The Reserve Bank of Australia has just finished testing out the CBDC and has confirmed that it will be useful in a variety of fields.

The CBDC Used In Four Sectors

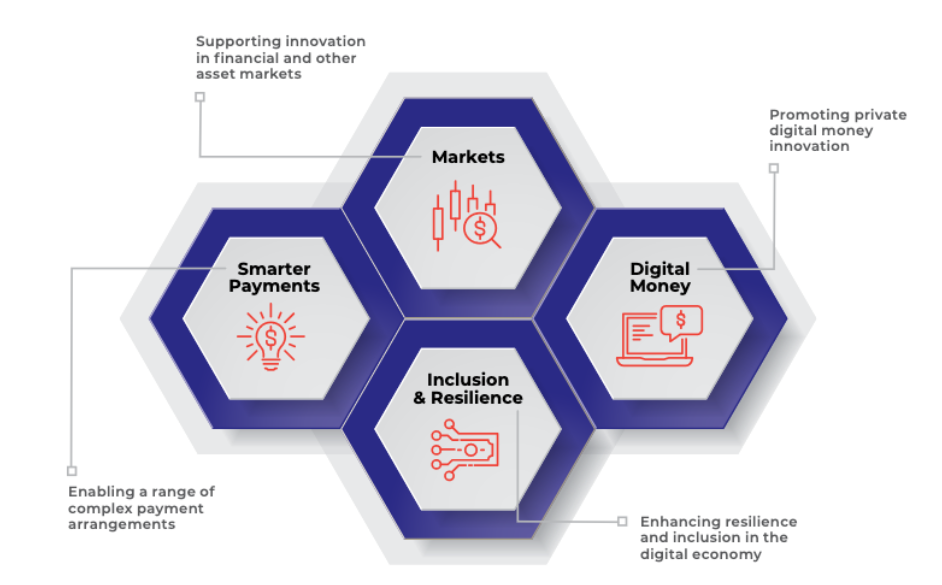

The Australian Central Bank reveals that the CBDC token can be used in four areas. Some of these areas include the tokenization of assets and payment transactions. In a report that aired on August 23rd, the Reserve Bank of Australia (RBA)and the Digital Finance Cooperative Research Centre stated where the token would be used.

We’ve released a report with the Digital Finance CRC @DigiFinanceCRC today on the findings from an Australian central bank digital currency pilot.https://t.co/bTT84yBp02#RBA #CBDC #Payments #DigitalPayments #Blockchain #FinTech pic.twitter.com/WXfe7lchHj

— Reserve Bank of Australia (@RBAInfo) August 23, 2023

The details of the report included:

- The CBDC token could support a variety of payments that are complex and cannot be done by any other payment system.

- The CBDC token would also enhance the financial sector in terms of loan settlement, digitization of the money sectors, resilience, and inclusion within the broader aspects of the economy that is becoming more digitized.

Also Read: CBDCs: Important Social Experiment or Digital Slavery?

A total of 16 firms were engaged in the pilot program and they submitted reports that highlighted the significance that the CBDC holds for “atomic settlements”. An atomic settlement is one which allows two transactions to take place and is immediate.

RBA based the CBDC pilot program on a legal claim foundation. This led to many investors questioning the legal status of the project as well as the regulatory matters concerning it. To add to this, a few customers shared their uncertainty by claiming that they were not sure if they were dealing with a custodian of assets or a regulatory firm.

In its final remarks, the report stated that these matters would be addressed accordingly as the CBDC comes to realization.

The 44 page report revealed that benefits could arise from using bank deposits that were privately issued or stablecoins that were backed up by assets.

It however mentioned that research should be done more to fully unleash the benefits of the CBDC as much as the token would lead to increased efficiency and resilience in the Australian payment system.

Discussion about this post