Main Pointers:

- The surge in Bitcoin futures open interest by $1 billion on September 18 raised questions of market manipulation or genuine market dynamics.

- Despite initial enthusiasm, the unsealing of Binance’s court documents did not provide significant new information, leading to a decline in Bitcoin’s open interest.

- The correlation between the surge in open interest and the subsequent price drop suggests that bullish sentiment played a role, but other factors were at play.

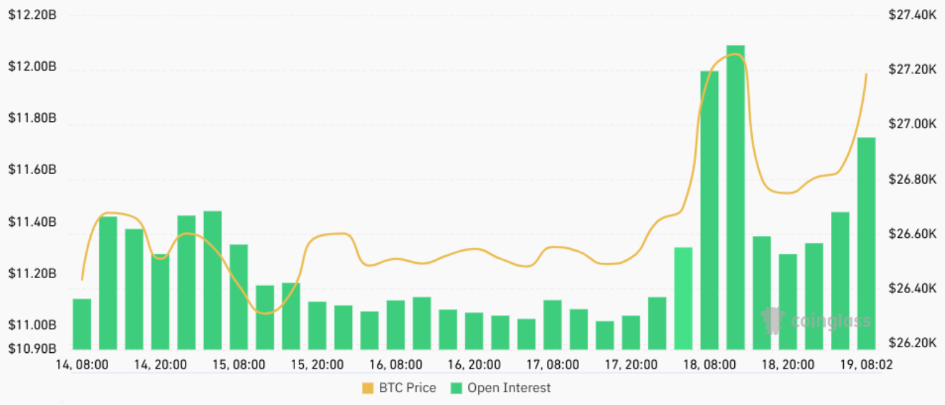

In a surprising turn of events, Bitcoin’s open interest in derivatives exchanges skyrocketed by an astonishing $1 billion on September 18, causing ripples of speculation throughout the cryptocurrency community. As the price of Bitcoin surged past the $27,200 mark, questions arose regarding whether this surge was driven by market manipulation or genuine market dynamics.

Unveiling The Surge

Bitcoin, the world’s most renowned cryptocurrency, experienced a sudden surge in open interest, reaching a staggering $12.1 billion, while the cryptocurrency’s price concurrently rose by 3.4%, hitting a peak of $27,430. This sudden spike in open interest ignited a flurry of speculations and theories about the underlying reasons. Many wondered if influential players, often referred to as “whales,” were strategically accumulating Bitcoin in anticipation of the unsealing of Binance’s court filings.

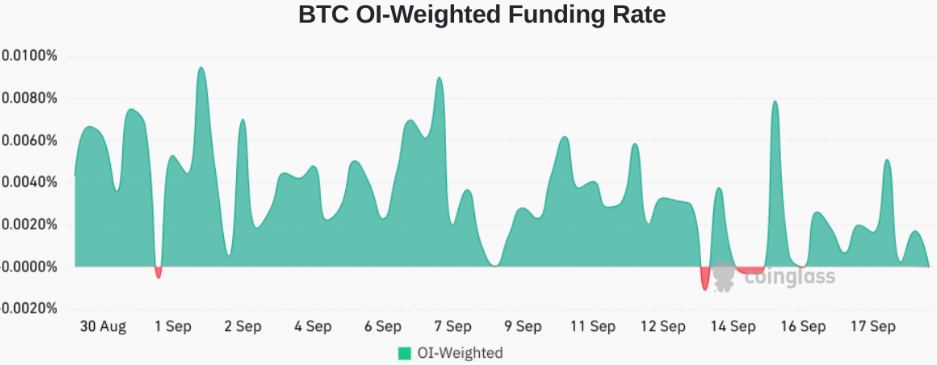

However, a closer examination of derivatives metrics paints a more nuanced picture. Surprisingly, the funding rate, a key indicator of excessive buying demand, did not exhibit clear signs of such demand during this period.

The SEC’s Role

To understand the context, it’s crucial to note that the decision to unseal the documents in question was granted to the United States Securities and Exchange Commission (SEC). The SEC had previously accused Binance, a major cryptocurrency exchange, of non-cooperation in matters related to unregistered securities operations and other allegations. This legal dispute became a focal point of speculation.

Rise and Fall

The excitement among investors was short-lived, as the unsealed documents failed to reveal significant new information. Meanwhile, Federal Judge Zia Faruqui rejected the SEC’s request to inspect Binance.US’ technical infrastructure and share additional information. Despite this setback, the judge stipulated that Binance.US must provide more details about its custody solution, casting doubt on whether Binance International ultimately controls these assets.

By the end of September 18, Bitcoin’s open interest had receded to $11.3 billion as its price dropped by 2.4% to $26,770. This decline indicated that the entities behind the initial open interest surge were no longer inclined to maintain their positions. A staggering 80% of the open interest increase disappeared in less than 24 hours.

Also Read: Bitcoin Long-Term Holders Show Resilience Amidst Short-Term Sell-offs

Exploring the Whales’ Behavior

The abrupt rise and fall in open interest raised questions about the motives of these entities. Were they disappointed with the court’s outcomes, or did the price action simply not unfold as expected? The correlation between the surge in open interest and the subsequent drop in Bitcoin’s price suggests that most of the demand for leverage was driven by bullish sentiment. However, attributing cause and effect solely to Binance’s court rulings seems premature.

Analyzing the Funding Rate

The Bitcoin futures contract funding rate, a critical indicator of market sentiment, remained relatively stable throughout this period. If the surge in open interest had indeed been driven by desperate buyers, it would have been reasonable to expect the funding rate to spike above 0.01%. Contrary to this expectation, the funding rate actually plunged to zero on September 19, as Bitcoin’s open interest expanded to $11.7 billion.

Price Pressure and Market Makers

As Bitcoin’s price surged above $27,200 during this second phase of open interest growth, it became increasingly evident that, regardless of the underlying motives, the price pressure favoured upward movement. While the exact rationale remained elusive, certain trading patterns offered insights into this phenomenon.

One plausible explanation for this rollercoaster could be the involvement of market makers executing buy orders on behalf of significant clients. This initial enthusiasm in both the spot market and Bitcoin futures propelled the price higher. However, once the market maker became fully hedged, further buying was unnecessary, leading to a price correction.

In the subsequent phase of the trade, the market maker’s actions had no impact on Bitcoin’s price, as they had to offload BTC futures contracts and purchase spot Bitcoin, resulting in a reduction in open interest.

Avoiding Hasty Conclusions

In conclusion, rather than hastily labelling every market movement as manipulation, it is advisable to delve into the operations of arbitrage desks and carefully analyze the Bitcoin futures funding rate before jumping to conclusions. The surge in open interest on September 18, driven by various factors, highlights the complex and multifaceted nature of cryptocurrency markets, where market dynamics can be as influential as market manipulation.

Discussion about this post