In view of the unbridled monetary policy of a number of financial regulators and rising global inflation, leading analytical agencies are once again comparing Bitcoin to gold. Unlike fiat, gold and bitcoin have a limited supply.

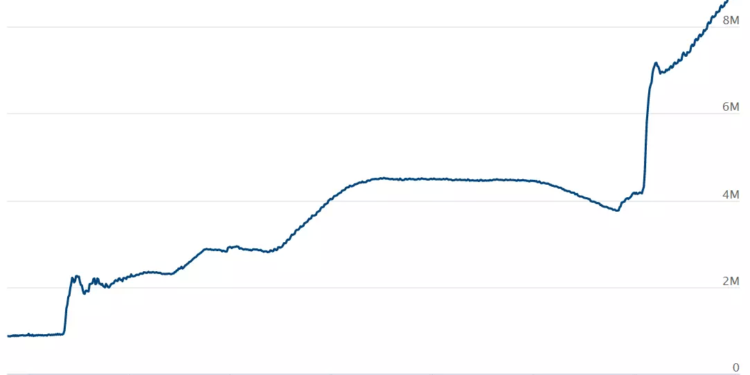

Over the past two years, the US dollar money supply (aggregate M2) has increased by 38%, and the Fed’s balance sheet has more than doubled due to the purchase of various treasury and commercial papers. To put it simply, the regulator printed additional money to cover government spending.

Not surprisingly, US inflation is now hitting a 40-year high, hitting 7.5% in January. For almost the entirety of last year, the Fed chair called price increases a “transient phenomenon,” turning a blind eye to causality. On this subject, gold apologist Peter Schiff said: “The Fed is not able to fight inflation without the collapse of the markets, so it pretended that this was a temporary phenomenon. Now the Fed is pretending to be ready to fight rising prices.”

Peter Schiff suggests looking for salvation from rising prices in gold, while JPMorgan notes the growth of institutional demand for Bitcoin as insurance against inflation. The amount of gold on the planet is limited, and mining becomes more labor-intensive every year. The same thing happens with Bitcoin: due to the increase in the number of miners, the complexity of calculations is constantly growing, and production is limited to 21 million coins. In addition to these factors, the cryptocurrency also has a deflationary mechanism, the so-called halving: every four years, the reward for mining a block is halved. All this contrasts sharply with national currencies, which can be printed indefinitely to patch up budget holes.

Discussion about this post