A significant increase in DOGE’s dormant circulation on May 30 may portend a selling wave. Shiba Inu and Dogecoin matched each other rather well on all of the measures that were examined. Shiba Inu was restricted, but Dogecoin might be dangerous for those who just keep it temporarily.

A week ago, the memecoin market collapsed as a result of Bitcoin’s [BTC] inability to break above the $70k barrier. Of the top five meme coins by market capitalization, only dogwifhat [WIF] experienced a positive price performance over the previous week, according to CoinMarketCap data.

The price performance of Dogecoin [DOGE] and Shiba Inu [SHIB] was comparable, albeit the latter was trading in a range. Although the former has trended higher slightly more regularly, it has been more erratic in May.

Which token is most likely to see higher returns as June approaches?

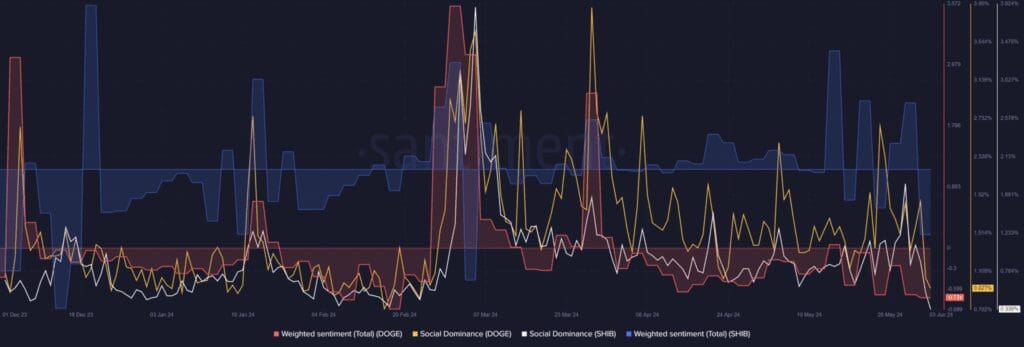

Contrasting the social metrics An indication of how bullish or bearish the social media interaction was was provided by the weighted sentiment. For DOGE and SHIB, the three-day interval values were -0.72 and -0.74, respectively. This demonstrated that participation for both coins was bearish in a similar way.

On the other hand, the patterns show that Dogecoin has been steadily declining since April. Over the previous two months, Shiba Inu, on the other hand, was more commonly favorable. This could be a result of Dogecoin seeing greater volatility. DOGE’s social dominance was 0.927%, while SHIB’s was 0.339%. This makes sense as well, given Dogecoin has long been the face of the meme coin industry.

This measure suggests that Dogecoin may see increased volatility in the near future. The latent circulation of DOGE experienced a significant increase on May 30. This is typically an indication of selling pressure and shows a rush of tokens transferring between wallets.

Since then, DOGE prices have only decreased by 3%, and as of this writing, a rebound is in progress. The prospective selling wave, though, might raise some questions. However, Shiba Inu witnessed a greater HODL attitude during the last two months as fewer coins moved on-chain.

Also Read: Dogecoin Price Prediction: Rally or Sell-Off in the Cards?

By comparing the MVRV ratios, we can observe that DOGE had a greater negative six-week period than SHIB. Thus, holders of DOGE incurred higher losses, particularly in the first part of May.

The holders of SHIBs were sitting on larger unrealized losses as of the time of publication. The social indicators were rather comparable overall. The MVRV ratios demonstrated that as the metric moved over zero, DOGE holders were more inclined to sell.

Dogecoin may experience more volatility than Shiba Inu when combined with the latent circulation surge.

Discussion about this post