Bitcoin’s long-term trend indicators are signalling robustness, with both the 200-day and 200-week moving averages reaching unprecedented levels. Anthony Pompliano emphasizes Bitcoin’s resilience, stating that it remains “as strong as ever.”

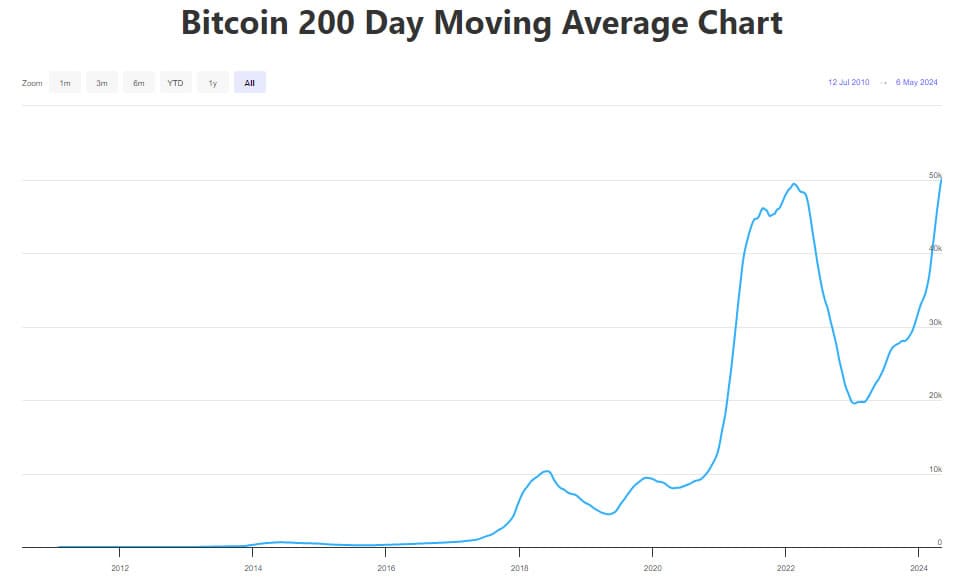

200-Day Moving Average: A Bullish Signal for Bitcoin’s Long-Term Outlook

Bitcoin’s 200-day moving average has surged to an all-time high of $50,178, a significant technical milestone indicating a bullish trajectory for the cryptocurrency’s long-term performance. This key indicator peaked on May 6, marking a notable recovery from a post-halving price decline that saw Bitcoin plummet to as low as $56,800 following the reduction of block rewards on April 20.

Analyzing Long-Term Trends: Insights from Moving Averages

The 200-day simple moving average (SMA) offers insights into Bitcoin’s long-term trend by averaging the closing prices over the past 200 days. This smoothed-out metric aims to mitigate short-term price fluctuations, providing traders and analysts with a clearer perspective on the cryptocurrency’s overarching trajectory.

When Bitcoin trades above this indicator, as it currently does, it typically signifies a bullish long-term trend, contrasting with bearish sentiment when prices fall below the 200-day moving average.

Bitcoin's 200 day moving average just hit a new all-time high.

GBTC saw the first day of inflows in 78 days.

Don't get lulled to sleep by bitcoin going sideways. The long-term thesis is as strong as ever.

Here is my segment on @SquawkCNBC this morning. pic.twitter.com/BG6GkzqVIi

— Pomp 🌪 (@APompliano) May 6, 2024

Also Read: 5 Key Factors Behind Bitcoin’s Confirmed Price Recovery

Bitcoin advocate Anthony Pompliano underscored this perspective during an appearance on CNBC’s Squawk Box, noting the significance of Bitcoin’s 200-day moving average surpassing the $50,000 mark. He emphasized Bitcoin’s enduring upward trajectory despite day-to-day volatility, urging observers not to underestimate its long-term potential.

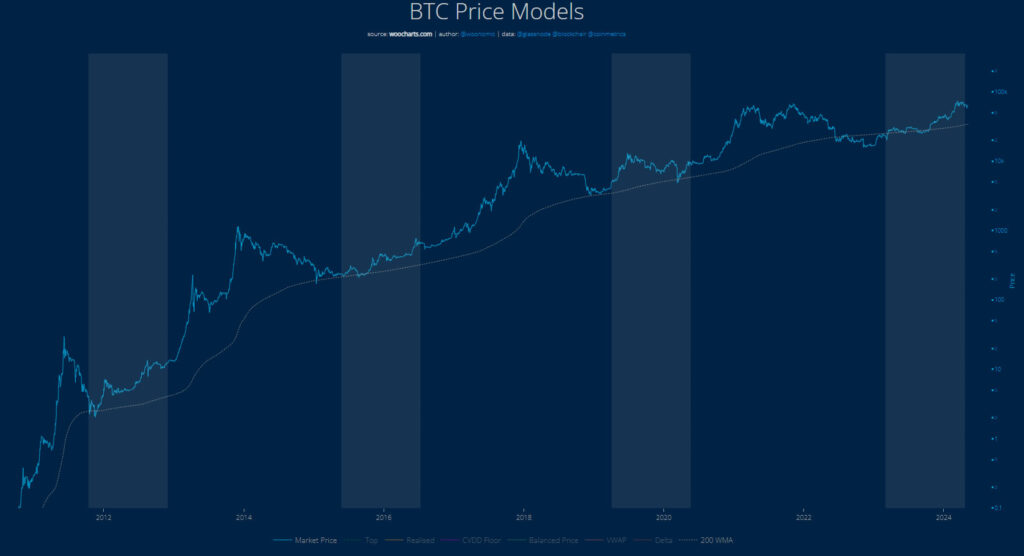

“WooCharts” analyst Willy Woo’s price models further reinforce this optimistic outlook, with the 200-week moving average, a more extended trend indicator, also reaching an all-time high of over $34,000. This prolonged bullish sentiment is underscored by Bitcoin’s sustained position above the 200-week moving average since mid-October.

However, amidst these positive indicators, the shorter-term 50-day moving average has experienced a slight dip from its peak in mid-April, coinciding with Bitcoin’s descent from its mid-March all-time high.

Pompliano also highlighted noteworthy developments in the institutional realm, noting that Grayscale’s spot Bitcoin exchange-traded fund (ETF) witnessed its first inflow on May 3. This marked a significant reversal from previous outflows, signaling renewed investor interest in Bitcoin exposure through traditional financial channels.

Discussion about this post