Amid concerns about Bitcoin’s potential plunge and the worry of losing recent gains, a crypto expert has offered a refreshing perspective, suggesting that a correction to around $40,000 may not be a negative event for the cryptocurrency.

Necessity of a Bitcoin Correction

William Clemente, co-founder of Reflexivity Research, emphasized the importance of a corrective phase for Bitcoin. He highlighted that such a pullback would eliminate overleveraged positions, providing a more robust foundation for future upward movements. Clemente argued that Bitcoin’s volatility is an inherent characteristic that facilitates healthier market dynamics.

Clemente’s remarks were made considering Bitcoin’s notable surge over the past months, driven by expectations surrounding the potential approval of Spot BTC ETF applications by the Securities and Exchange Commission (SEC).

The Expected Correction

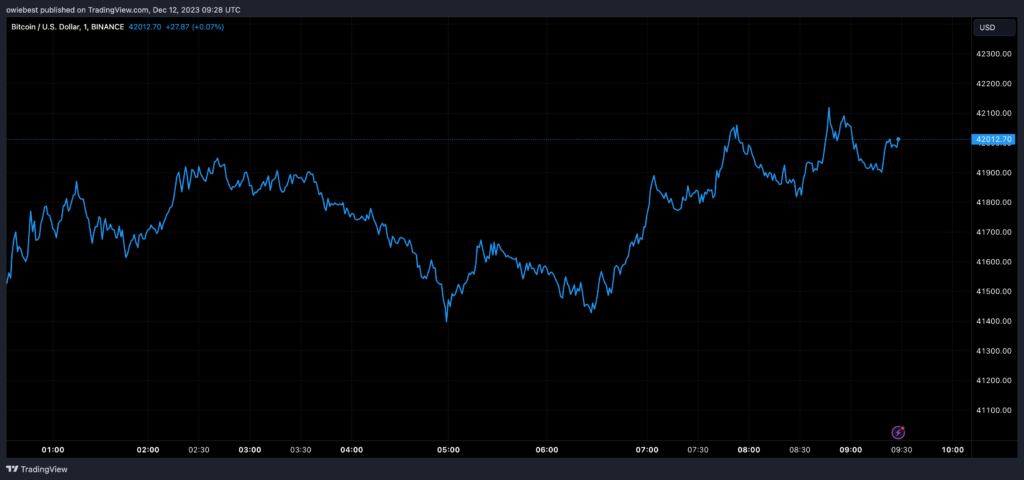

While Bitcoin has witnessed a significant rally with minimal retracement, market dynamics point to an impending correction. Recent data from Coinglass indicates a higher number of long positions liquidating compared to shorts, signalling a shift in the market sentiment.

Clemente previously cautioned about sharp corrections due to excessive leveraged positions. The breather in Bitcoin’s rally might also be linked to macroeconomic events like the forthcoming release of CPI inflation data and the concurrent FOMC meeting scheduled for December 12 and 13.

Market Sentiment and Future Prospects

Anticipation is high within the crypto community for positive outcomes from these macroeconomic events, which could further fuel the prevailing bullish sentiment. Despite short-term fluctuations, enthusiasm remains buoyant, especially with the looming possibility of a Spot Bitcoin ETF approval in January.

The ecosystem continues to witness a steady inflow of liquidity, with digital asset investment products experiencing consistent weeks of inflows. Bitcoin continues to capture the attention of investors, attracting substantial inflows of $20 million amidst the ongoing market developments.

Discussion about this post