The beginning of March was marked by a series of the banking crisis in the United States, which brought uncertainty into the financial markets, including the cryptocurrency market. Some digital assets have been under significant selling pressure, marking notable drops.

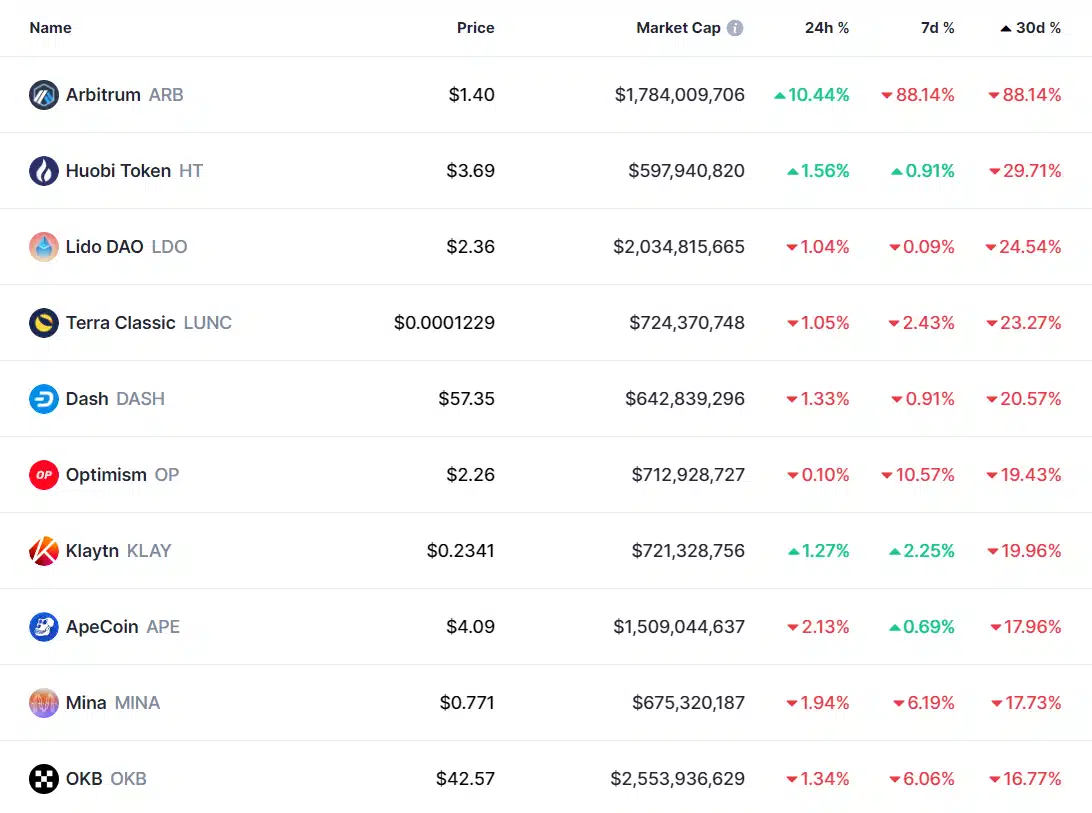

Arbitrum (ARB) is the youngest asset among the top 100 cryptocurrencies listed on CoinMarketCap(CMC) and reflects the greatest loss. In just four days following its debut on March 23, ARB’s share price dropped by nearly 90%.

ARB is still down more than 88% from its all-time high (ATH) of $11.8, reached on March 23 even though it has gained around 10.4% in the last 24 hours. Arbitrum gained attention for its airdrop and début. At the time of writing, it is trading at $1.4.

According to CMC data, the price declines of the remaining losers on the list were extremely close. In the past 30 days, the prices of Huobi token (HT), lido DAO (LDO), and terra classic (LUNC) have fallen by 29.7%, 24.5%, and 23.3%, respectively. In the past twenty-four hours, HT could have recovered by 1.5%.

In addition, the final three assets are apecoin (APE), mina (MINA), and OKB. In March, the digital currencies fell by 17.9%, 17.7%, and 16.7%, respectively.

The crypto market as a whole has experienced a significant crisis as a result of the collapse of several prominent banks and the most recent regulatory action against the largest exchange, Binance.

In addition, the total market capitalization of cryptocurrencies dropped to $912 billion on March 10, a decrease of $88 billion in less than 24 hours. However, the industry experienced a quick recovery beginning on March 12.

According to CMC data, the total crypto market capitalization reached $1.19 trillion at the time of writing, the highest level since June 2022.

Discussion about this post