Ethereum restaking presents a promising avenue for network growth, but analysts warn of hidden risks associated with the new yield-bearing mechanism.

Challenges with Restaking Protocol

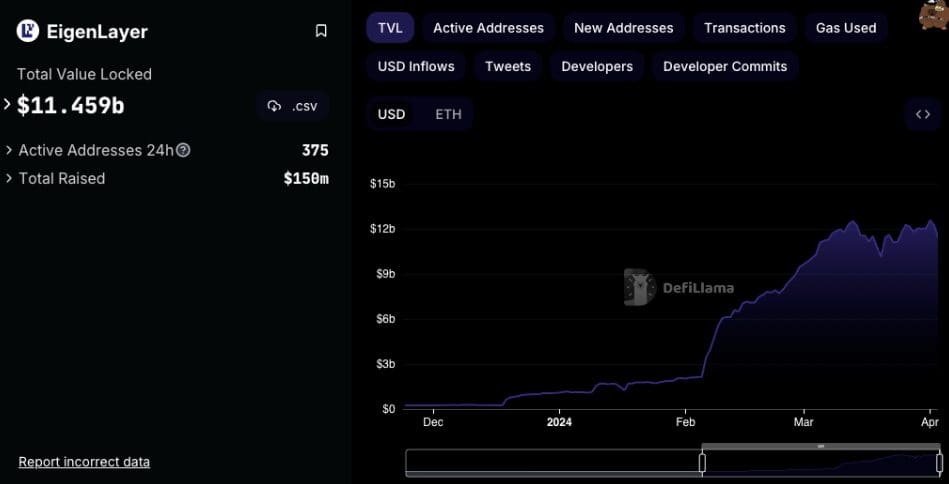

Coinbase analysts highlight potential risks stemming from the Eigenlayer protocol and the issuance of liquid restaking tokens (LRTs), emphasizing the complexity of allocating staked tokens across multiple validators.

Concerns Over Concentration and Competition

The addition of LRTs could lead to concentration among high-yield providers, potentially amplifying the risk profile associated with restaking. Furthermore, competition among LRT providers and decentralized autonomous organizations (DAOs) may incentivize excessive restaking, raising concerns about market stability.

Ethereum’s restaking landscape is evolving rapidly, with the Eigenlayer protocol emerging as a pivotal player. While the protocol promises to underpin new services and middleware on Ethereum, analysts caution against overlooking the inherent risks. Despite the short-term challenges, restaking proponents remain optimistic about the potential rewards for validators and the broader Ethereum ecosystem.

Also Read: What Could Follow if SEC Classifies ETH as a Security

Discussion about this post