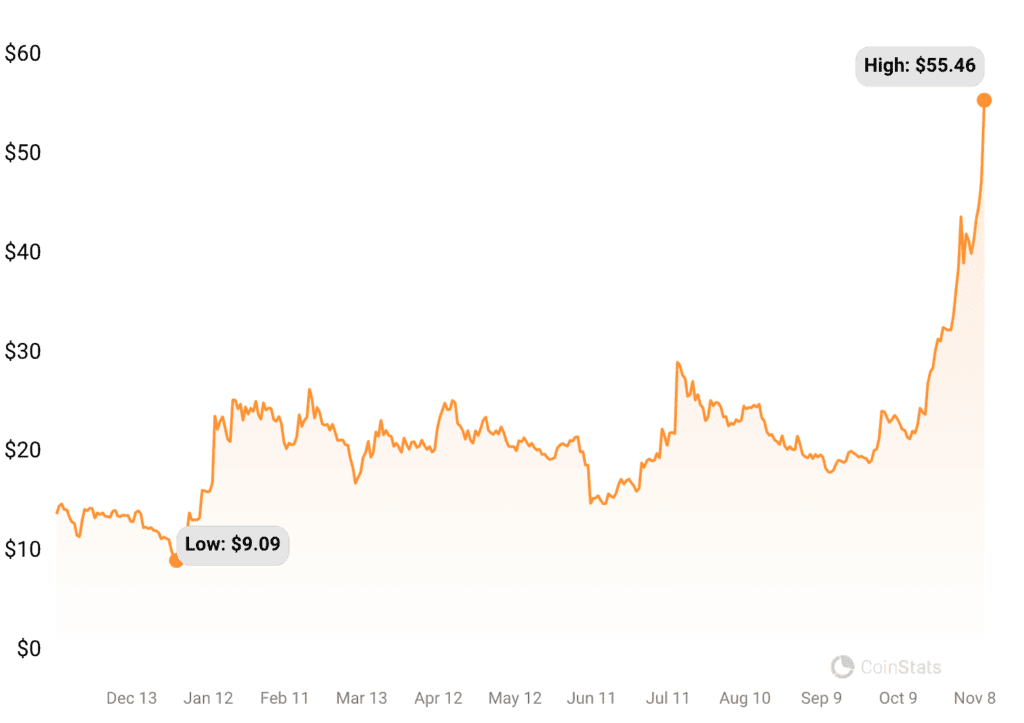

In the fast-paced and often unpredictable world of cryptocurrencies, Solana has emerged as a beacon of resilience and potential. After plummeting to a mere $8 in the wake of FTX’s bankruptcy in December 2022, SOL has made a phenomenal comeback, marking a 17% increase to reach $55. This surge isn’t just a number; it represents a week-over-week gain of 35% and an astonishing monthly climb of over 150%, defying expectations and turning heads in the crypto community.

SOL’s Price Dynamics: Understanding the Momentum

Solana’s recent triumph is more than just a recovery story. It’s a narrative of a digital asset demonstrating robustness and gaining investor confidence. Breaking through the $53 resistance level, SOL’s price dynamics point towards a market sentiment that is both optimistic and cautious. Analysts like JACKIS, while being long-term proponents of Solana, advise against hasty investments. They point to the need for a significant market correction, despite SOL’s impressive performance, marked by ten consecutive weeks of gains.

Institutional Interest: A Vote of Confidence for Solana

The narrative of Solana’s ascent is further bolstered by its reception among institutional investors. The Grayscale Solana Trust (GSOL) trades at a 300% premium to SOL’s spot price, mirroring investor confidence and speculation about its long-term value. This premium, echoing similar trends in other digital assets like Chainlink, signifies a profound institutional interest in Solana’s future. GSOL’s shares, trading at $202 compared to Solana’s spot price of around $55, have surged over 800% since the beginning of the year, underscoring the significant institutional bet on Solana’s technology and market position.

Discussion about this post