Summary:

- Bitcoin’s recent price correction below $37,000 is influenced by softening U.S. inflation, global economic concerns, and regulatory uncertainties.

- Factors such as cautious market sentiments, potential government shutdowns, and pending SEC decisions on BTC ETFs contribute to Bitcoin’s challenge in maintaining its upward momentum.

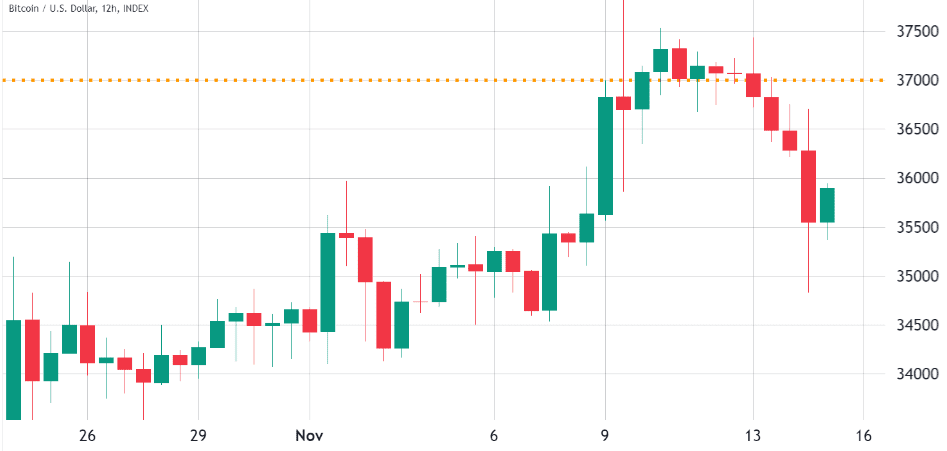

Bitcoin’s recent price surge towards $37,000 witnessed a reversal as the cryptocurrency corrected downwards to approximately $35,000 on November 13. This downturn, triggering liquidations of long futures contracts worth $121 million, has left investors seeking clarity regarding the underlying causes of this setback.

Economic Indicators And BTC Price Movement

The unexpected softening of U.S. inflation data on November 14 affected this price movement. The U.S. Consumer Price Index (CPI) indicated a 3.2% rise in October compared to the previous year, prompting reduced yields on U.S. short-term Treasurys.

This prompted a shift towards traditional assets, potentially lowering demand for alternative hedge instruments like Bitcoin. Should the Federal Reserve’s strategy to manage inflation without causing a recession succeed, Bitcoin might lose its appeal as a hedge against economic uncertainties.

Moody’s lowering of its outlook on the U.S. credit and the preference for short-term fixed-income instruments over alternatives like gold contributed to this sentiment, impacting Bitcoin’s standing as a hedge asset.

Global Economic Dynamics And Regulatory Influence

China’s economic scenario, reflected in the retail sales surge but underlying challenges in the property sector, adds to investor caution in riskier assets like Bitcoin. The nation’s economic situation, coupled with the U.S. government shutdown threats, creates a cautious outlook for global economic prospects, potentially impacting Bitcoin’s performance.

Moreover, recent regulatory scrutiny in the crypto sector, sparked by a fraudulent BlackRock XRP trust filing, further amplifies the cautious sentiment. The pending SEC decisions on spot Bitcoin ETFs, expectedly delayed until January as per analysts, add to the uncertain regulatory environment.

Factors Impacting Bitcoin’s Momentum

Bitcoin’s inability to sustain above $37,000 is a culmination of several factors. Investors reevaluating their positions amidst Bitcoin’s substantial market capitalization and considerations about the economic prowess of major corporations like Berkshire Hathaway contribute to this reassessment.

Bitcoin’s scarcity is challenged by large corporations utilizing profits to reduce the available stock supply. Moreover, during economic downturns, these corporations can leverage their financial strength to dominate markets or acquire competitors.

Discussion about this post