Main Pointers:

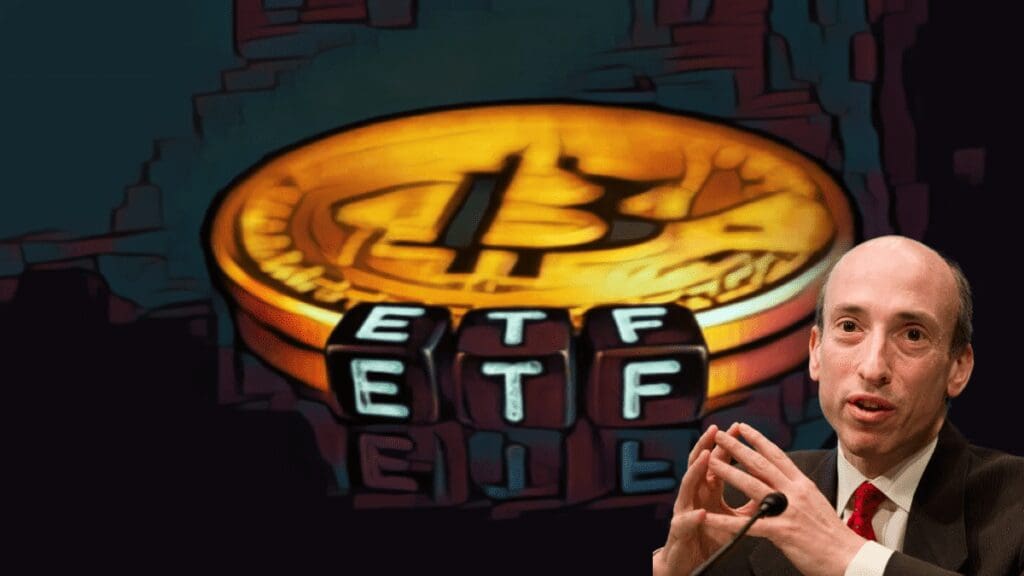

- Speculation arises following SEC Chair Gensler’s mysterious post, hinting at a potential spot Bitcoin ETF approval.

- Analysts and experts weigh in on the significance of Gensler’s communication and the potential indicators pointing towards a spot Bitcoin ETF approval.

The anticipation surrounding the approval of a spot Bitcoin exchange-traded fund (ETF) by the U.S. Securities and Exchange Commission (SEC) has set the crypto market and traditional financial services on edge. Recently, SEC Chair Gary Gensler’s cryptic post on X triggered speculation regarding the imminent approval of a spot Bitcoin ETF.

Speculation Arises After Gensler’s Post

Despite SEC Chair Gary Gensler’s reticence on the topic of a spot Bitcoin ETF approval, his recent post regarding the SEC’s Division of Trading and Markets has sparked fervent speculation. This unforeseen move occurred amidst key meetings such as the SEC-BlackRock encounter and the SEC’s verdict on Franklin Templeton and Hashdex’s applications for a spot Bitcoin ETF.

Bloomberg ETF analyst, Eric Balchunas, shed light on Gensler’s video, stating that while the timing appears significant, it’s not an uncommon occurrence as each division of the SEC has undergone such communication. Balchunas downplayed the post’s significance, suggesting that there are other credible indicators pointing towards an impending approval.

Expert Insights on Gensler’s Statement

Reacting to the enigmatic video, Gabor Gurbacs, an advisor to VanEck and Tether, expressed concern over the reliance on deciphering signals from a single individual for supervising the world’s largest market.

During the Healthy Markets Association conference on November 29, Gary Gensler refrained from prejudging the situation when asked about the likelihood of a spot Bitcoin ETF approval, despite having previously denied multiple applications in this vein.

Also Read: Gary Gensler Stands High Chances Of Losing His Job In 2024: John Reed Speaks

Indicators Paving the Way for a Spot Bitcoin ETF

Grayscale, the investment firm behind the Grayscale Bitcoin Trust (GBTC), has made notable amendments to its agreement, a move unseen since 2018. This strategic adjustment appears to align with the potential transition towards a spot Bitcoin ETF.

The SEC’s accelerated update on Franklin Templeton, preceding its January 1, 2023 deadline, indicates a proactive stance. Despite this, Bloomberg’s Balchunas maintains the odds of approval at a promising 90%, with the next expected update on the approval likelihood slated for January 10, 2024.