Analyzing the Discrepancies: Binance CEO Denies SEC Allegations Amid Contradictory Statements

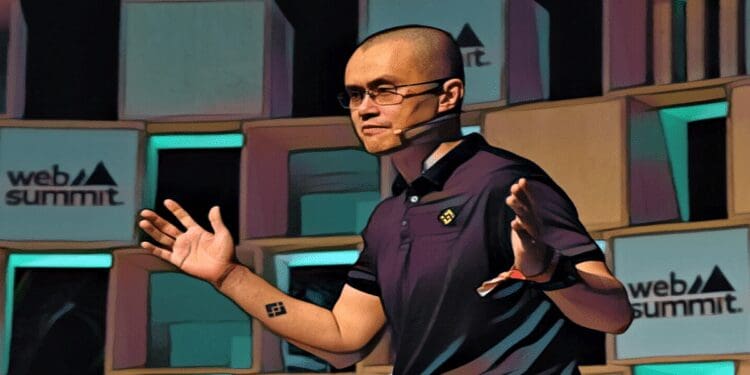

In the unfolding legal saga between Binance, one of the world’s largest cryptocurrency exchanges, and the U.S. Securities and Exchange Commission (SEC), contradictions have emerged that shed light on the complex web of regulatory compliance. Binance’s founder and CEO, Changpeng Zhao (CZ), has vociferously denied the SEC’s allegations, directly opposing statements previously made by his own legal team.

For the record. Binance US does not use, and have NEVER used Ceffu or Binance Custody.

You can't just make this stuff up. 🤷♂️ https://t.co/JIkIVTf8tc

— CZ 🔶 BNB (@cz_binance) September 19, 2023

BAM Trading Services’ Shifting Narrative

At the heart of the controversy lies BAM Trading Services, the U.S.-based entity responsible for operating Binance. US. Initially, BAM vehemently resisted sharing information with the SEC regarding Ceffu, a crypto custodian formerly known as Binance Holdings Limited. BAM asserted that Ceffu’s activities were unrelated to the custody of customer assets, creating an air of mystery around the custodian’s role.

However, BAM’s stance underwent a significant transformation as the legal battle unfolded. Subsequently, BAM admitted that Ceffu had indeed played a pivotal role in generating new crypto wallets and access keys for BAM. This admission, as revealed in a court document filed by the SEC, directly contradicted BAM’s earlier claims.

“[BAM] later admitted that Ceffu had created BAM’s new crypto asset cold wallets and New Private and Administrative Keys,” the SEC document disclosed, raising questions about the veracity of the initial statements made by the exchange’s U.S. arm.

Also Read: Binance vs. SEC: Legal Clash Escalates as Exchange Fights Back Against Document Demands

Ireland-based Holdings and Removed References

Adding to the intrigue, the SEC presented screenshots indicating that Binance Institutional Holdings Limited, based in Ireland, exercised control over Ceffu’s trademarks and data. This revelation prompted speculation about the intricate relationships within the Binance ecosystem.

In response to the SEC’s claims, Binance took swift action by removing references to the Ireland-based entity from its official website. This move raised eyebrows in the cryptocurrency community, as it hinted at a concerted effort to distance itself from any perceived entanglements.

Regulatory Quandary Unveiled: Key Takeaways

- Legal Tightrope Walk: The legal dispute between Binance and the SEC highlights the complexities of navigating the evolving regulatory landscape in the cryptocurrency industry.

- Internal Contradictions: Discrepancies in statements made by BAM Trading Services underscore the challenges faced by crypto exchanges in ensuring consistent and transparent communication with regulators.

In conclusion, the legal battle between Binance and the SEC has brought to the fore a multitude of intricate details, exposing the tightrope that crypto exchanges must walk to navigate the regulatory landscape successfully. Contradictions within Binance’s responses raise questions about transparency and consistency in a rapidly evolving industry.

Discussion about this post