- Bitcoin and Ethereum have set new records in December 2023, while the focus on resistance and support levels intensifies within the cryptocurrency market.

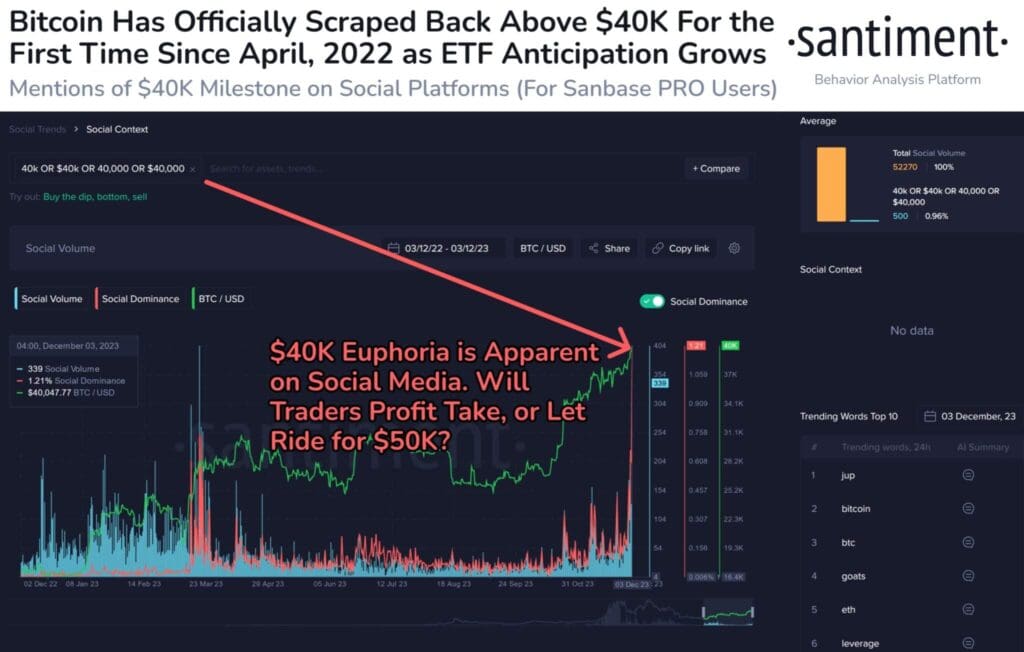

- Factors such as indications of inflation cooling, conclusions on interest rate hikes by the Federal Reserve, and the anticipation of Bitcoin ETFs contribute to bolstering confidence in the crypto industry’s future.

In the ever-evolving landscape of cryptocurrencies, the current December wave has brought forth a whirlwind of developments. With Bitcoin (BTC) and Ethereum (ETH) taking centre stage by shattering their 2023 records, the focus on deciphering resistance and support levels has intensified. Simultaneously, the speculative discussions about Bitcoin’s trajectory persist, creating ripples across the crypto sphere.

Bitcoin’s Meteoric Rise: Breaking Barriers and Charting New Trajectories

The remarkable surge in Bitcoin’s value has propelled the cryptocurrency to unprecedented heights, surpassing the $41,500 mark. Notably, a prominent figure in the crypto domain, Crypto4Every₿ody, highlighted the unforeseen nature of this surge and pointed out the new resistance and support levels following the surge in BTC prices.

The unexpected ascent of Bitcoin has stirred immense enthusiasm, leaving the industry in anticipation of the forthcoming benchmarks. As per Crypto4Every₿ody’s analysis, the crucial junctures lie at a resistance level of $43,100 and a support point at $39,400, beckoning attention from traders and enthusiasts alike.

Read More: Bitcoin Surpasses $41,000: What’s Next for the Cryptocurrency Rally?

Strengthening Confidence in Crypto: Factors and Forecasts

The growing trust in the cryptocurrency market is attributed to several key factors, including signs indicating a tapering of inflation and the prevailing belief among investors that the Federal Reserve has concluded its series of interest rate hikes. Furthermore, there exists a palpable anticipation within the cryptocurrency realm for updates on applications submitted by major players like BlackRock, vying for the potential introduction of U.S. spot Bitcoin ETFs.

Matrixport’s recent report unveiled an optimistic trajectory for Bitcoin, foreseeing a surge to $63,140 by April 2024 and an astonishing projection of $125,000 by December 2024. These projections have injected an additional layer of fervour into the ongoing Bitcoin rally, painting a bullish outlook for the future of the crypto market.

Discussion about this post