The year 2022 was a challenging one for investors. Not only did stock values fall, but cryptocurrency values also plunged. According to estimates, Bitcoin alone lost over 60% of its value in 2022, so if you held that asset, you were probably affected. If you lose money on an investment, it’s never a good thing, as that’s the opposite of what you’re trying to achieve.

If you actually made a loss on crypto in 2022, you may be able to use it to your advantage when you file your taxes.

In this article, we will explore everything you need to know about reporting cryptocurrency losses and reducing your tax bill. By the end, you’ll feel confident in navigating this complex topic and potentially save yourself some money in the process. So let’s dive in!

If you’ve been an active trader of cryptocurrency, there’s a good chance you’ve experienced some losses. Maybe you sold your Bitcoin when it was worth $19,000 only to watch it drop to $9,000 a few months later.

Any time you take a loss on an investment, you can use it to offset your capital gains. For example, if you lost $5,000 in crypto in 2022, you can use that loss as a tax break. Even if you don’t earn $5,000 in capital gains, you can offset your ordinary income with some of that loss.

To be clear, though, you can only claim a capital loss on your taxes if you actually went and sold off assets at a price that’s lower than what you paid for them. Let’s say you bought stocks for $4,000 and sold them for $3,000. If the value of those stocks dropped to $3,000, but you did not sell them, you don’t have a loss — and there is no tax refund.

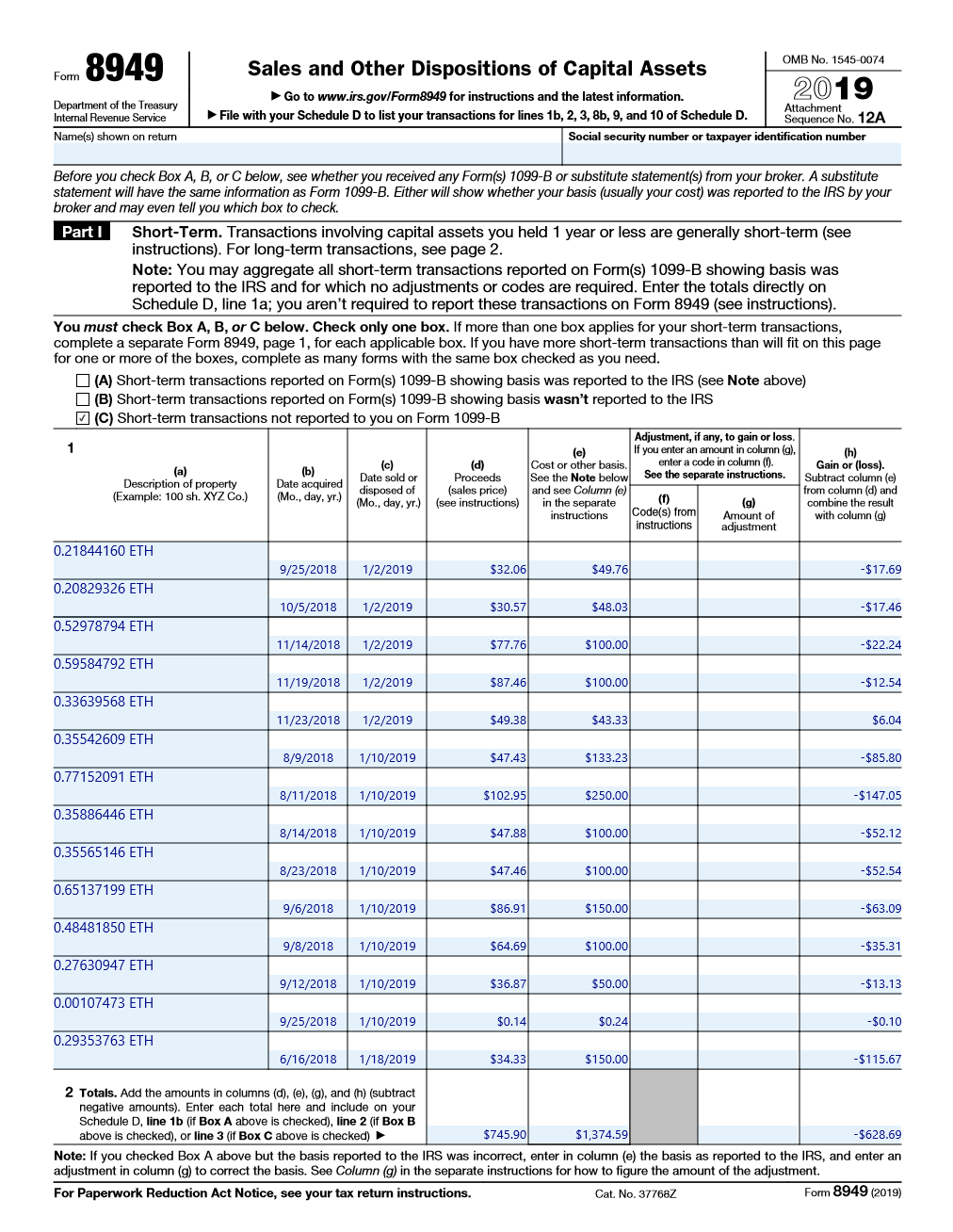

Crypto is the same. If you did not sell your digital currencies at a lower price than what you paid for them, you will not be able to claim a loss. To report crypto losses, you’ll need to fill out IRS Form 8949. This is the form used for reporting capital gains and losses from the sale or exchange of capital assets.

Make sure you know the rules

You can save a lot of money by writing off capital losses. But it’s important to do so with accuracy. That’s why you should consult a tax professional when you have capital losses. They can help you navigate the rules and ensure you’re taking advantage of the tax breaks that are available to you. They can also help ensure you don’t accidentally claim a tax break you aren’t entitled to.

Is it necessary to report crypto losses to the IRS?

It is a common misconception that cryptocurrency investors only need to report gains on their taxes if they have made them. The IRS needs to be notified of all taxable events. If you fail to report your cryptocurrency losses, you won’t be able to claim the associated tax benefits.

In Form 8949, record the gain or loss from your cryptocurrency disposal on one line. You need to enter your total net gain or loss at the bottom of Form 8949 (pictured below) when you have completed all the lines for each taxable event.

If you have multiple crypto transactions that resulted in a loss, you can list them all on a single Form 8949. Just be sure to indicate whether each transaction is short-term or long-term. Short-term capital gains and losses are taxed at your ordinary income tax.

How much can you save by claiming crypto losses?

If you’ve lost money on your cryptocurrency investments, you may be able to reduce your tax bill by claiming those losses on your return. But how much can you actually save?

Let’s say you invested $10,000 in Bitcoin at the beginning of 2022 and sold it all at the end of the year for $5,000. You would have a $5,000 capital loss that you could use to offset other capital gains or up to $3,000 of ordinary income.

If your marginal tax rate is 25%, that means you could save up to $750 in taxes by claiming your crypto losses. Of course, this is just a hypothetical example – your actual savings will depend on your specific circumstances.

So if you’ve suffered losses on your cryptocurrency investments, make sure to keep track of them so that you can claim them come tax time. It could end up saving you a significant amount of money!

If you lost money on crypto in 2022, you can claim that loss on your tax return. You’ll need to itemize your deductions to do so, but the process is relatively simple.

- First, calculate your total capital gains for the year. This is the difference between what you paid for your cryptos and their value when you sold them. If you sold at a loss, that loss can be deducted from your other income.

- Next, determine how much of the losses are short-term and how much are long-term. Short-term losses are those incurred on assets held for one year or less; long-term losses are those on assets held for more than one year.

- Then, figure out your adjusted gross income (AGI). This is your total income minus certain adjustments, such as business expenses or IRA contributions.

- Finally, apply the appropriate deduction to your AGI. For short-term losses, you can deduct up to $3,000 from your AGI; for long-term losses, the deduction is unlimited.

If you have any questions about how to report your crypto losses on your taxes, speak with a tax professional. They can help you maximize your deductions and ensure that you comply with all applicable laws.

Also Read: ‘Worst case scenario’ Predicts Bitcoin bear market bottom as Close to $6k in BTC.

How to Treat Crypto Catastrophes, Hacks, and Thefts

No one wants to think about losing their cryptocurrency to hacks, theft, or other catastrophes, but it’s important to be prepared in case it does happen. Here’s how to report your crypto losses and reduce your tax bill:

If you’ve lost your cryptocurrency due to a hack, theft, or other catastrophes, the first thing you should do is report the loss to the appropriate exchange. Many exchanges have insurance that will cover losses due to hacks or theft, so you may be able to get some of your money back.

Once you’ve reported the loss to the exchange, you’ll need to file a police report. Be sure to include as much information as possible about the incident, including when and where it occurred and how much cryptocurrency was stolen.

Once you’ve filed a police report, you can then file a claim with your insurance company. If your policy covers crypto losses, they should reimburse you for the value of the currency that was stolen.

Finally, you’ll need to report the loss on your taxes. The IRS treats cryptocurrency as property, so any losses are treated as capital gains losses. You can deduct up to $3,000 in capital gains losses per year on your taxes, which can help offset any gains you’ve made from investing in cryptocurrency.

Discussion about this post