Bitcoin’s price may be in severe danger of plummeting to $25,000 if support at $30,000 fails as trading volume declines.

On Tuesday, the Bitcoin price briefly surpassed $31,000. The extended weekend in the United States rendered the cryptocurrency market tranquil, with the exception of the ongoing sell-off in the non-fungible token (NFT) market, which has seen many assets decline to extremely low floor prices.

The Bitcoin price is down 1% to $30,845 at the end of the Asian trading session. Similarly, Ethereum’s price dropped by 1% to $1,938. In light of the 1% decline in total market capitalization to $1.25 trillion, it is anticipated that crypto market performance will remain relatively depressed over the weekend.

How to Navigate the Technical Outlook for Bitcoin Price

As soon as investors re-enter the market after a long weekend, they will notice that trading volume has decreased across the board. According to data from CoinGlass, all main cryptocurrency exchanges continue to report volume declines between 15 and 20%.

This significant decline in volume had an impact on the number of liquidations, which totalled $47.67 million in the past 24 hours.

Curiously, the market has maintained open interest at $14.50 billion, and the long/short ratio suggests that long traders have a minor advantage over short traders.

However, trader sentiment remains a source of concern, with a sizable proportion of neutral traders balancing the bearish and bullish crowds.

Where Will The Bitcoin Price Go?

According to CoinDesk, the liquidity crunch in the market is an ongoing challenge that cannot be wished away because it stems from fiat. Cryptocurrency and other risky assets, such as technology stocks, are the most affected.

The abundance of important economic data set for release this week, however, means that traders must be ready to act proactively when necessary.

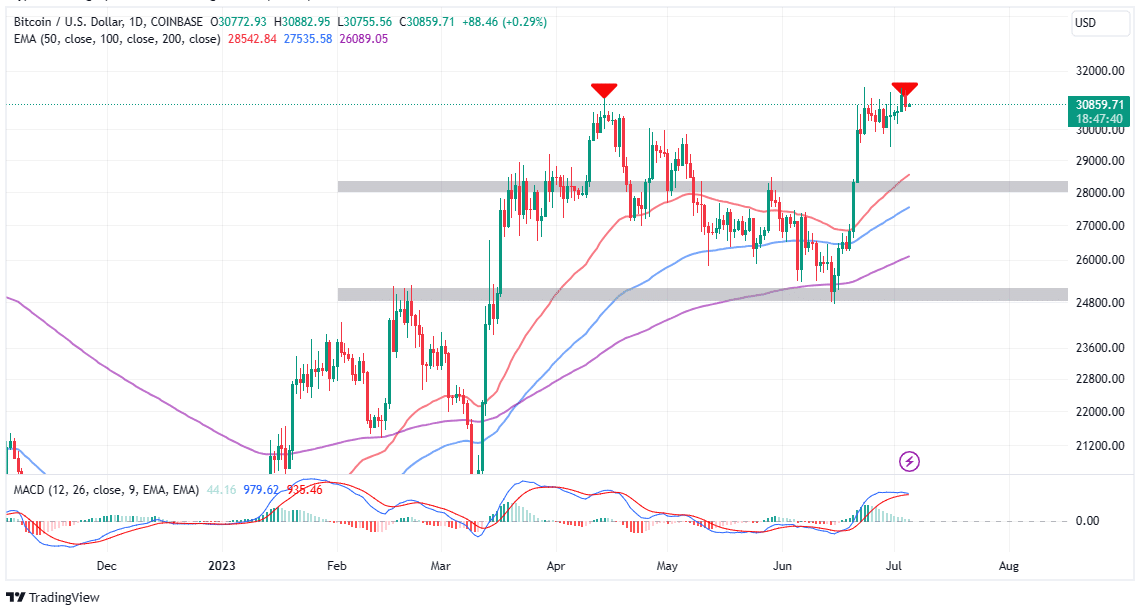

Currently, the Bitcoin price is encountering stubborn resistance at $31,000, while its downside appears to be protected at $30,500. The largest cryptocurrency’s options are shrinking by the day, as it fails to maintain its upward trajectory past the $31,000 barrier.

This indicates that overhead pressure, particularly buyer congestion at $30,000, will likely continue to erode support. A confirmed break below this price level would indicate that the bullish front has been defeated.

On the other hand, it can set off an aggressive bearish front, causing investors to sell in order to preserve profits after the price increased from $25,000 to $31,500.

If short traders act on an incoming sell signal from the Moving Average Convergence Divergence (MACD) indicator, pressure is likely to skyrocket. The MACD line in blue crossing below the signal line in red would indicate a sell signal for Bitcoin.

In general, the movement of the momentum indicator as it falls toward the mean line (0.00) and potentially the negative region would tighten the bearish grip, a move that would likely trigger a sell-off below $30,000.

Notable levels for speculators to keep in mind include the resistance at $31,000 and the support at $30,000. Notably, a break and hold above $31,000 could encourage more investors to join the trend, targeting a breakout to $35,000 and $38,000.

Bitcoin could be in grave peril of falling to $25,000 if support at $30,000 breaks down. Traders must take into account the tentative buyer congestion at $28,000, which could allow Bitcoin to surge through fresh liquidity before a kneejerk bullish reaction.

Disclaimer:

The preceding article is for informational purposes only and should not be construed as financial advice. It is highly recommended that readers carefully and independently check the content. The risk of capital loss when investing in cryptocurrencies exists, thus readers are urged to seek professional advice before taking any decision.

Discussion about this post