The biggest cryptocurrency options exchange in the world, Deribit, is entering the spot trading market.

The company announced late on Wednesday that it is going to start operating a zero-fee spot exchange on April 24. The move was taken soon after competitor Binance’s zero-fee spot trading campaign ended last month.

With the availability of the spot market, traders are no longer needed to go elsewhere in order to exchange popular cryptocurrencies. They are now able to set up multi-leg complex strategies all in one place.

A new spot trading feature will be launched by Deribit, the largest crypto options exchange in the world based on open interest and trade volumes.

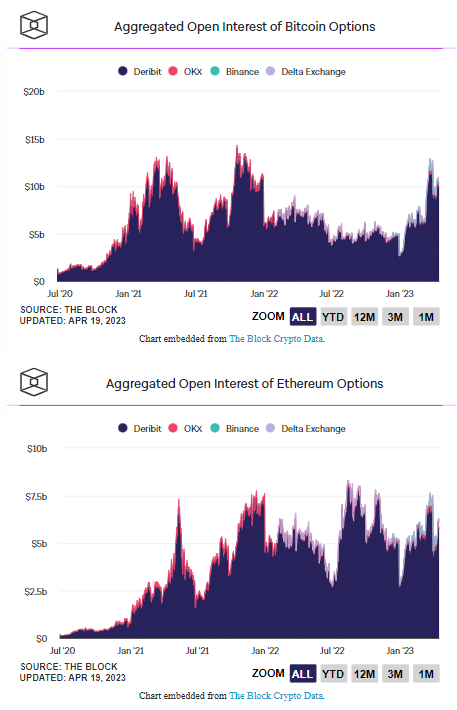

The exchange announced that the new platform would go live on April 24 featuring three pairs: BTC/USDC, ETH/USDC, and ETH/BTC. The exchange accounted for 91% of worldwide options open interest of over $13 billion in March.

There will be no maker or taker fees for the feature, therefore the exchange will not require any margin. Takers take available orders while makers place new orders and wait for them to be filled.

Due to the availability of spot trading, users can now trade derivatives, in which the payment and delivery of the underlying asset are made at a future date, as well as immediately buy and sell bitcoin (BTC) and ether (ETH).

Additionally, it indicates that experienced traders will be able to set up multi-leg complex strategies combining both the spot market and futures and options contracts in a single place.

According to Luuk Strijers, the chief commercial officer of Deribit, “With this most recent addition, our platform now boasts a comprehensive suite of both derivatives and spot trading solutions, catering to the varied needs of traders in the digital asset space.”

“With the added benefit of zero costs, our spot trading feature serves as an exceptional tool for exchanging collateral like BTC and ETH, further enhancing the overall trading experience for our clients,” Strijers continued.

The inverse and linear perpetual and futures markets for three base currencies—bitcoin, ether, and the dollar-pegged stablecoin USDC—have now been added by Deribit, which first started trading bitcoin options in 2016.

The exchange started offering trading in bitcoin volatility futures last month, allowing traders to place bets on the level of price volatility in the leading cryptocurrency. On March 30, the platform’s total monetary value of open positions reached a record high of more than $20 billion.

Deribit insights

Deribit is making its debut in spot trading seven years after it began operations.

According to The Block’s Data Dashboard, the exchange presently holds a 90% share of open interest in both bitcoin and ether options trading, making it the market leader in cryptocurrency options.

The value of active derivative contracts that have not yet been settled is known as open interest.

Deribit faced difficulties last year when it was forced to sell Three Arrows Capital’s (3AC) positions because the now-bankrupt crypto hedge fund failed to fulfill its margin calls. Deribit suffered a “small” setback as a result but went on to raise $40 million from current shareholders at a $400 million valuation.

In August 2021, the company’s previous investment round valued it at $2.1 billion. The valuation, according to Strijers at the time, “is essentially irrelevant” because the funding came from current investors.

The retail approach of Deribit

With the launch of spot trading, Deribit aims to attract more retail users, according to Strijers. Additionally, it intends to relocate its corporate headquarters from Panama to Dubai and obtain a crypto license there.

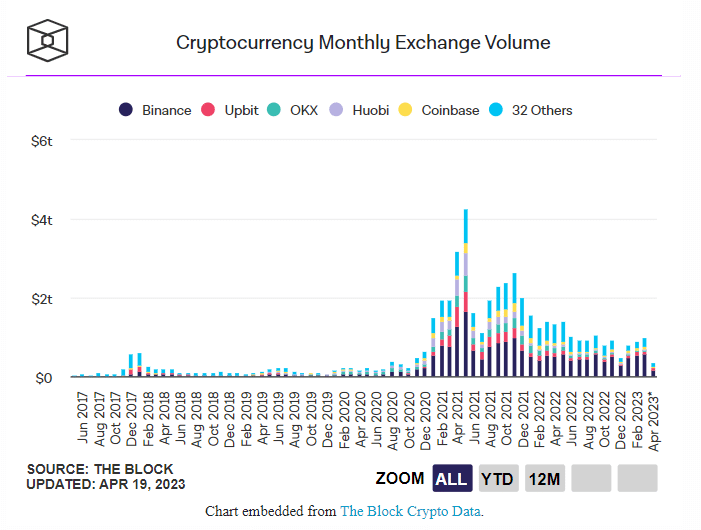

It is uncertain whether Deribit will replicate its options performance in the spot market, where Binance presently dominates. According to Strijers, “trading venues will have to grow alongside the digital asset space as it continues to evolve and ensure the ecosystem remains secure, transparent, and compliant.”

Users in the United States and a few other restricted countries won’t have access to Deribit’s spot exchange or its derivatives platform, said Strijers.

Discussion about this post