Japanese cryptocurrency exchange BitFlyer has announced its acquisition of FTX Japan, the local arm of the collapsed crypto trading platform FTX. The acquisition, finalized on June 20, marks a significant shift in FTX Japan’s business model from a crypto exchange to an institutional-grade crypto custody service.

BitFlyer to Transform FTX Japan into an Institutional Crypto Custody Service

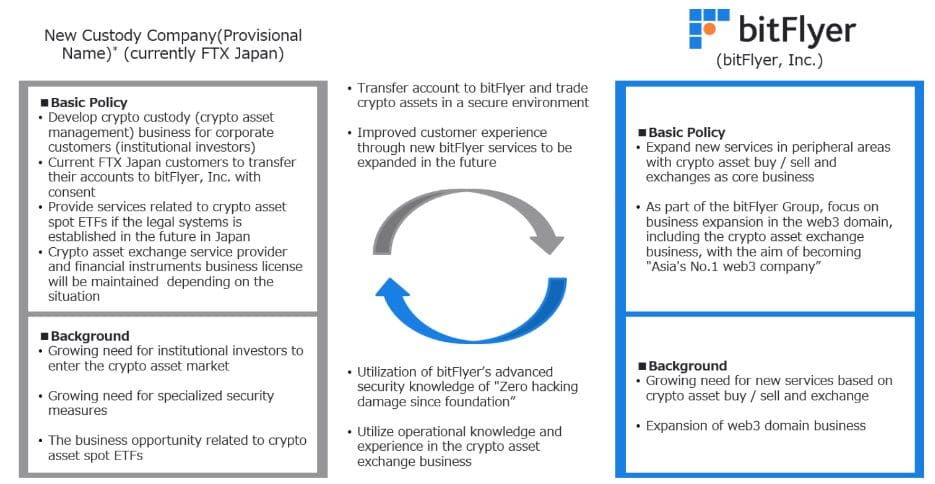

BitFlyer Holdings revealed plans to rebrand FTX Japan as New Custody Company, although the final name has not yet been decided. The revamped entity will focus on providing crypto custody services tailored for financial institutions. This strategic move comes as Japan anticipates regulatory changes that could allow the launch of crypto exchange-traded funds (ETFs).

“While we will need to wait for the establishment of the legal system, including tax regulations, if crypto asset spot ETFs are approved in Japan, services related to crypto asset spot ETFs that meet the needs of financial institutions, including trust banks, will also be offered under New Custody Company,” BitFlyer stated in its announcement.

Transition of Customer Accounts and Rebranding Efforts

In conjunction with the acquisition, BitFlyer plans to transfer FTX Japan customer accounts to BitFlyer, pending customer consent. This move aims to streamline the transition and ensure continuity of service for existing FTX Japan users.

The acquisition reportedly cost BitFlyer billions of yen, equating to tens of millions of dollars, as noted by local news agency Nikkei.

Background and Impact of FTX’s Collapse

FTX Japan, previously known as Liquid, was acquired by Sam Bankman-Fried’s FTX exchange in early 2022. The rebranding to FTX Japan occurred just months before the FTX empire’s dramatic collapse in November 2022. Despite the turmoil, FTX Japan managed to secure its customers’ assets, eventually resuming withdrawals and repaying its users by February 2023.

The collapse of FTX led to a series of high-profile acquisitions and legal battles. In 2022, FTX was aggressively expanding, including the $1.4 billion acquisition of crypto brokerage firm Voyager Digital. However, the downfall culminated in April 2024, when a U.S. judge approved a $450 million settlement agreement between FTX debtors and Voyager.

The news of BitFlyer’s acquisition comes shortly after Bankman-Fried was sentenced to 25 years in prison in the United States, following his conviction on seven felony charges.

Also Read: XRP in Japan: Ripple’s Latest Move Strengthens Market Foothold

Discussion about this post