Cryptocurrency Legal Landscape in Saudi Arabia

In Saudi Arabia, the stance on cryptocurrencies blends caution with a forward-looking approach. While the Saudi Arabian Monetary Authority (SAMA) oversees cryptocurrency transactions, the country maintains a quasi-legal status regarding digital assets. Despite a lack of clear legal consequences for crypto dealings, potential investors are deterred due to uncertainties surrounding its legality.

Shariah Compliance in Crypto Investments

Shariah law plays a pivotal role in shaping attitudes towards cryptocurrency investments. The compatibility of digital assets like Bitcoin with Islamic finance principles remains a topic of debate. Concerns about excessive speculation and lack of intrinsic value challenge the Shariah compliance of cryptocurrencies, leaving their permissibility subject to individual interpretations.

Regulatory Restrictions in Qatar

Cryptocurrency Ban in Qatar Financial Centre

In Qatar, the regulatory environment for cryptocurrencies is stringent, with the Qatar Financial Centre Regulatory Authority (QFCRA) imposing a blanket ban on all crypto-related activities within its jurisdiction. This prohibition extends to crypto trading, exchanges, and custody services, reflecting concerns about investor protection and financial stability.

Exemption for Security Tokens

Despite the broad ban, the QFCRA exempts security tokens from its regulatory measures, recognizing their potential as a more transparent and regulated investment option. This exemption underscores Qatar’s commitment to fostering financial innovation while mitigating risks associated with unregulated cryptocurrencies.

Shariah Perspectives and Regulatory Outlook

Evaluation of Cryptocurrency Permissibility

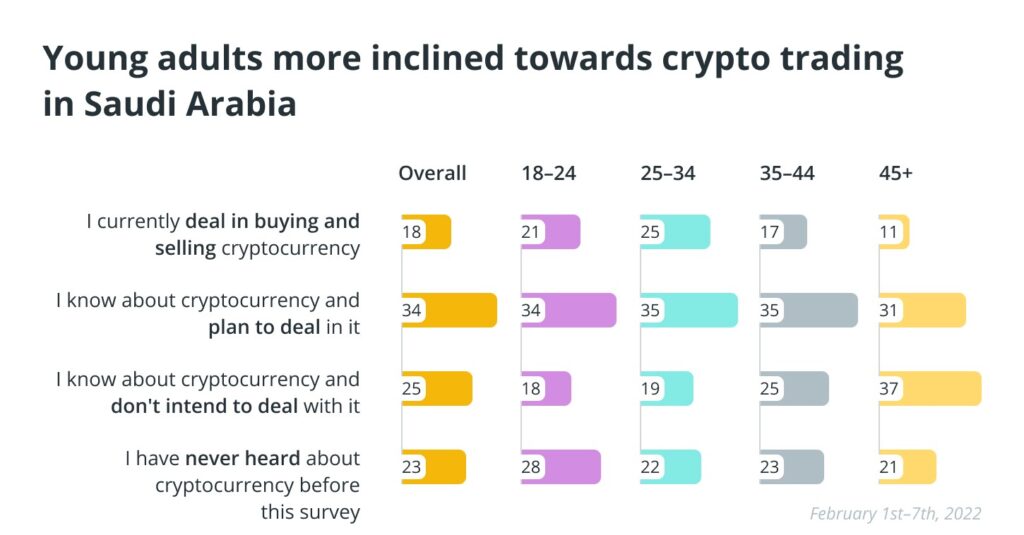

In both Saudi Arabia and Qatar, Shariah perspectives pose challenges to the acceptance of cryptocurrencies. The absence of tangible assets backing most digital currencies and concerns about volatility and illicit use conflict with Islamic finance principles. As younger Saudis express interest in crypto investments, regulatory bodies grapple with establishing a legal framework that balances innovation and risk mitigation.

Future of Cryptocurrency Regulation

While Saudi Arabia and Qatar currently maintain strict regulatory stances towards cryptocurrencies, the evolving global landscape and competitive pressures from neighbouring nations may influence future policy decisions. As technological advancements and regulatory frameworks mature, the prospect of embracing cryptocurrencies in the region remains subject to ongoing deliberation and speculation.

Discussion about this post