Coinbase’s financial performance in the second quarter of 2024 has demonstrated the company’s growing influence and adaptability within the crypto market. Marking its third consecutive profitable quarter, Coinbase reported substantial year-on-year growth in both net revenue and trading volumes, highlighting its resilience and strategic prowess in an ever-evolving industry.

Strong Financial Results Drive Investor Confidence

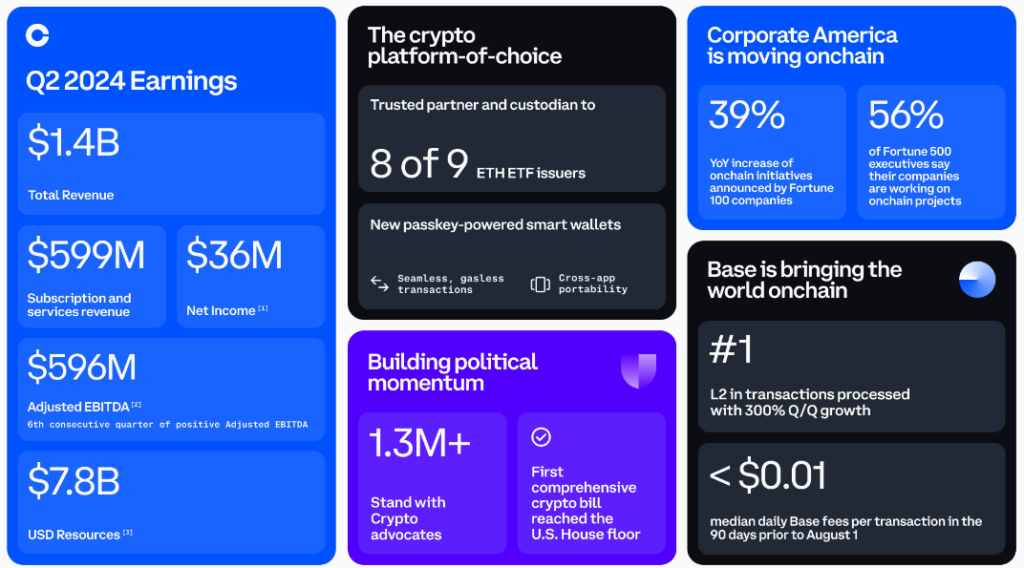

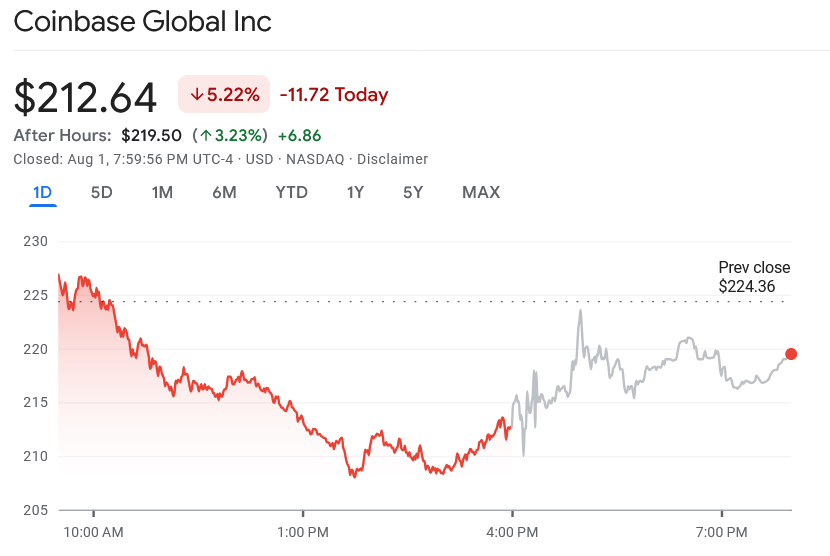

On the heels of its Q2 earnings announcement, Coinbase shares surged 3.2% in after-hours trading. The crypto exchange reported a robust $1.4 billion in revenue for the quarter, showcasing a significant improvement in its financial health. This impressive figure was complemented by a 108% increase in net revenue and a staggering 145% rise in crypto trading volumes compared to the same period last year.

The exchange’s trading volumes hit $266 billion, reflecting a substantial year-over-year increase. Although this figure represented a drop from the $312 billion reported in Q1, it aligned with analyst expectations, underscoring Coinbase’s ability to maintain a strong market presence despite quarterly fluctuations.

Diversified Revenue Streams and Increased Subscriptions

One of the key highlights of Coinbase’s Q2 performance was the notable growth in subscription and service revenue. This category, encompassing stablecoin revenue, blockchain rewards, and various fees, saw a 17% increase from Q1 and nearly doubled compared to Q2 2023. This diversification of revenue streams underscores Coinbase’s strategic shift towards creating a more balanced and resilient business model.

The rise in subscription and services revenue was partly attributed to the exchanges’ role as custodians for several asset managers issuing spot Bitcoin exchange-traded funds (ETFs). This strategic positioning not only bolstered Coinbase’s revenue but also reinforced its reputation as a trusted and reliable player in the crypto market.

Transaction Revenue and Institutional Trading

Coinbase’s transaction revenue, driven by crypto trading activity, also saw significant growth. The company reported $780.9 million in transaction revenue for Q2, doubling from the same period last year.

However, this was a decrease from the first quarter’s figures, of the total transaction revenue, $664.8 million came from consumer-based transactions, slightly missing the $695 million estimate from investment research firm Zacks. Institutional transaction revenues, however, exceeded expectations, coming in at $63.6 million against a $55 million estimate from Zacks.

Despite the mixed results in transaction revenue, the company’s consistent profitability is notable. Coinbase achieved a net income of $36 million for the quarter, marking its third consecutive quarter of profitability and the sixth on an adjusted EBITDA basis.

Regulatory Progress and Market Position

While financial gains are critical, Coinbase’s significant regulatory advancements in Q2 may be its most impactful achievement. The company made notable strides toward achieving regulatory clarity in the United States and globally. With bipartisan support growing within both the House and the Senate, there is real momentum toward passing meaningful crypto legislation, which could further stabilize and legitimize the industry.

This regulatory progress, combined with strong financial performance, has positioned Coinbase as a leading entity in the crypto market. The firm’s strategic direction and robust market presence have instilled confidence among investors, as reflected in the 3% rebound in its share price following the earnings announcement.

Discussion about this post