In a meaningful development for cryptocurrency investors, CoinStats, the all-in-one digital asset management platform, has launched its new Exit Strategy feature.

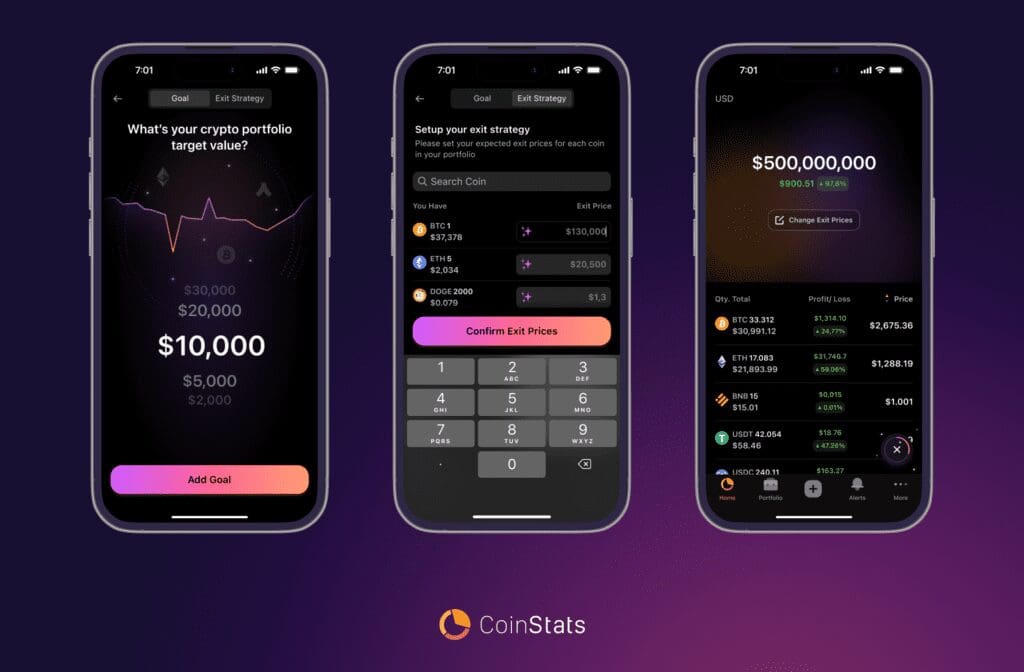

Exit Strategy enables investors to plan the ideal selling price of their cryptocurrency holdings directly within the CoinStats app.

As the Bitcoin ETF fever propels the crypto bull market to new all-time highs, it’s becoming increasingly important for investors to take profit from their open positions. The Exit Strategy feature is here to maximize investor profits by enabling users to set specific selling prices for their crypto portfolio.

New users connecting their portfolio to CoinStats will be automatically prompted to set up this feature and define the target prices at which they intend to sell their coins. Once set, the Exit Strategy feature is always just a glance away — allowing users to seamlessly switch between the portfolio view and the Exit Strategy view to review their target selling prices.

Premium CoinStats users can benefit from Exit Strategy’s AI Suggest, a tool powered by artificial intelligence (AI) designed to predict the Bull Market Price (BMP) of specific cryptocurrencies.

For investors without an intricate exit plan, AI Suggests leverages cutting-edge AI algorithms to offer peak bull market estimates for their crypto holdings. AI-powered analytics are crucial in the volatile and unpredictable field of cryptocurrency, as they provide an additional data-driven approach to securing profits.

The biggest mistake for most crypto investors is not having a plan, wrote Narek Gevorgyan, the Chief Executive Officer of CoinStats.

CoinStats enables over 1 million monthly active users to track and manage their crypto holdings in real time across 300 different wallets and exchanges.

CoinStats is the only crypto tracker on the market that supports all major cryptocurrency platforms and DeFi protocols — including over 20,000 cryptocurrencies, over 1,000 DeFi protocols, and over 70 blockchain networks.

Discussion about this post