Summary:

- Bitcoin’s Halving Impact: Understanding the recurring phenomenon of Bitcoin halving and its historical implications on price surges.

- Analyst Perspectives: Examining the positive projections for Bitcoin’s future post the imminent halving event and its current market performance.

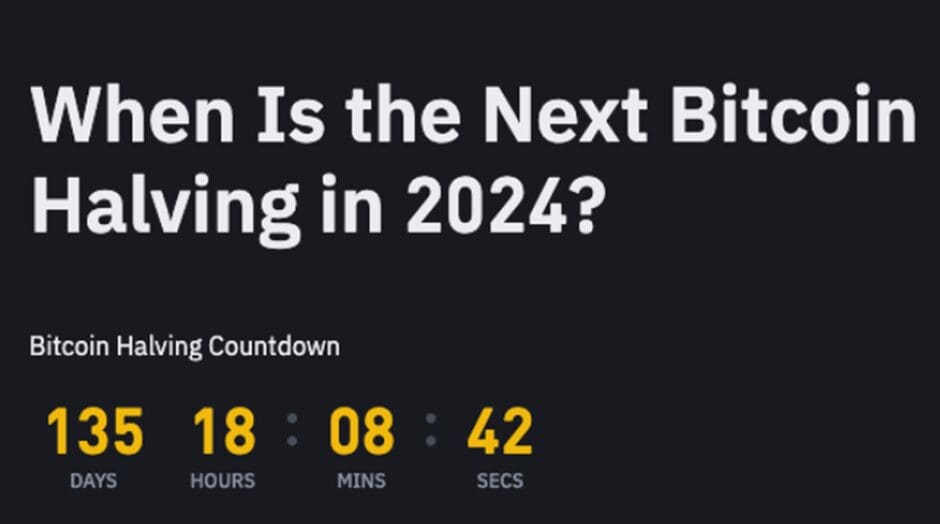

Changpeng Zhao, the CEO of Binance, recently sparked enthusiasm among cryptocurrency enthusiasts by unveiling a countdown to Bitcoin’s highly anticipated halving event. According to Zhao’s recent post, the fourth Bitcoin halving is scheduled to occur in the initial week of April 2024, hinting at significant developments on the horizon for the crypto community.

Bitcoin Halving And Its Impact

The impending Bitcoin halving, an essential event ingrained in the Bitcoin blockchain, is poised to reduce mining rewards by half. This process, occurring roughly every four years, curtails the rate at which new Bitcoin enters circulation. As revealed in Zhao’s shared screenshot, the countdown indicates that the forthcoming halving is 135 days away, commencing from November 19, 2023.

#Bitcoin halving soon. pic.twitter.com/xp4mWyMKkD

— CZ 🔶 BNB (@cz_binance) November 19, 2023

Historical Halvings And Price Surges

The significance of Bitcoin halving events is evident in their historical precedents. The inaugural halving in 2012 slashed block rewards from 50 BTC to 25 BTC. Subsequent halvings in 2016 and 2020 further reduced rewards to 12.5 BTC and 6.25 BTC, respectively.

Interestingly, Bitcoin’s price trajectory following these halvings has shown substantial surges. The reduction in new Bitcoin supply due to increased scarcity after halving tends to trigger a supply shock, eventually exerting upward pressure on its price. Notably, Bitcoin’s previous all-time high of approximately $66,000 materialized about 18 months after the third halving.

Anticipating The Fourth Halving

With the impending fourth Bitcoin halving poised to reduce miner rewards to 3.125 BTC, analysts are optimistic about a bullish trend post-halving. The current positive momentum of Bitcoin, primarily fueled by the anticipated approval of the U.S. Bitcoin spot exchange-traded fund (ETF), reinforces analysts’ optimistic outlooks.

As of the latest update, Bitcoin stands at a price of $37,157.63, registering a 1.57% increase in a day, 0.54% over a week, and an impressive 27.19% surge in a month. This resilience continues to solidify Bitcoin’s prominent position in the crypto sphere, boasting a market cap of $725.38 billion.

Discussion about this post