More than 100,000 creditors, $500 million to $1 billion in assets, and $500 million to $1 billion in liabilities were estimated by the firm.

Bittrex, a cryptocurrency exchange recently filed for Chapter 11 bankruptcy protection in the District of Delaware.

Bittrex stated in a filing on May 8 in the United States Bankruptcy Court for the District of Delaware that it has over 100,000 creditors, assets worth between $500 million and $1 billion, and liabilities worth between $500 million and $1 billion as part of the bankruptcy proceedings.

The Seattle-based Bittrex, Inc., two Bittrex firms in Malta, and an associated entity, Desolation Holdings LLC, are all covered in the bankruptcy. Bittrex Global GmbH, the exchange’s global entity based in Liechtenstein, was excluded from the filing.

The announcement came after William Shihara, the company’s co-founder and former CEO, was charged with securities violations by the U.S. Securities and Exchange Commission (SEC) in April.

Read More: Bittrex, A US Cryptocurrency Exchange, Could Face SEC Potential Regulatory Violation

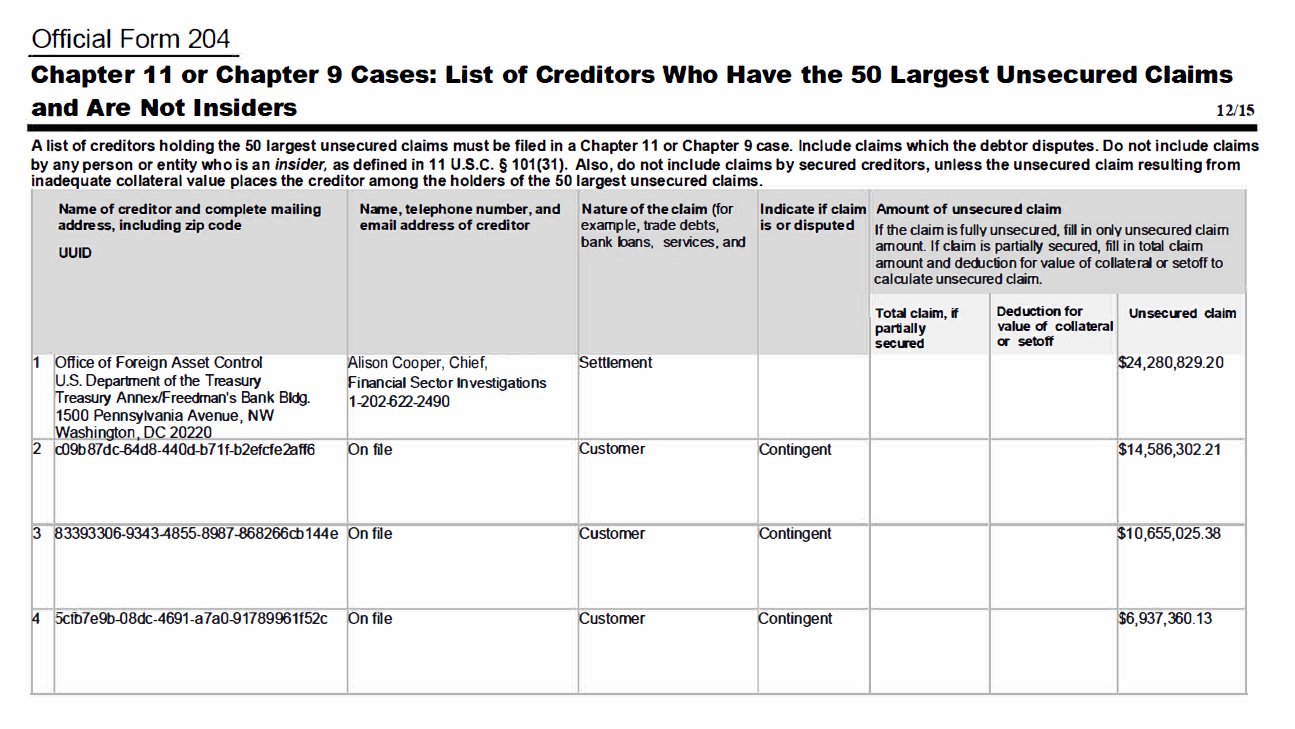

Bittrex, Inc. and Bittrex Global were accused by the SEC of running an unlicensed securities exchange. The Office of Foreign Assets Control (OFAC) and the Financial Crimes Enforcement Network (FinCEN) of the U.S. Treasury filed charges against the exchange for alleged violations of the Bank Secrecy Act in October, and the exchange subsequently agreed to pay a settlement of about $29 million.

The largest creditor identified on Bittrex’s bankruptcy filing is OFAC, for whom the exchange has recorded a $24.2 million claim. A cryptocurrency wallet is its second-largest creditor, with a $14.5 million claim.

With a claim of $3.5 million, FinCEN is also included as one of the top 50 creditors. The SEC is listed with an unidentified amount of claims.

The SEC’s enforcement efforts and Bittrex’s most recent bankruptcy filing coincide with the company’s March announcement that it would cease operations in the United States by April 30 due to “continued regulatory uncertainty” there.

The U.S. division of Bittrex has had a difficult year in 2023. The exchange also laid off 83 workers in February, citing a downturn in the cryptocurrency industry brought on by the failures and insolvencies of other crypto companies.

The bankruptcy of Bittrex is the most recent in a string of other cryptocurrency exchange or lending companies, including FTX, BlockFi, Celsius, and Voyager Digital, that has also recently filed for Chapter 11 protection.

Discussion about this post