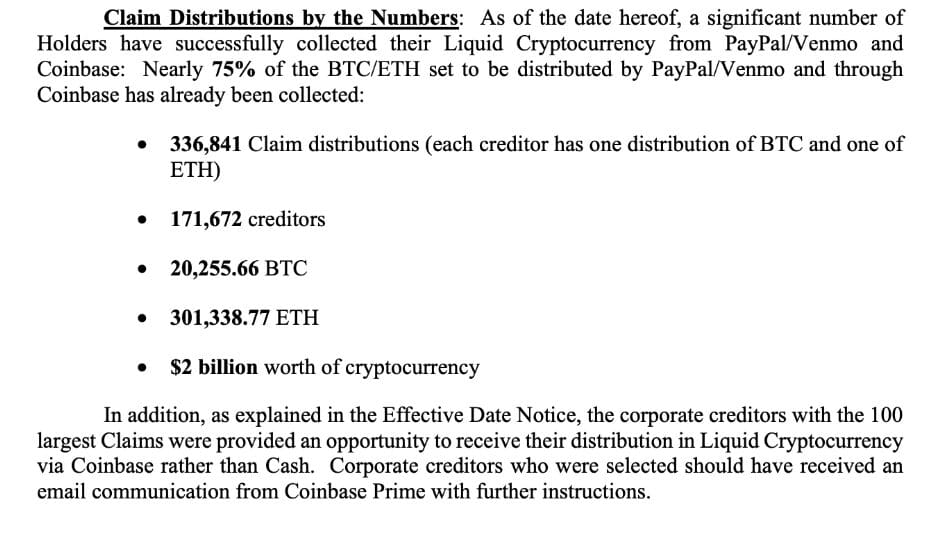

Cryptocurrency lending platform Celsius has successfully distributed $2 billion worth of crypto assets to 172,000 creditors, marking a significant milestone in its post-bankruptcy journey. The distributions, outlined in a recent court filing by legal representatives Kirkland & Ellis, signify progress in Celsius’ restructuring efforts following its bankruptcy filing in July 2022.

Celsius Smooth Distribution Process with PayPal and Coinbase

Celsius revealed that the distribution process was facilitated seamlessly through its appointed agents, payments giant PayPal and leading crypto exchange Coinbase. Eligible creditors, both domestic and international, have received their liquid crypto distributions without encountering any security or operational hurdles.

According to the court filing, over 20,500 Bitcoin and 301,000 Ether tokens have been successfully distributed among creditors. This milestone underscores Celsius’ commitment to fulfilling its obligations to stakeholders while navigating its restructuring phase. Read more: Celsius Exits Bankruptcy, Initiates $3 Billion Distribution to Creditors

Challenges and Speculations Amid Distribution

While the majority of eligible creditors have received their crypto distributions, the filing highlighted potential challenges for account holders who did not consent to the restructuring plan. Such individuals will not receive distributions until their claims are resolved, potentially prolonging the process for some creditors.

Moreover, concerns have emerged regarding potential compliance issues that could hinder certain account holders from receiving their distributions. Distribution agents PayPal and Coinbase maintain discretion to withhold distributions from individuals who fail to meet compliance requirements, raising questions about the overall distribution timeline.

Industry Speculation and Legal Complexities

The completion of creditor distributions has sparked speculation within the crypto industry about its broader implications. As Celsius navigates its post-bankruptcy phase, industry observers are monitoring how these actions may impact the wider crypto market landscape.

Meanwhile, legal complexities continue to surround Celsius’ former CEO, Alex Mashinsky, who is scheduled for trial in September 2024. Concerns have been raised regarding potential conflicts of interest involving Mashinsky’s legal team, which also represents Sam Bankman-Fried, former CEO of bankrupt crypto exchange FTX.

Recent developments, including U.S. Prosecutors’ inquiries into potential conflicts of interest among legal representatives, underscore the intricacies of navigating legal proceedings within the crypto space.

Key Takeaways:

- Celsius successfully distributes $2 billion worth of crypto to 172,000 creditors, marking a significant milestone in its restructuring journey.

- Distribution agents PayPal and Coinbase facilitate the process, ensuring a seamless experience for eligible creditors.

- Challenges remain for account holders who did not agree to the restructuring plan, potentially prolonging the distribution timeline.

- Speculation arises within the crypto industry about the broader market implications of Celsius’ restructuring efforts.

- Legal complexities persist surrounding Celsius’ former CEO, Alex Mashinsky, highlighting the intricacies of legal proceedings in the crypto space.

Discussion about this post