The U.S. Securities and Exchange Commission (SEC) is facing significant hurdles in hiring and retaining crypto experts, citing internal restrictions and regulatory barriers that limit the pool of potential candidates for the agency. The Inspector General’s report has outlined these challenges, shedding light on the difficulties faced by the SEC in its pursuit of personnel knowledgeable in the crypto domain.

Hiring Restrictions Hindering Talent Acquisition:

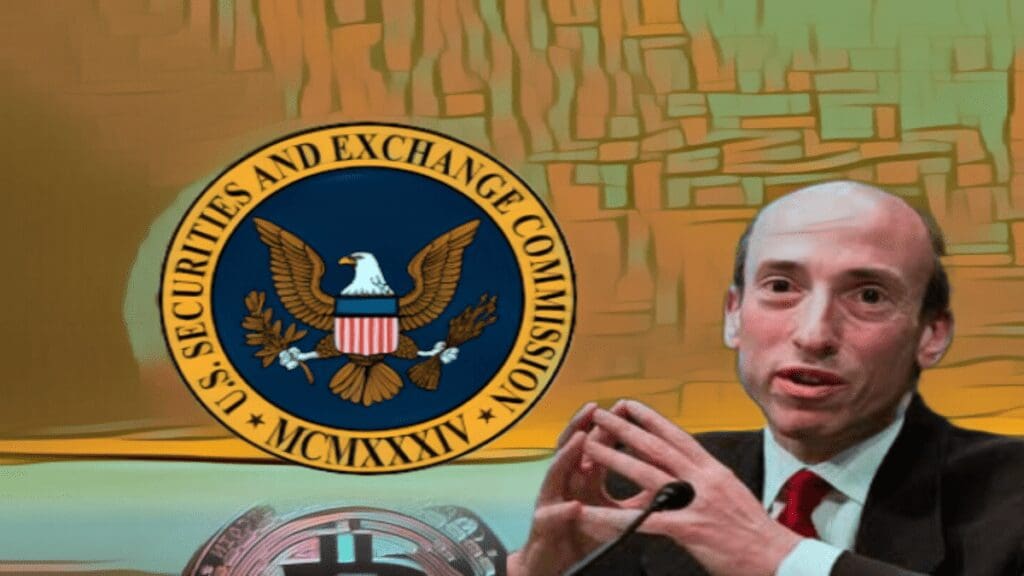

- According to the Inspector General’s report, the SEC encounters obstacles in recruiting specialists well-versed in crypto assets for roles involving investigation and enforcement. The agency’s recent focus on scrutinizing the blockchain industry, especially in light of Chairman Gary Gensler’s assertions regarding non-compliance, has increased the need for crypto-savvy experts.

Struggles In A Regulatory Landscape:

- The SEC has initiated more than 50 enforcement actions against prominent crypto entities this year, targeting major global exchanges like Coinbase and Binance. The disputes primarily revolve around unregistered crypto asset securities, resulting in extensive legal debates over the classification of specific cryptos as investment contracts.

The Dearth Of Crypto Expertise And Private Sector Competition:

- Recruiting is further complicated by a lack of qualified crypto professionals and tough competition from the private sector. A notable deterrent to potential employees is the SEC’s restriction on crypto ownership. This clause, stated by the Office of the Ethics Counsel, prevents individuals owning crypto assets from handling crypto-related matters within the SEC.

Also Read: Gary Gensler Stands High Chances Of Losing His Job In 2024: John Reed Speaks

Adapting To Evolving Industries:

- The report underscores the need for the SEC to continually evolve and enhance its expertise and capabilities in industries like crypto and artificial intelligence. The agency’s challenge is compounded by the absence of a comprehensive regulatory authority for non-securities crypto markets like Bitcoin.

Understanding The Disconnect:

- A survey revealed that a majority of non-Bitcoin owners refrained from investing in crypto due to a lack of understanding. Proficiency and familiarity with Bitcoin were observed as significant determinants for considering investment opportunities. As a result, regulators, especially the SEC, face a challenge when it comes to recruiting crypto-savvy employees.

Bitcoin Ownership In The Political Realm:

- Notably, several prominent figures in the U.S. Congress, like Senators Cynthia Lummis and Ted Cruz, and presidential candidate Robert F. Kennedy, are Bitcoin owners. Owning crypto assets but not understanding them highlights the difficulty regulatory bodies face in hiring crypto experts.