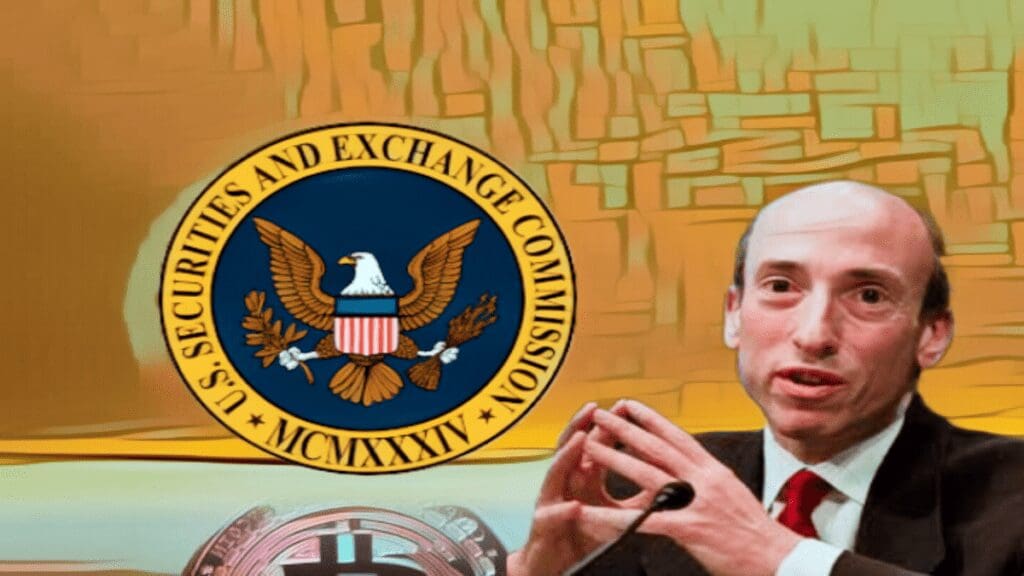

The cryptocurrency industry, often associated with innovation and decentralization, finds itself under the scrutiny of the U.S. Securities and Exchange Commission (SEC). In a significant address at the 2023 Securities Enforcement Forum, SEC Chair Gary Gensler voiced concerns about the crypto sector’s compliance with U.S. regulations.

This article delves into Gensler’s criticisms, emphasizing the need for alignment with traditional financial rules, the interpretation of “investment contracts,” and the pressing issues faced by the industry.

Decentralization vs. Regulation

At the heart of the matter lies the tension between the decentralized nature of cryptocurrencies and the regulatory framework of traditional finance. Gensler underscores that despite their decentralized ethos, crypto firms cannot evade the essential compliance expected of financial entities. This debate raises fundamental questions about how the industry should navigate the evolving regulatory landscape.

Investment Contracts And Securities Laws

Gensler references historical securities laws and the term “investment contract.” He contends that investors and issuers in the crypto asset securities markets deserve the same level of protection as their counterparts in traditional finance.

His argument hinges on the idea that many crypto assets could be considered “investment contracts,” thereby subject to securities laws. Understanding the implications of this interpretation is vital for both the crypto community and regulatory bodies.

Also Read: Gary Gensler Stands High Chances Of Losing His Job In 2024: John Reed Speaks

Contrasting Views: Gensler vs. Clayton

Gensler’s stern stance contrasts with the optimism expressed by former SEC Chair Jay Clayton, who believes the approval of a Bitcoin exchange-traded fund (ETF) is inevitable. This section explores the differing perspectives of these regulatory leaders, examining the regulatory concerns that once hindered the path to a Bitcoin ETF and how these concerns have evolved over time. Understanding these viewpoints offers insight into the ongoing evolution of cryptocurrency regulation.

Conclusion

The crypto industry’s journey through the regulatory landscape is marked by contrasting viewpoints, tensions between decentralization and compliance, and evolving interpretations of securities laws. As SEC Chair Gensler continues to emphasize the need for alignment with traditional financial rules, the crypto community and regulators alike must grapple with complex questions regarding the industry’s future.

Ultimately, finding common ground that ensures investor protection while fostering innovation remains a critical challenge in this rapidly evolving space.