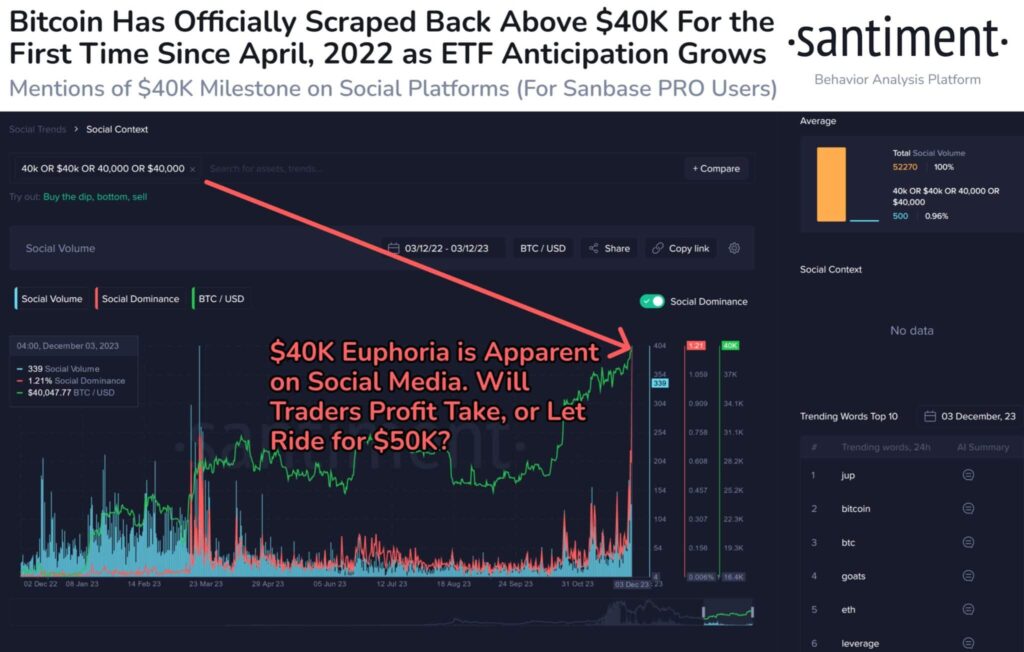

Over the weekend, Bitcoin (BTC) achieved a remarkable milestone, soaring past the long-awaited $40,000 mark, marking a significant breakthrough for the cryptocurrency. Currently, BTC is trading at $41,246 with strong trading volumes, signalling a resurgence after 18 months of fluctuation. The surge has reignited the focus on the impact of the upcoming exchange-traded fund (ETF) confirmation and the implications for the crypto market’s future.

The ETF and Bitcoin’s Potential Trajectory

Analysts speculate that the Bitcoin ETF’s impending confirmation could be the catalyst propelling BTC towards $50,000. The crypto market is abuzz with fear of missing out (FOMO) and fear, uncertainty, and doubt (FUD) concerning the ETF’s potential impact. The current landscape, with cooling inflation and discussions of potential Federal Reserve rate cuts in 2024, is setting the stage for a global market rally.

The digital asset industry eagerly awaits the SEC’s verdict on applications by major players like BlackRock Inc. seeking approval for the first U.S. spot Bitcoin exchange-traded funds. It’s anticipated that these ETFs might receive SEC approval by January, significantly influencing the digital asset market.

Also Read: Bitcoin Forecast: Matrixport Anticipates $60K Price Pre-Halving

BTC’s Future Trajectory and Technical Analysis

Technical analysis suggests that BTC next resistance could be at $42,330. Despite the recent surge, the analysis highlights relatively low open interest (OI), historically resulting in a $2,000 drop before stabilizing. This implies a potential bottom after a decline in OI.

Currently trading at $40,500, the local bullish invalidation stands at $39,500. While some anticipate drops to $30,000 or $35,000, skepticism surrounds the plausibility of these predictions.

OI remains relatively low here as price continues to climb.

Even when we did get a flush from these levels of OI the most we saw was a $2,000 drop to the downside before OI hit the "baseline" which marked our bottom.

We're trading at 40.5k.

Local bullish invalidation is at… https://t.co/lyt83ddz58 pic.twitter.com/o4Xz7soIut

— CrediBULL Crypto (@CredibleCrypto) December 4, 2023

Maintaining their stance, analysts express confidence in Bitcoin’s sustained momentum above the 40k+ regions. Some industry experts even forecast BTC to reach $60,000 before the next halving in April 2024.

This recent surge beyond $41,000 has rekindled market enthusiasm, projecting a promising trajectory for Bitcoin’s value in the near future. The impact of the ETF confirmation remains the pivotal point guiding BTC’s trajectory, with market experts closely monitoring its implications on the crypto market’s future.

Discussion about this post