Fast Facts

- In the last 24 hours, traders in PEPE have lost $7 million.

- From its peak, the meme coin has fallen by more than 50%.

- Is it the end of PEPE rally?

PEPE, the face of the meme coin season this year, is down over 50% from its all-time high. Is the rally’s momentum now over?

Meme coins have dominated the market since last month. Despite the fact that PEPE’s price has increased by more than 1000% in less than a month, investors should be wary of extreme volatility and various scams.

Market Volatility Washes Away $7 Million From PEPE Traders

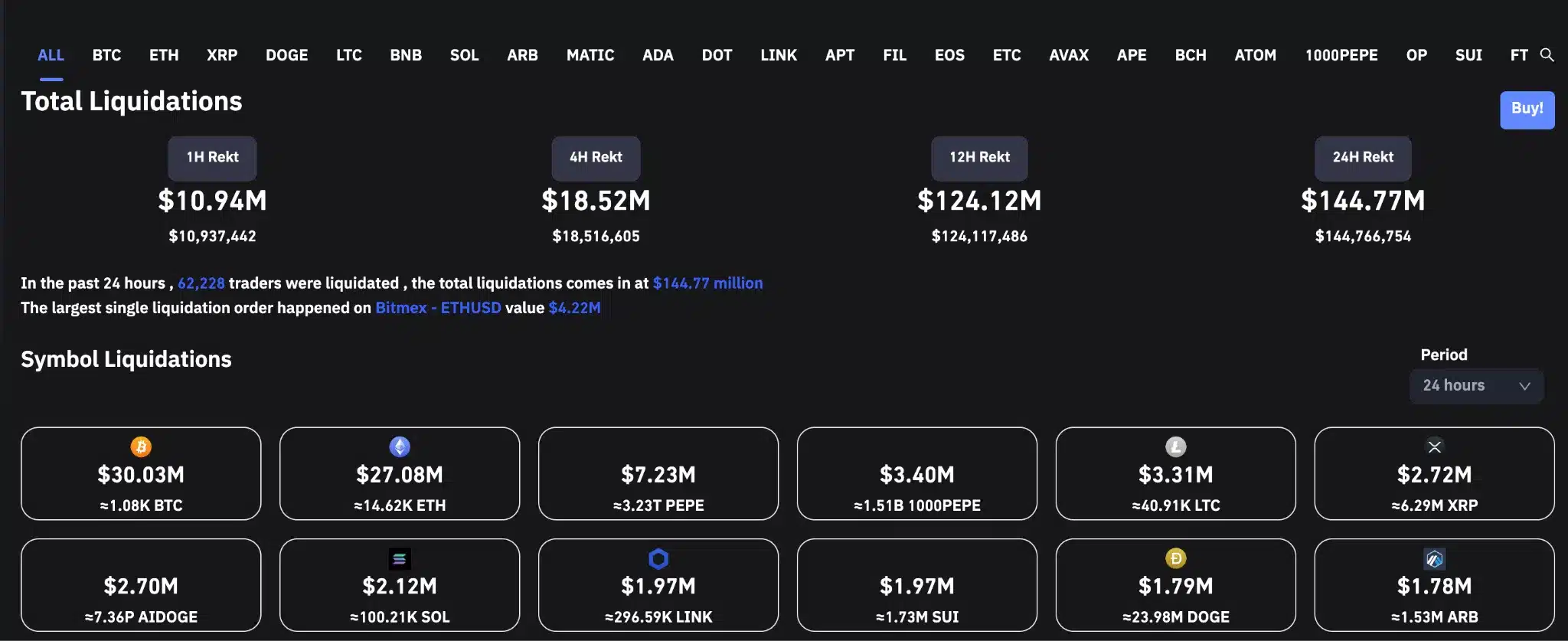

Trades worth approximately $144 million were liquidated in the last day as Bitcoin fell below $28,000. Data from Coinglass shows that traders of PEPE lost $7.23 million due to liquidation.

Based on liquidations over the previous day, it rose to third place in the cryptocurrency rankings, trailing only Ethereum (ETH) ($27 million) and Bitcoin (BTC) ($30 million).

A whale began purchasing PEPE coins worth $2.94 million last Friday, according to a tweet from Lookonchain. As of this writing, their PEPE stake is only worth $2.24 million. The whale is therefore sitting on an unrealized loss of more than $700,000 over the course of three days.

PEPE Token Is Down By 50%

Large liquidations and unrealized losses occurred as PEPE fell significantly from its all-time high on Friday of $0.00000449730 to its current price of 0.00000223252. The 10-day Exponential Moving Average (EMA) and its next support level are both at 0.00000192478.

This support may be a sign of a trend reversal if the meme currency breaks it.

However, it is important to remember that a small number of whales dominate the supply of meme coins. The supply is so heavily concentrated that volatility can be very unpredictable. While trading meme coins, investors must exercise caution and adhere to risk management.

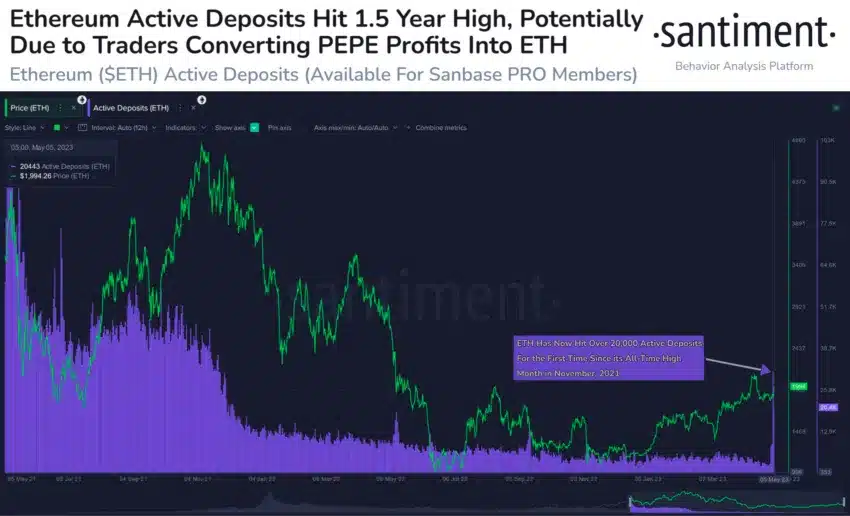

Separately, Santiment noted that the volume of active ETH deposits has increased to its highest level since November 2021. According to the on-chain analytical platform, traders turning PEPE earnings into ETH may be the cause of the rise in active deposits for ETH.

Discussion about this post