Lawyers Challenge FTX’s Reorganization Plan

FTX’s proposed reorganization plan has come under scrutiny as class action lawyers raise objections over the valuation of customer recoveries and lack of transparency. The legal teams argue that the plan undervalues cryptocurrency recoveries and fails to meet full disclosure requirements, while also highlighting concerns over creditor representation and potential conflicts of interest.

Misleading Recovery Figures and Transparency Issues

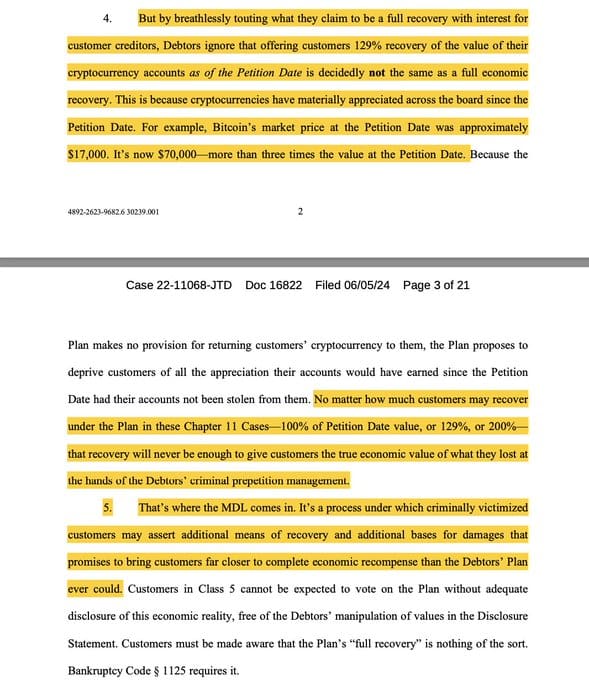

Class action lawyers from Moskowitz Law Firm and Boies Schiller Flexner LLP, representing thousands of plaintiffs in the multi-district litigation (MDL) against FTX, have objected to the reorganization plan for FTX Trading Ltd. and its affiliates. They argue that the recovery figures proposed by the plan are misleading and fail to account for the appreciation in cryptocurrency value since the Petition Date.

For example, while the plan promises a “full recovery” by returning 129% of the value of customers’ cryptocurrency accounts as of the Petition Date, this does not reflect the current value of Bitcoin, which has significantly increased from $17,000 to around $70,000. This discrepancy, they argue, means that customers would not receive the true value of their losses.

Also Read: FTX’s Compensation Proposal: Addressing the Fallout of 2022 Collapse

Dispute Over the Anti-Double-Dip Provision

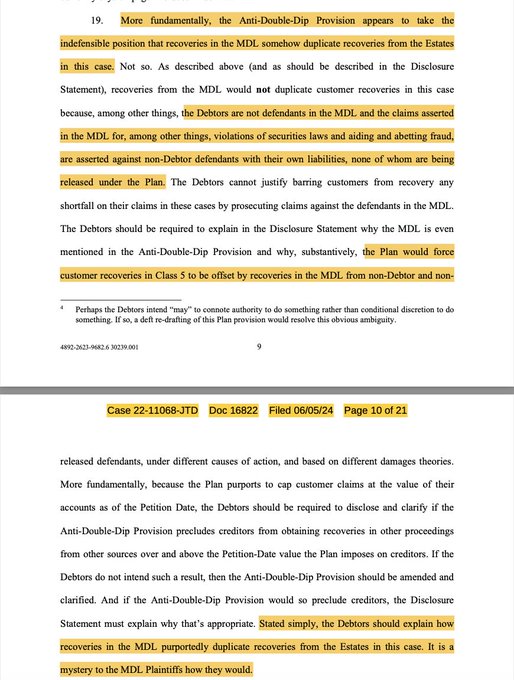

A key contention in the objection is the plan’s Anti-Double-Dip Provision, which implies that any recovery from the MDL would duplicate the recovery from the reorganization plan. The MDL Plaintiffs dispute this, arguing that their claims are against non-debtor entities for different legal violations, and thus do not duplicate the recoveries under the plan. They call for the Disclosure Statement to clarify this provision and disclose whether it precludes further recoveries.

Lack of Creditor Representation and Potential Conflicts of Interest

Another major concern raised is the lack of creditor representation on the proposed Consolidated Wind Down Trust. The plan currently includes only the Plan Administrator and joint official liquidators from the Bahamas, which the MDL Plaintiffs argue undermines creditor interests and questions the plan’s good faith under Bankruptcy Code 1129.

Additionally, the involvement of Sullivan and Cromwell, a defendant in the MDL, in drafting the plan raises potential conflicts of interest. The objection calls for revisions to ensure fairness and transparency in the reorganization process.

Impact of Examiner Report and Criminal Case Findings

The MDL Plaintiffs criticize the debtors for not including the findings of Robert J. Cleary’s Examiner Report in the Disclosure Statement. The report identifies potential causes of action and unresolved issues that creditors need to understand. The objection demands transparency about how these findings impact the reorganization plan.

Furthermore, the objection points out a contradiction between the debtors’ stance and the findings in Sam Bankman-Fried’s (SBF) criminal case. The jury found that SBF misappropriated customer funds, which opposes the debtors’ position. The Disclosure Statement must address this contradiction and inform customers that their funds were misappropriated, impacting their recovery.

Discussion about this post