OKB token price has risen more than 13% over the last 24 hours despite a decline in the price of bitcoin and Ethereum, which are dominant cryptocurrencies. The spike took place on January 2 in the early hours of the Asian trading session.

Significant price hike for OKB

The Seychelles-based cryptocurrency and derivatives exchange OKX has created the ERC-20 token known as OKB. The exchange’s initiative to promote transparency among centralized exchanges was followed by OKB’s immediate success, which heralds the New Year.

The organization has taken the lead on accountability and responsibility by offering proof-of-reserves (PoR) to win over investors who are familiar with cryptocurrencies.

The Merkle Tree method-derived sustainable balance sheet is indicated by OKX’s most recent Proof-Of-Reserve (PoR). This process creates an image of all current accounts and assigns each one a unique identification code.

The reserves display the balances in each account as Merkle leaves combined to represent the Merkle root. The platform’s overall consumer deposits are represented by the root.

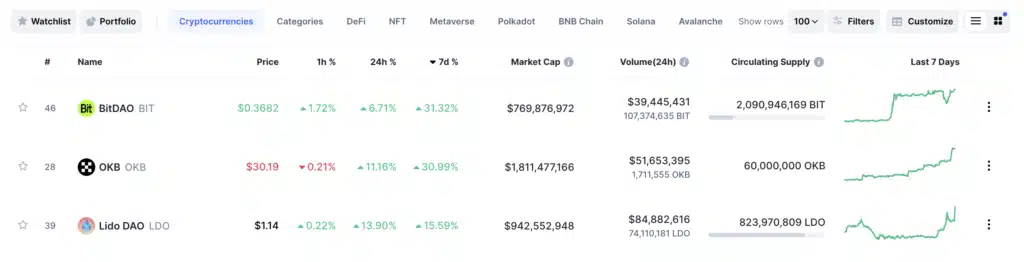

A blockchain analytics website called CoinMarketCap has provided critical details on OKB’s success. The token’s price has increased significantly over the last seven days by more than 30%, reaching a total of $29.9 at the time of publication. When compared to pricing on October 1st of last year, this is an increase of 86%.

Another token produced by the exchange is called OKT. The exchange’s native blockchain, OKX Chain (OKC), powers the token, which has seen a significant price increase to $28.85 in the last 24 hours.

Another token produced by the exchange is called OKT. The exchange’s native blockchain, OKX Chain (OKC), powers the token, which has seen a significant price increase to $28.85 in the last 24 hours.

OKX introduces a liquidity pool for investors

On December 20, OKX introduced a liquidity staking pool with 40% annualized percentage rewards for investors. By trading volume, OKX is the second-largest exchange in the world, following Binance.

The newest on-chain improvement to OKX’s ecosystem intended to support the exchange’s rapidly growing DeFi space is the launch of a staking platform on OKC. Users of OKC will stake OKT on the liquidity pool and obtain tokenized incentives at the same time. The price of OKT has risen by almost 40% since the staking service was launched.

The United Arab Emirates recently granted the exchange permission to operate in Dubai. The license was granted by Dubai World Trade Center on behalf of the Dubai Virtual Assets Regulatory Authority. The surge seen on OKX’s native and utility tokens may be sparked by these reforms.

Discussion about this post