Bitcoin (BTC) enthusiasts have found reason to celebrate as signs of a confirmed price recovery emerge, dispelling concerns following a recent slump from $67,000 to around $56,000. Despite the dip, several analysts maintained their bullish outlook. Here are five compelling reasons why Bitcoin’s recovery appears inevitable.

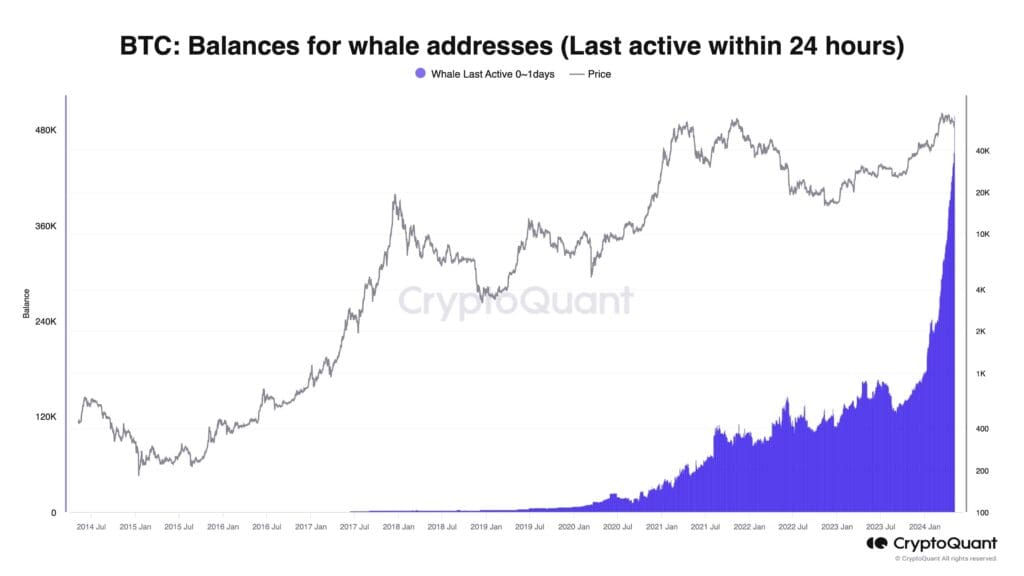

1. Institutional Confidence Fuels Whale Accumulation

The crypto community received a boost of confidence with CryptoQuant CEO Ki Young Ju’s revelation of significant Bitcoin whale activity. Institutional investors amassed a staggering 47,000 BTC, valued at over $3 billion, within a 24-hour period. This accumulation deemed the start of a “new era” by Ju, indicates a resounding vote of confidence in Bitcoin’s future trajectory. However, caution persists as the potential for sell pressure looms if Bitcoin rebounds to $62,000.

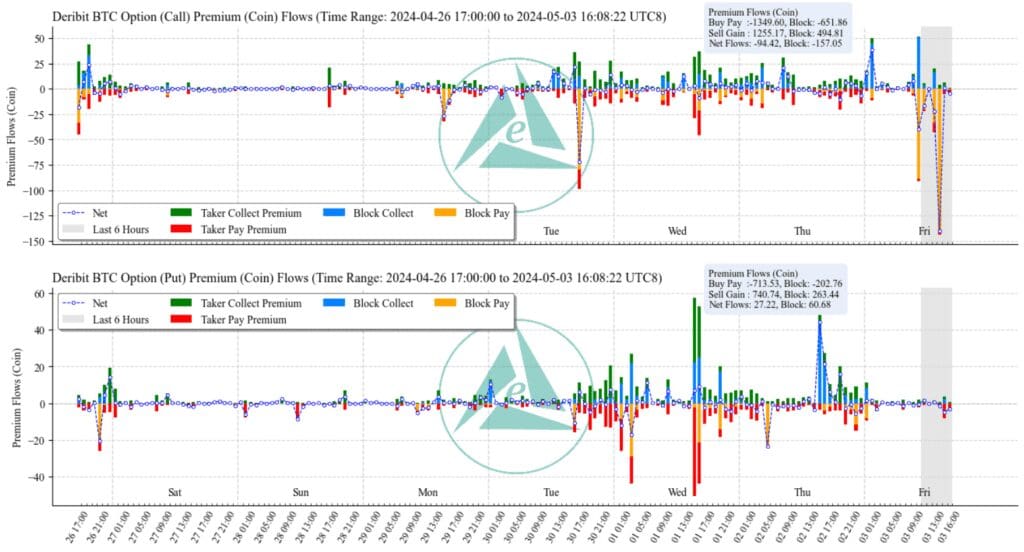

2. Surge in Bullish Sentiment in the Options Market

Reports from professional options traders at Greeks Live highlight an unprecedented surge in bullish sentiment within the Bitcoin options market. Large block trades in call options, including two massive 65,000 call options valued at $3.35 million each, have injected optimism among market participants. Noteworthy strategies like the September call ratio spread signal strategic positioning amidst low implied volatility and market pullback, fostering further bullish momentum.

3. Steady Bitcoin Futures Open Interest Signals Confidence

Despite recent market turbulence, Bitcoin futures open interest remains robust, standing at an impressive $27.94 billion according to Coinglass data. This sustained interest underscores a persistent appetite among institutional and retail traders to capitalize on future price movements. While lower than the peak of $73,800, this figure reflects widespread belief in Bitcoin’s long-term viability and growth potential, bolstering confidence in its recovery.

4. Expert Analysis Points Towards Breakout Potential

Crypto analysts like Captain Faibik and Michaël van de Poppe offer cautious optimism, emphasizing Bitcoin’s potential for a breakout. Faibik highlights the importance of surpassing the $61,000 resistance level to confirm a breakout, with a bullish target set at $78,000. Van de Poppe echoes this sentiment, foreseeing positive momentum ahead, signalling good times on the horizon.

Also Read: Bitcoin Options Regulation: SEC’s Latest Move and Its Ramification

5. Mixed Economic Data Reflects Resilience Amid Policy Concerns

Recent economic indicators, including the Manufacturing Purchasing Managers’ Index (PMI), offer insights into broader economic trends. While the PMI fell slightly short of expectations, indicating a marginal slowdown in manufacturing activity, it still signals overall economic expansion. Additionally, a robust labour market with steady job openings fuels optimism about economic resilience. However, concerns over potential delays in Federal Reserve rate cut plans underscore the delicate balance between economic recovery and monetary policy.

As Bitcoin’s recovery journey unfolds, these factors collectively contribute to the growing confidence in its future trajectory, offering a glimmer of hope amidst market uncertainties.

Discussion about this post