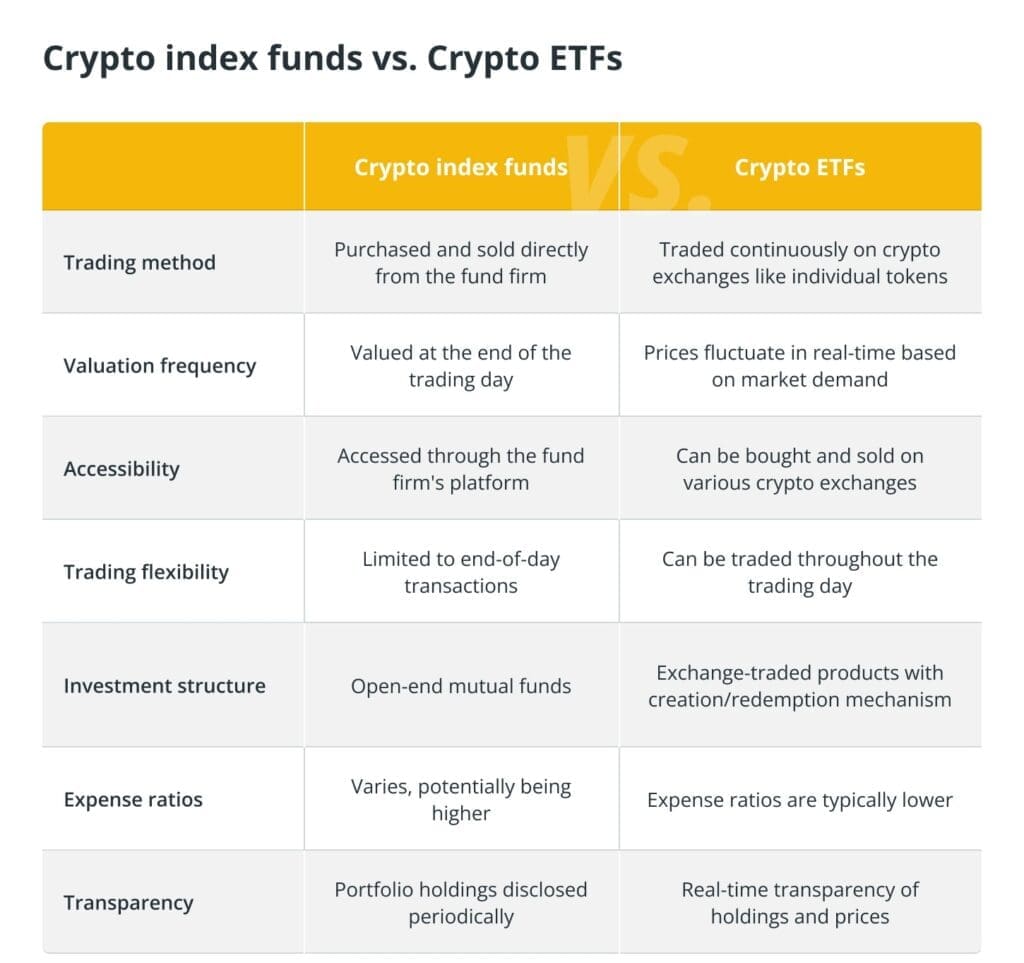

There are a few differences which separate the assets from each other. Let us take a look at some of them below:

- The crypto index funds have lower trading ability than the crypto ETFS. This is because the crypto index funds are bought from the fund organization and become more appreciated as the trading day ends. Crypto ETFs are readily available on the exchanges with realistic values.

- Crypto ETFs have lower expense ratios than crypto index funds.

Also Read: Peer-to-Peer Lending For Passive Income: Essential Tips To Get Started

What should you consider before embarking on passive income investments?

- Your knowledge of cryptocurrency market index funds and ETFs: Should be expanded.

- Your risk tolerance and investment goals.

- The reliability of the crypto exchange.

- The value of the expense ratios, diversity and performance.

Once you have done this, you can start the investment process. Here are the steps you should take into consideration:

- Sign up on the crypto exchange and finish the verification process.

- Carry out the trades to buy index funds and ETFs.

- Evaluate the progress of your investments and carry out periodic rebalancing.

- Get the value of any income that comes from dividends and staking.

- Study the market changes and any other influencing factors such as legislative changes.

Techniques you can use to generate passive income using crypto index funds and ETFs

Investing in crypto index funds pays out dividends

There are a few index funds and ETFs which come with dividends. They put a portion of their money into cryptocurrencies that one can stake and with time, generate passive income.

Staking and yield farming

Yield farming involves receiving rewards in exchange for enhancing liquidity in decentralized finance (DeFi) protocols.

Staking involves holding onto coins while receiving the rewards.

Tokenized real estate funds

Some cryptocurrency index funds invest in real estate assets and convert them into tokens. The investors can therefore gain from capital growth and rental income.

Issuing of loans

Crypto index funds and ETFs that issue loans earn interest on the principal they loan out. This income is generated on a passive basis.

Maintaining portfolio balance to ensure growth

Crypto index funds always try to balance their portfolio growth. Well-performing assets are sold while underperforming assets are bought. The investors can easily take advantage of the capital gains. This can be done if the fund outshines its expected performance levels.

Investing in fractional shares and dollar-cost averaging

Taking advantage of fractional shares allows you to invest small amounts of money. This allows you to diversify your portfolio and as a result, the market volatility is reduced. The investors can slowly build their portfolio and therefore earn more returns from the long-term development of these assets.

The challenges associated with crypto index funds and crypto ETFs

- These passive income-generative methods are associated with high volatility. Diversification and regular portfolio rebalancing are essential to control this.

- There may be a chance of illegal risks taking place due to the unstable regulatory environment. To avoid this, you should invest in reputable funds due to third parties being involved in the legal action.

- Funds with low trading volumes can’t purchase shares at the price they want and this can be done by determining the liquidity before investing.

Discussion about this post