Cardano‘s (ADA) price action has been catching the attention of the cryptocurrency community as it stages a promising recovery, pushing towards critical resistance levels. The recent price surge has fueled speculation about a potential bull run, with buyers setting their sights on the $0.40 mark and possibly even higher. This development marks a significant turnaround for ADA, which had been struggling to regain its footing after a series of downturns earlier this year.

Key Support and Resistance Levels to Watch

In the current market setup, ADA is approaching crucial technical levels that could determine its next move. The key support level is firmly established at $0.31, a zone that has provided a reliable base for the cryptocurrency during recent fluctuations. On the other hand, the key resistance level at $0.37 is now under intense scrutiny as ADA attempts to break through this barrier. A successful breach of this resistance could signal a shift in market sentiment, potentially transforming this resistance into a new support level and paving the way for further gains.

Buyers Intensify Pressure on $0.37 Resistance

The bullish momentum in ADA’s price is largely driven by increasing buying pressure as traders and investors eye the $0.37 resistance. This level has proven to be a significant hurdle in recent weeks, but the persistent buying activity suggests that a breakout may be imminent. Should ADA manage to flip this resistance into support, it could trigger a sustained rally, allowing the cryptocurrency to recover some of the losses it has incurred since March.

Volume Surge Signals Growing Market Interest

One of the most encouraging signs for ADA bulls is the noticeable increase in trading volume. Since the start of the week, the buy volume has been steadily rising, reflecting growing investor confidence in ADA’s potential. If the current uptrend continues and today’s candle closes in the green, it would further solidify the bullish outlook for ADA. Even if the market experiences a temporary pullback, the underlying momentum remains positive, suggesting that buyers could resume their push at a later stage.

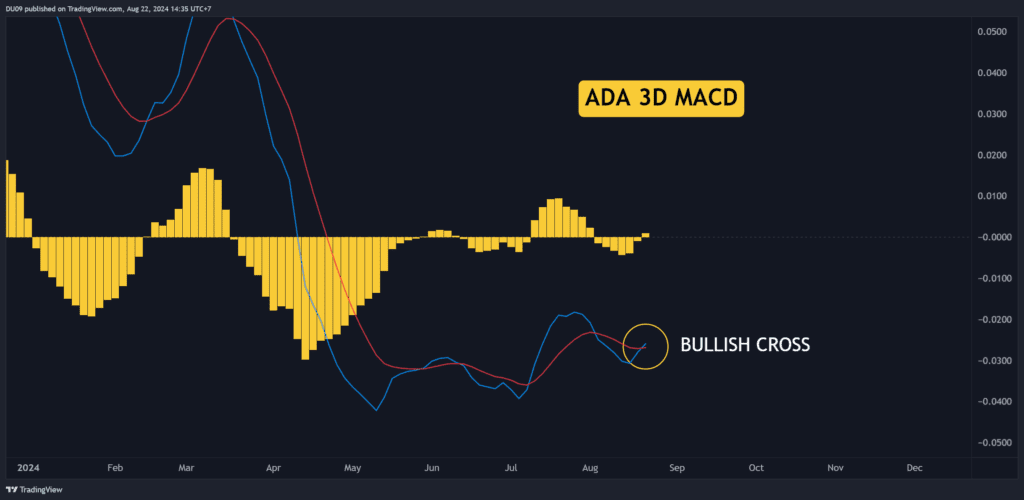

Bullish MACD Cross Indicates Potential Rally

Adding to the optimism is the recent bullish cross in the 3-day MACD indicator, which underscores a significant shift in market dynamics favouring the buyers. This technical signal often precedes a rally, and with ADA currently challenging the $0.37 resistance, the stage is set for a possible breakout. Should ADA succeed in overcoming this resistance, the next targets would be at $0.42 and $0.46, offering potential upside for investors who are betting on a continued recovery.

Discussion about this post