What is Crypto Insurance?

Crypto Insurance is a form of backup that crypto exchanges and investors use to recover a segment of their losses when theft or systems within the protocols fail to work out. There are a few crypto insurance companies that offer safety and protection against theft and security hacks within crypto exchanges.

For investors, there are a number of decentralized insurance platforms that help them protect and recover their assets in case there is a system failure in the individual protocols. They also protect the tokens that earn interest from de-pegging scenarios as well as hacks and unsuccessful withdrawals on the exchange platforms and crypto wallets.

An insurance company is meant to help you recover the object or asset that you registered to be insured in the company. Crypto insurance schemes have been a challenge to pull due to the lack of regulations within the cryptocurrency field. The crypto assets are also still new in the market and therefore adoption of their recovery might take some time.

The Working Mechanisms of Crypto Insurance

Crypto assets are not covered under federal insurance policies like bonds and stocks. Binance and Coinbase have their fiat currency insured by the Federal Deposit Insurance Corporation (FDIC). The maximum amount for each is $250,000. Their crypto assets, however, are left to their team to be handled in case of any losses.

For individual cryptocurrency investors, can purchase insurance packages. The packages may involve a certain amount that covers the assets for a certain period of time. Nexus Mutual offers this type of package. Alternatively, it can involve a plan that has a certain amount that cuts across different covers. An example of this cover is inSure DeFi. There are also packages that depend on the token, exchange platform, and protocol.

Investors can purchase these packages using a specific number of the protocol’s native tokens. In case someone files a claim, the DAO will decide whether to roll it out or not.

Also Read: How To Report Cryptocurrency Losses And Save On Taxes

The Emergencies That Decentralized Crypto Insurance Cover

The following are some of the scenarios where Decentralized Crypto Insurance cover:

Losses made due to the failure in the protocol

If the investor makes a loss as a result of the protocol code malfunction, economic design failure, government establishment failure and oracles, the Nexus Mutual Protocol Cover beneficiaries can recover their assets using the approved amount. The cover does not apply to phishing, a loss of private keys, hacks in the exchange or any activity that does not deter the proper functioning of the protocol.

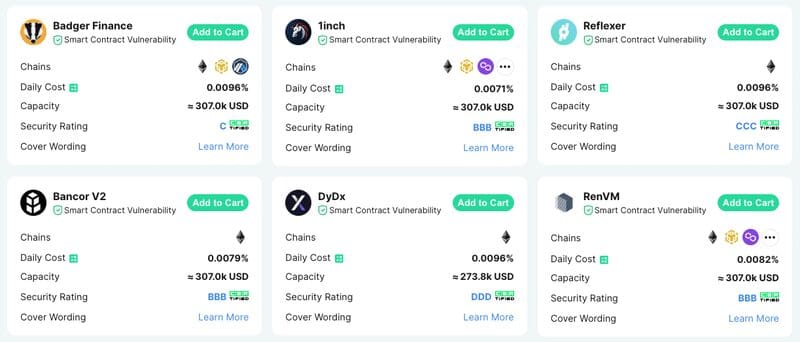

InsurAce provides protection for scenarios where tokens may be lost due to malfunctions in the bridges, hacks, and exploitation due to vulnerability subjection as well as loss of tokens in transit to error in slippage that has been reported by the bridge or DEX. Smart contract vulnerabilities are also featured in this policy.

Custody risk

The Nexus Mutual Custody Cover and inSure DeFis Stolen Funds provide safety for users’ funds and assets if a custodial institution shuts down due to being hacked. Withdrawals that have been put on hold for more than 3 months (90) days are also considered.

Scams

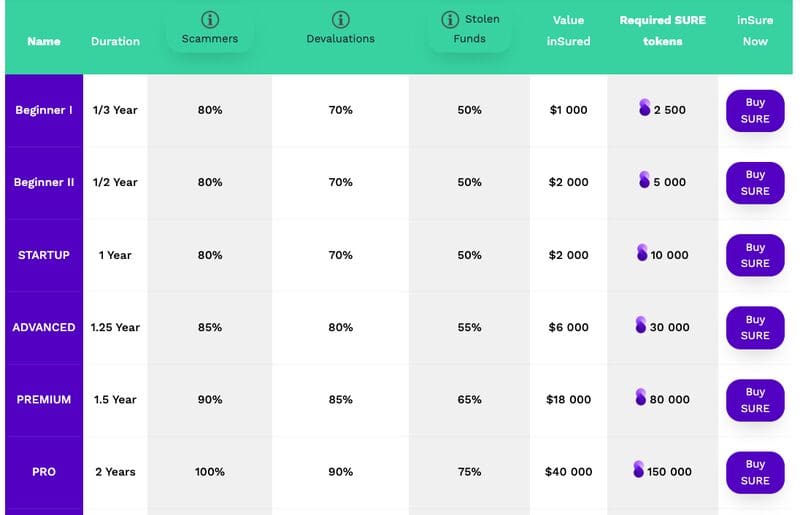

inSure DeFi offers protection to investors who get scammed and can’t manage to get access to their funds after they’ve made a deposit. The policy does not cover events where the investor used the wrong smart contract, or sent to instant reward wallets. Others include Ponzi scheme projects and projects that offer more than 100% APY.

Devaluations

inSure DeFi covers devaluations in cases where crypto holdings lose more than 98% of their investment. The terms and conditions that must be satisfied include the fact that the token must have a fungible token that appears on CoinGecko. The NFT must also be listed on at least two centralized exchanges.

Nexus Mutual offers asset protection for yield-bearing tokens, Ethereum (ETH) specifically. Investors can claim up to 90% of their loss if the token de-pegs by more than 10%. InsurAce covers stablecoin de-pegging for BUSD, USDC, USDT and MIM. The value for the loss coverage varies but it is said to cover losses up to 70%.

Non-Crypto Risk Insurance Cover

Etherisic Decentralized Insurance Platform (DIP), an Ethereum-based insurance project is on the move to leverage Oracle protocols, the will of the community, and smart contracts tech to construct an insurance package that will bring in various insurance policies. The risks covered will include, hurricane protection, crop destruction, and flight delays.

The DIP has partnered with Chainlink to ensure it gets information from external sources since insurance claims are processed using actual-time information that is not within the crypto financial field.

Platforms Offering Insurance Covers

Nexus Mutual

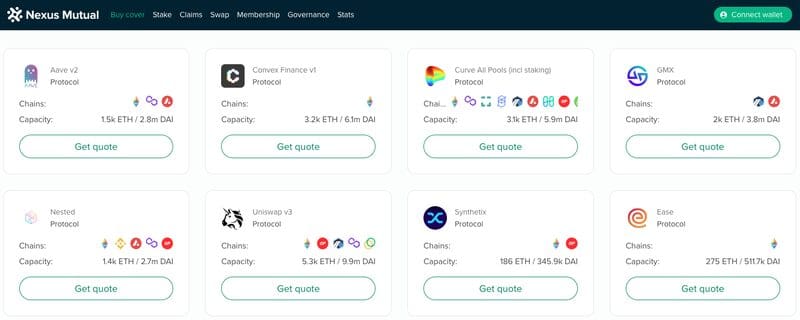

It has a market capitalization of more than $357 million. The insurance plans available include yield tokens, protocols, and a few custodians. The protocols covered include Aave, Curve, GMX, and Uniswap. The custodians covered include Binance and Coinbase.

inSure DeFi

inSure DeFi has a market capitalization(cap) of $106.6 million and offers plans that include a certain amount that covers multiple scenarios. These scenarios include scams and devaluations.

Uno Re

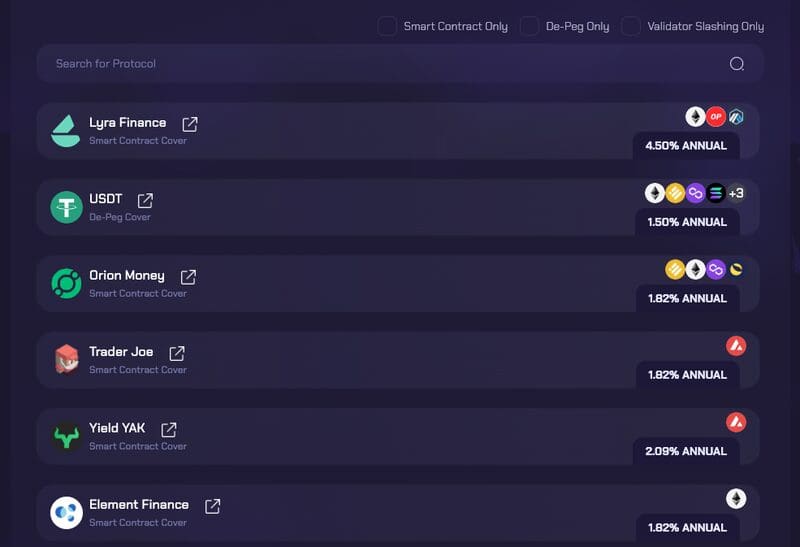

It has a market cap of $4.6 million and covers smart contacts, validator slashing, and de-pegs. They apply to certain protocols and tokens.

InSurAce

The market cap of InSurAce is $4.5 million. The insurance cover is applicable to smart contract vulnerabilities, and stablecoin de-pegs. It also stands out as the only insurance provider that offers bridge insurance for token transfers across different chains.

Do Crypto Exchanges Get Insurance Covers?

According to Coingecko, the answer isn’t that clear. The crypto insurance plans that are outlined by various cryptocurrency exchanges are not inclusive of the information about the assets they cover and the level of damage as well.

This is because the crypto exchanges lack a regulatory body which controls the protection of the investors and the firms. The cryptocurrency world is yet to come up with a system like the Deposit Insurance Corporations established by the national central banks.

$200 Million is said to have covered Coinbase while Bitstamp has a cover of more than $300 million. Binance has created an insurance cover of their own and it is known as the Secure Asset for User (SAFU) insurance scheme.

FTX claimed that it had an insurance cover amounting to $250 Million before it collapsed. The plan, however, was not inclusive of the customer deposits. It is clear that these insurance policies are not well-outlined and therefore do not clarify the safety of the investors’ assets.

Can Cryptocurrency Exchanges Get Insurance?

Crypto exchanges can’t get insured that easily because of the type of assets they hold as well as the technology behind their operations. According to a press release that aired in February 2020, Lloyds, a London–based insurance firm-announced that it had partnered with Coincover, a crypto insurance firm to provide insurance services for crypto assets in hot wallets. The insurance plan covers wallet balances that go as low as 1,000 euros.

One of the insurance brokers from Lloyd has launched Daylight, a crypto insurance product that provides insurance to crypto business establishments protecting them from business interruption, ransomware attacks, and copyright infringement that was not intended to happen.

The SAFU scheme, the Binances protection scheme, puts aside a certain amount of the company revenues for the protection of the customer’s deposits and acts as an insurance plan for centralized exchanges.

Conclusion

Edin Imirsovic, AM Best associate director, says that less than 2% of crypto-related risks are under insurance. Many crypto institutions are facing a lot of pressure to make sure they deliver insurance policies that deal with these risks. On the other hand, decentralized insurance platforms are trying to come up with plans that cover a wide range of users’ needs.

Crypto insurance will continue to be refined as its need will grow in the future. It is important for investors to do their research and find out which plans are suitable for them before choosing to go for an insurance plan. Insurance companies are bound to come up with policies that protect them from the high volatility that is associated with these assets.

Discussion about this post