Swiss financial watchdog forces FlowBank, known for its cryptocurrency services, into bankruptcy due to serious regulatory breaches.

In a significant blow to the cryptocurrency banking sector, Swiss-based FlowBank has been forced into bankruptcy by the country’s financial regulator. The Swiss Financial Market Supervisory Authority (FINMA) announced the closure on June 13, citing severe breaches of operational standards and insufficient capital.

Regulatory Crackdown on FlowBank

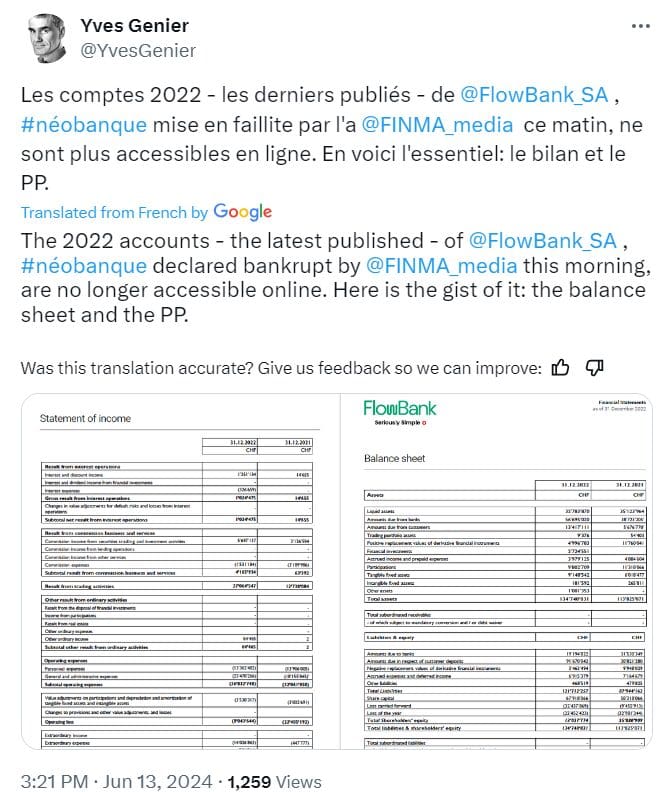

FlowBank, an online bank known for its cryptocurrency trading services, has been found in serious violation of regulatory requirements. FINMA’s investigation revealed that the bank did not maintain the minimum capital necessary for its business operations, leading to concerns about over-indebtedness. “The bank must be wound up,” FINMA declared, noting the absence of any feasible restructuring plan.

Ties to Major Crypto Entities

Launched in 2020, FlowBank quickly established itself within the crypto industry. It became the banking partner for Techteryx, the issuer of the TrueUSD (TUSD) stablecoin, and was partly owned by CoinShares, a prominent crypto asset management firm. Additionally, FlowBank reportedly provided banking services to Binance, the world’s largest cryptocurrency exchange.

Despite these high-profile connections, FINMA’s findings highlighted numerous compliance failures. The regulator first placed FlowBank under scrutiny in October 2021 due to serious breaches of supervisory law, particularly concerning capital requirements. An independent auditor was appointed in 2022 to oversee the bank’s efforts to regain compliance. However, ongoing issues led to the appointment of another supervisor in June 2023 to further investigate the bank’s financial activities.

Customer Protection and Asset Recovery

FINMA has assured that customers with deposits up to 100,000 Swiss francs ($111,710) will be prioritized for reimbursement. FlowBank holds assets totaling 680 million Swiss francs ($760 million) and manages over 22,000 client accounts globally. The regulator emphasized that it aims to expedite the process of returning funds to affected customers.

FlowBank’s downfall highlights significant regulatory challenges in the burgeoning crypto banking sector. FINMA’s detailed investigation found that the bank had engaged in high-risk business relationships and processed large transactions without adequate due diligence. This culminated in the withdrawal of FlowBank’s banking license on March 8, 2024, a decision currently pending appeal at the Federal Administrative Court.

Also Read: Genesis to Repay $3 Billion to Creditors After Bankruptcy Approval

Discussion about this post