In a recent analysis by Kaiko, Ethereum (ETH) might see significant gains over Bitcoin (BTC) following the launch of highly anticipated Ether exchange-traded funds (ETFs) in the United States. The launch, expected to be around July 23, could mark a pivotal moment for Ethereum.

Ethereum Poised to Lead Post-ETF Launch

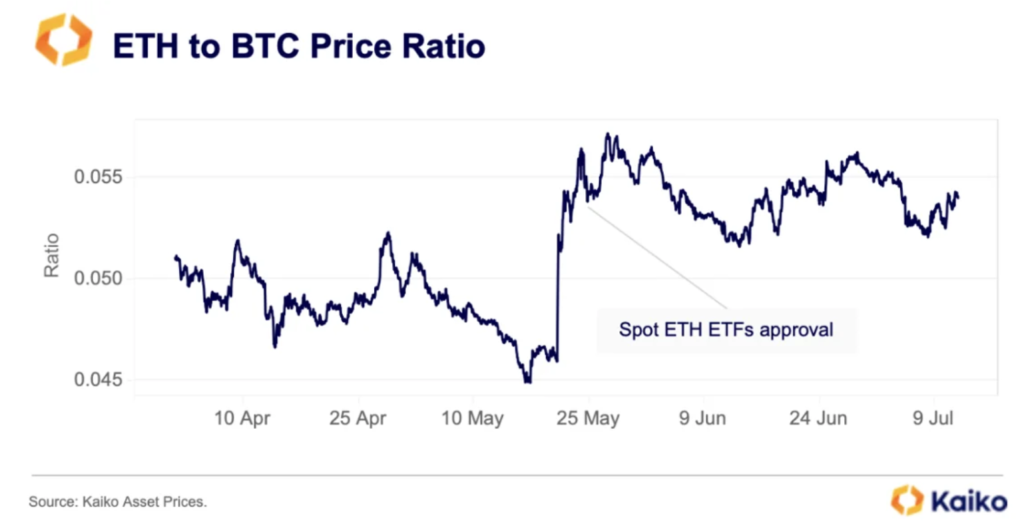

Kaiko’s analysis focuses on the Ether to Bitcoin price ratio, which measures how much BTC is needed to buy 1 ETH. This ratio currently stands at 0.05, up from 0.045 before the U.S. Securities and Exchange Commission (SEC) gave the green light for spot Ether ETFs. A rising ratio indicates that Ether is gaining value relative to Bitcoin, suggesting a bullish trend for ETH.

Low Market Depth Signals Potential for Growth

Another crucial factor highlighted in the report is Ether’s 1% market depth. This metric indicates the level of liquidity in the market. Lower liquidity often leads to higher volatility, whereas higher liquidity can stabilize prices during large transactions. Currently, the market depth for Ether is low, pointing to potential price volatility and significant upward movement as demand increases.

Also Read: Ethereum ETFs Get SEC Approval: Trading to Start on July 23

The Ethereum Exchange Reserve, which tracks the amount of ETH available for purchase on exchanges, is at multi-year lows. This indicates a potential supply shock as institutional investors prepare to fill their ETF allocations, likely driving prices higher.

Spot Ether ETFs: A Game Changer

The imminent launch of spot Ether ETFs is a major focus for market analysts. Eric Balchunas, a senior ETF analyst at Bloomberg, has forecasted a July launch window. Balchunas noted that the SEC asked applicants to finalize their amended S-1 forms by July 16, hinting at a potential July 23 launch date.

Institutional investor Tom Dunleavy told Cointelegraph that he expects these ETFs to attract $10 billion in inflows, at a rate of approximately $1 billion per month. Such substantial investment could significantly impact Ether’s market dynamics.

Regulatory Challenges and Opportunities

The regulatory landscape for Ether remains complex. Ether’s classification as a commodity or a security has been a contentious issue. In June, the SEC dropped its investigation into Ethereum’s smart contract protocol, possibly to avoid further complications. Consensys attorney Laura Brookover suggested that this move could be seen as a tactical retreat by the SEC.

Discussion about this post