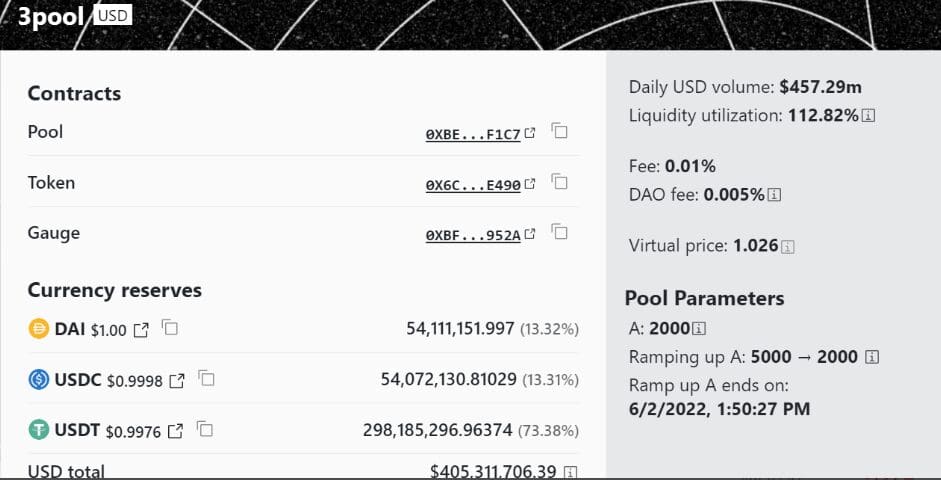

The ideal proportion of USDT, USDC, and DAI in the stablecoin pool is 33.3%; however, as of June 15, USDT weighted the pool at more than 70%.

Due to an imbalance in Curve’s 3pool, the Tether stablecoin somewhat drifted from its peg to the US dollar on June 15. When compared to curve 3pool’s regular weighting of 33.1%, USDT’s price dropped by 0.3% to about 0.997.

A stablecoin pool for decentralized finance called Curve’s 3pool holds enormous amounts of liquidity in the three most popular stablecoins: USDT, USD Coin USDC, and Dai DAI.

Significant increases in a stablecoin’s weight in the pool imply active selling of that asset.

Since USDT is 73.8% of the market, traders are progressively exchanging USDT for DAI or USDC. Prior to November 2022, when the FTX collapsed, USDT concentration in Curve’s 3pool passed 50%.

The primary reason for the imbalance was a whale address by the name of CZSamSun, which borrowed 31.5 million USDT and exchanged it for USDC, causing a small variation in the USDT’s peg value to the US dollar. The address used the 1inch Network to convert the borrowed funds into USDC using 17,000 Ether and 14,000 staked Ether (stETH) as collateral.

The borrower proceeded to make deposits worth $10 million and $21 million to Aave v2 and v3, respectively. The borrower then took USDT loans worth $12,000,000 from v3 and deposited them into v2.

About 20 minutes after CZSamSun borrowed USDT, another address (0xd2…0701) used Aave v2 to mortgage 52,200 staked Ether (stETH) and borrowed 50 million USDC utilizing the difference in price between USDT and USDC.

The USDC/USDT trading pair on Binance reached a new yearly high of $1.0034 thanks to the small USDT price fluctuation. The three currencies that made up Curve’s 3pool were USDT (73.79%), DAI (13.15%), and USDC (13.16%).

Paolo Ardoino, the chief technology officer of Tether, posted on Twitter to reassure the cryptocurrency community that there is no need to fear about the depeg fear and that the company is prepared to redeem any amount. Later, Ardoino shared a “FUD meme” in answer to market rumors regarding the depeg of Tether.

— Paolo Ardoino 🍐 (@paoloardoino) June 15, 2023

Only a few months have passed since the USDC depeg, which caused havoc on the portfolios of many investors. As Circle said it has over $3 billion locked up with Silicon Valley Bank, USDC depegged below $0.90 in March. Circle was able to raise enough funds to repeg USDC to the dollar in less than two days, but the depegging-induced panic caused many traders to sell USDC at a loss.

Discussion about this post