The recent approval of Ethereum ETFs by the SEC marks a pivotal moment in the cryptocurrency landscape, potentially setting the stage for Ethereum to reach new heights. Crypto trader Blockchain Mane highlights three crucial indicators that suggest Ethereum (ETH) might surpass its previous all-time high of $4,878 in 2021, with the potential to surge towards $5,000.

Indicators Point to a Promising Future for Ethereum

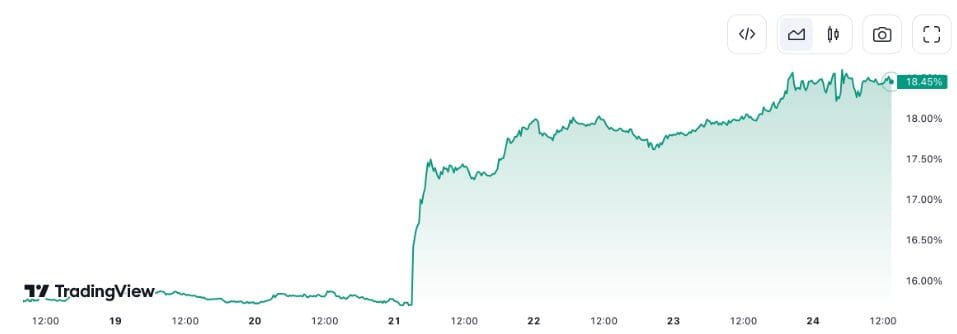

Following the SEC’s initial approval of eight spot Ether ETFs on May 23, Ethereum’s market dominance has shown a notable increase. Data from TradingView reveals that ETH’s market share has jumped 19.56% over the past week. This surge comes amid growing optimism that the SEC’s stance on ETFs is softening, which could drive more institutional investment into Ethereum.

“The dominance chart suggests we’re entering an ‘ETH Season’ where Ethereum is likely to outperform other cryptocurrencies,” Blockchain Mane stated. This optimism is underpinned by three key long-term indicators.

Also Read: Ethereum ETF Approved: Future Predictions for Bitcoin and Altcoins

Fibonacci Retracement Indicates Strong Support

One of the critical indicators is the Fibonacci retracement, which is used to predict potential price levels based on mathematical patterns. According to Blockchain Mane, Ethereum is showing “strong support” with resistance targets at $5,080.60 and $6,231.83. These levels suggest that Ethereum might not only retest its previous high but could potentially surpass it.

At the time of publication, Ethereum is trading at $3,802, indicating a bullish trend that could see significant gains if these levels hold.

Parabolic Curve Suggests Bullish Trend

Another important indicator is the parabolic curve, which helps identify potential trend changes. Blockchain Mane notes that Ethereum is following a “bullish trend” along this curve, marked by three phases: base one, base two, and base three. The parabolic curve indicates continued upward movement, especially after the recent breakout from a falling wedge pattern.

Market Sentiment and Short-Term Movements

While long-term indicators look promising, short-term price action also remains critical. Crypto commentator Benjamin Cowen highlighted Ethereum’s recent performance, noting, “ETH is up more this week than the S&P 500 typically gives you in a year.” This underscores the rapid gains Ethereum has made following the ETF approval news.

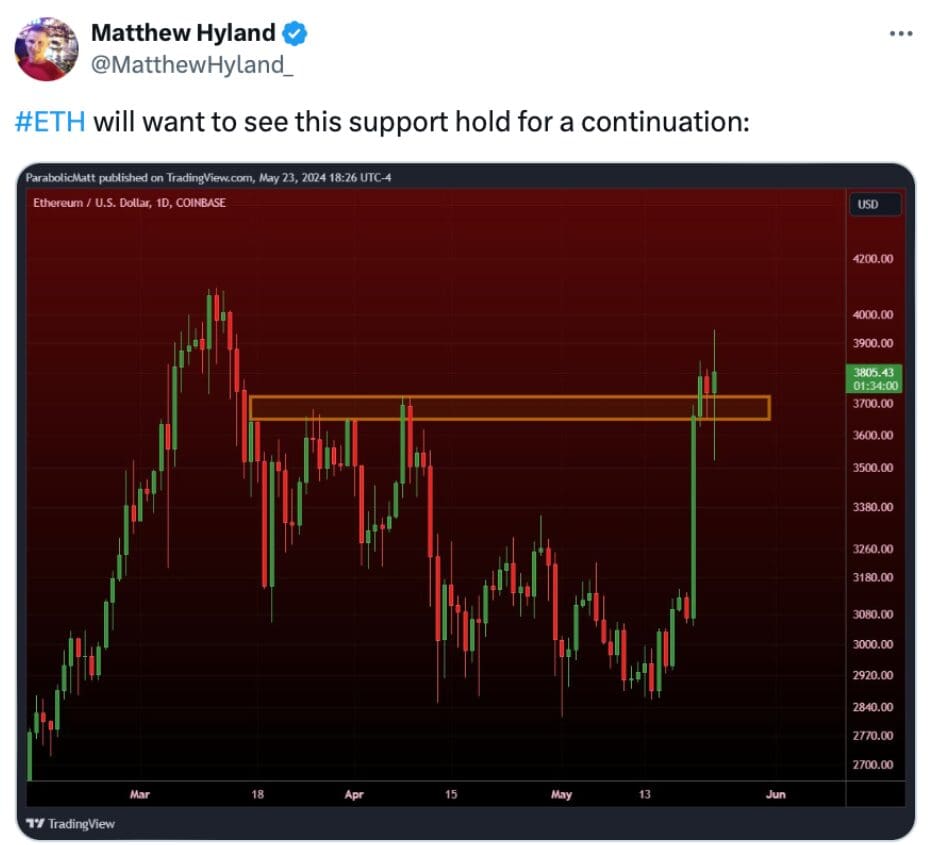

Crypto trader Matthew Hyland emphasizes the importance of Ethereum maintaining support around $3,800 to ensure continued upward momentum. Despite the ETF approvals, Ethereum’s price has remained relatively stable, likely because the positive news was already priced in and trading of the ETFs has yet to commence.

Conclusion

The approval of Ethereum ETFs by the SEC could indeed be a game-changer for the cryptocurrency market. With key indicators pointing towards a bullish future, Ethereum might be on the brink of entering a new ‘ETH Season.’ Investors and traders will be closely watching these developments, as Ethereum’s performance could significantly impact the broader crypto market.

Discussion about this post