Summary

- Base is Coinbase’s most recent Ethereum Layer 2 (L2) network, built with OP Stack.

- While the Base testnet was launched in February, the Mainnet is expected to go live on August 9.

- This article outlines 5 vital features of the Base blockchain that set it apart from other L2s.

With the Base Mainnet due to launch on August 9, anticipation is growing for Coinbase’s Ethereum Layer 2 (L2) blockchain.

Base, which launched its testnet in February, is touted by Coinbase as a “secure, low-cost, developer-friendly Ethereum L2 built to bring the next billion users to web3.”

But what sets Base apart from other L2s in the increasingly crowded sector of Ethereum scaling solutions?

This article will look at five distinctive qualities of the new blockchain network.

1. OP Stack is Used to Build the Base Chain

Coinbase used OP Stack, a modular, open-source framework created by the developers behind Optimism, to construct Base. L2 developers that want to deploy optimistic rollups frequently use the OP Stack tool as the Ethereum ecosystem ushers in a new age of rollup-centric development.

The Base Mainnet will operate independently of Optimism. However, the choice to employ OP Stack ensures that the L2s will be highly interoperable.

The Base development team has worked closely with OP Labs, a key OP Stack developer, from the beginning. Additionally, the two projects’ strategies for scaling Ethereum are complementary. With a common goal of creating a decentralized, interoperable “Superchain” of L2s, Base is continuing the work that Optimism started.

The Base team has pledged to split the network’s transaction costs with the Optimism Collective in an effort to highlight the Superchain goal

2. Base Doesn’t Have a Token of Its Own

You might be wondering what type of token Base employs. Base does not currently have a dedicated network token, and there are no plans to create one, in contrast to other L2s.

This tokenless design is perhaps only viable because of Coinbase’s backing, which provides validity to the Base chain. The project has not provided a token incentive for locking assets on Base, in contrast to other comparable alternatives.

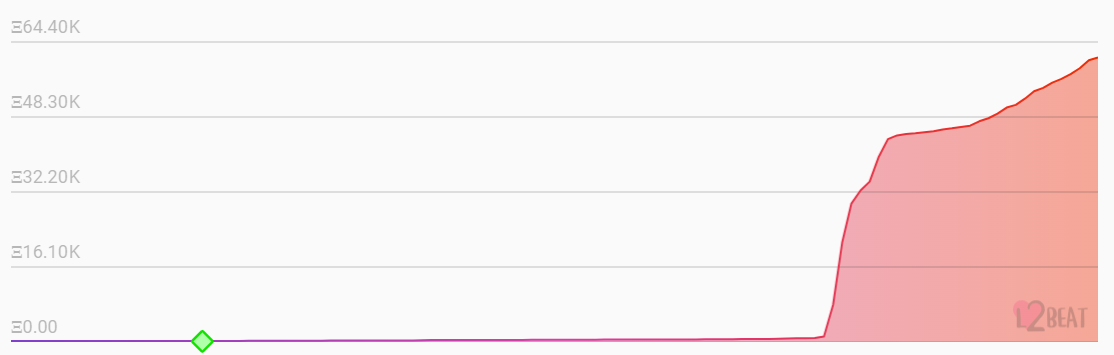

The total value locked (TVL) on the Base blockchain has increased to more than 61,000 ETH since the Mainnet launch. That translates to a TVL of almost $112 million in USD. The majority of this is probably the result of Coinbase’s efforts to increase network liquidity.

The decision to refrain from creating a native Base coin is in line with the idea of being as “close” to Ethereum as is practical. And Base has attempted to closely mimic Ethereum’s capabilities while growing its functionality in step with other L2s in an effort to attract Ethereum developers.

3. The Base Chain Was Made to House Coinbase Products But Has Wider Ecosystem Ambitions

Coinbase provided funding for Base’s development. Additionally, the owner of the cryptocurrency exchange plans to leverage the blockchain in the future to power a number of items.

The goal of Base is to create an open environment that will draw more apps, notwithstanding this initial impulse. In this way, it is comparable to the BNB chain, which was created by the Binance cryptocurrency exchange but currently functions mostly independently of the business that created it.

Coinbase is among the most well-known cryptocurrency brands in the world, similar to Binance. And Base wants to draw people by using this brand recognition.

With $120 billion in cryptocurrency holdings and millions of customers, Coinbase could undoubtedly provide tremendous value to Base. But in order to fulfil the aspiration of a billion Web3 users, it must show use cases that go beyond the constrained context of bitcoin trading.

In order to do this, Base has already welcomed a number of testnet users. New builders are also welcome to join the network, according to the Base team.

4. Base is Dedicated to Decentralization

The fact that Coinbase is involved raises concerns about Base being “owned” by a private company. However, blockchain projects that don’t follow the decentralization tenet are notoriously unpopular in the cryptocurrency community.

Currently, Coinbase is the only sequencer on the Base network. In other words, the firm’s servers are the only ones in charge of verifying transactions.

Base has a plan for decentralization for the upcoming months and years, nevertheless. Its governance and functioning will shift in the future to more closely resemble Ethereum.

The first action will be to transfer decision-making authority from the core Base developers to a “security council” composed of the important stakeholders as a stopgap measure. More democratic governance methods will be implemented as the Base ecosystem expands to reflect the diversity of network users.

Also Read: Celo Proposes Ethereum Layer 2 Integration: Advancing with Litecoin Halving

5. Base Supports Account Abstraction

There are two different kinds of “accounts” in Ethereum jargon. Upon receiving a transaction, contract accounts run code. EOAs, on the other hand, serve as addresses for sending and receiving ether.

EOAs are the only means through which users can initiate a transaction or carry out a smart contract on Ethereum. When a user uses the network without really holding the underlying account, this is known as account abstraction.

In other words, it permits third-party EOAs to carry out transactions on another party’s behalf. As a result, users can interact with smart contracts without having to worry about keeping private keys or paying gas expenses.

To make account abstraction on Base easier, Gelato and Safe worked together. The Base Mainnet comes with an account abstraction Software Development Kit (SDK), as was mentioned in a Gelato blog post. Developers of Web3 apps will find it simple to incorporate account abstraction thanks to the SDK.

Disclaimer: Before making any decisions based on this content, readers should conduct their own research and consult with a professional.

Discussion about this post