A GameStop investor who accused Keith Gill, popularly known as Roaring Kitty, of securities fraud, has voluntarily dismissed the lawsuit just three days after filing it.

Lawsuit Dismissed Without Prejudice

Plaintiff Martin Radev officially dropped the lawsuit on June 1 by submitting a voluntary motion to dismiss in the United States District Court for the Eastern District of New York. The dismissal “without prejudice” means Radev retains the right to file a similar lawsuit in the future. The law firm representing Radev, Pomerantz Law, has not provided any comment on the sudden withdrawal.

Allegations of Pump and Dump Scheme

The lawsuit, initially filed on June 28, accused Gill of using his social media influence to orchestrate a “pump and dump” scheme. Radev claimed that Gill had artificially inflated the price of GameStop shares for his financial gain, resulting in investor losses. The allegations centred on Gill’s failure to inform his followers and other GameStop investors about his plans to sell approximately 120,000 call options before their June 21 expiration date.

Also Read: ‘Roaring Kitty’ Faces Legal Battle Over Alleged GameStop Manipulation

Expert Commentary on the Lawsuit’s Viability

Eric Rosen, a former federal prosecutor and founding partner at the law firm Dynamis, analyzed the lawsuit in a June 30 blog post. Rosen argued that Radev would face significant challenges in proving Gill committed fraud. He emphasized that purchasing securities based solely on Roaring Kitty’s social media posts is not reasonable and would be difficult to justify in court.

Roaring Kitty’s Impact on GameStop and Beyond

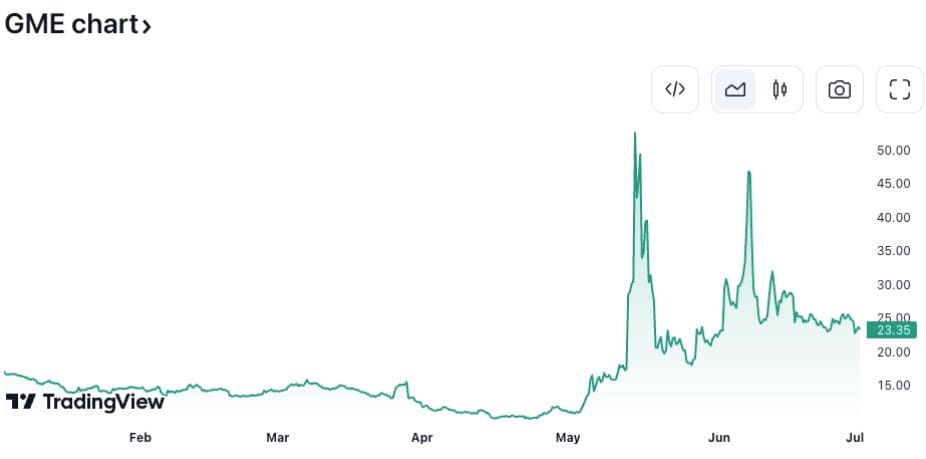

Gill, known for his role in the GameStop short squeeze of 2021, made a notable return to social media on May 13 after a two-year hiatus, posting cryptic memes that triggered significant volatility in GameStop’s stock price. In early June, Gill revealed on Reddit that he held 120,000 GameStop call options set to expire on June 21, which he exercised to purchase an additional four million shares.

Future Speculations and Market Influence

Gill’s latest move involves acquiring nine million shares in Chewy, a U.S.-based pet retailer, giving him a 6.6% ownership stake. Speculations are rife that Gill might attempt another short squeeze similar to GameStop’s, while others believe his investment will naturally drive up Chewy’s stock price due to his influential presence in the market.

Discussion about this post